It’s pretty amazing that about one out of three people in the world live in either India or China. But just as China has posted significantly higher growth rates than India over the past three decades, these two titans also differ in the composition of their population. And these demographic trends have implications for investors - especially for those willing to invest in Indian ADRs.

China’s population is aging at a much faster rate than India’s.

[text_ad]

Life expectancy for Chinese babies born today is 76 years, just short of that in America. This underlines how far China has come economically; there was a time when a Chinese person born in 1960 could expect to live only 44 years.

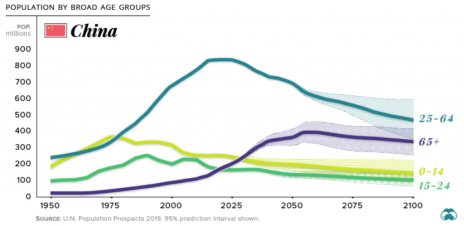

The first thing you’ll notice in the above chart is that China’s main working age population (25-64 years) has essentially already peaked in size. You’ll also notice that the populations of children (0-14 years) and young adults (15-24 years) have been on the decline for decades.

Today, Chinese women average only 1.6 children each – way below the 2.1 children required to maintain the current population.

According to United Nations projections, the median age of Chinese citizens will eclipse that of Americans this year and, during the next 25 years, the percentage of China’s population over the age of 65 will more than double, from 12% to 25%. By contrast, America is on track to take nearly a century to make the same shift.

Importantly, the working-age population of China, which began to shrink in 2012, will decline for decades to come.

This means that China will likely go from nine working-age adults per retired person in 2000 to just two by 2050. The United Nations projects that the median age in China in 2050 will be nearly 50, compared with 42 in America and just 38 in India.

These trends will impact China in a number of ways. The first is pressure on budgets and pension funds to support the aging population. This means that anything that helps the Chinese invest and prepare for retirement is to be encouraged.

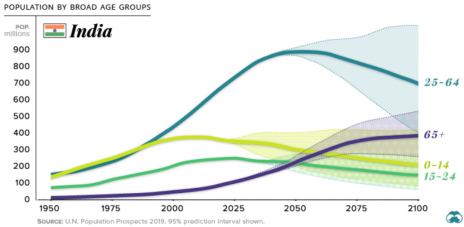

Let’s contrast China’s demographic situation with India’s more youthful population.

The above projections have India reaching a peak workforce age population near the year 2050, when it’s estimated that more than one-third of the country will be 60 years or older.

India is following a more traditional demographic path, and as long as it is uninterrupted by drastic policy decisions, the country will likely top out at around 1.6-1.7 billion people.

As India’s younger consumers increase their disposable income and savings rates in the coming years, they will increasingly move beyond the basics of food and housing to higher levels of goods and services.

The challenge with investing in India is that, relative to China, there are far fewer Indian stocks trading on U.S. exchanges.

Here are two high-quality Indian ADRs (American Depositary Receipts) to get you going.

The first is from a sector that is beginning to recover...

2 Indian ADRs Worth Watching

Indian ADR #1: MakeMyTrip Limited (MMYT)

MakeMyTrip Limited is a great play on India’s travel industry in a post-Covid world, as well as digital payments and marketing.

The company was founded in 2000 to initially serve the travel needs of the U.S.-based Indian community. But the company has evolved into a leading global travel company as India evolves into a digital marketplace by providing a comprehensive range of travel services.

MMYT has made some smart acquisitions and strategic partnerships such as with Ctrip, China’s largest online travel group.

Up 61% in the last year despite enduring a pronounced double bottom this spring and summer as India’s Covid cases spiked to world highs, MMYT is a good way to take advantage of demographic trends that will deliver both growth and profits.

Indian ADR #2: Tata Motors (TTM)

Buying a car is something that’s become increasingly realistic for India’s emerging middle class, and you can play this trend with Tata Motors (TTM), an India ADR that’s in a nice uptrend, up 259% including a big gap up to new highs earlier this month.

Tata Motors manufactures, and sells a range of cars, sports utility vehicles, trucks, and buses under the Tata, Daewoo, Fiat, Jaguar, and Land Rover brands.

Thus, TTM is an Indian ADR with plenty of momentum.

If you want to know what other Indian stocks, Chinese stocks and other global stocks I like, I urge you to take out a subscription to my Cabot Explorer advisory - where my current recommendations have an average return of more than 200%! - by clicking here.

What else would you like to know about Indian ADRs?

[author_ad]

*This post has been updated from an original version, published in 2020.