The rise of emerging markets has thankfully pulled hundreds of millions out of poverty with many of them of them propelled into the new middle class. And as incomes rise, studies show that these new consumers are spending their extra cash on more and better food and healthcare. And the emerging markets healthcare boom has significant investment ramifications.

In the United States, healthcare spending has outpaced income growth for nearly two decades, and is projected to grow by 57% over the next decade. In emerging markets healthcare spending is on an even steeper growth trajectory, boosted by new demand from the burgeoning middle class.

Healthcare spending accounts for about 10% of gross domestic product in well developed countries but just half that in emerging markets – implying strong long-term growth over the next 10 to 20 years. This higher spending is creating better health as well as opportunities in healthcare treatment. For example, emerging markets are well represented among the estimated 400 million people suffering from diabetes around the world.

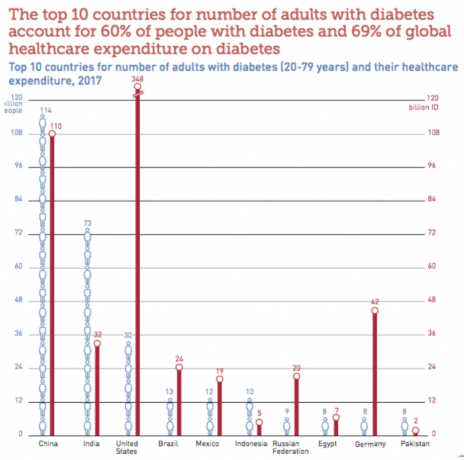

According to data from the International Diabetes Federation, India and China are first and second on the list of countries with the most diabetics. They’re followed by the U.S., which ranks third, and Brazil and Mexico, ranked fourth and fifth, respectively.

[text_ad]

The chart below highlights the wide gaps in treatment expenditures. For example, America has about half the number of adults with diabetes but spends more than 1,000% more on treatment.

In India, diabetes has become a raging epidemic, currently afflicting roughly 7% of the population. India now has more diabetics than any nation in the world.

And a study by researchers from the University of North Carolina found that Chinese teenagers are developing diabetes at a rate nearly four times that of American teenagers.

Diabetes isn’t the only disease that’s becoming increasingly common in the developing world. Income growth has driven increased consumption of tobacco products and alcohol, raising the incidence of lung cancer, cardiovascular illness and liver disease.

In China, healthcare spending is growing 10% every year from a base of $620 billion – faster than any other country in the world. Given China’s aging population, that is likely to accelerate. Meanwhile, India’s healthcare spending is projected to rise by 140% over the next decade.

Pharmaceuticals will likely account for the lion’s share of increased emerging markets healthcare spending, with drug sales expected to reach $550 billion annually by 2020. That equates to about 70% of global drug sales, with China becoming the fastest-growing pharmaceutical market in the world.

Two Emerging Markets Healthcare Stocks

Given all these trends and the need to keep prices and costs low, it should be no surprise that branded generic drugs have become a booming business. A generic drug is simply one that is the bioequivalent of a branded original. A branded generic is an off-patent drug marketed under a specific brand name.

And Dr. Reddy’s Laboratories (RDY) has become one of the biggest players in generic drugs, with more than 200 branded generic drugs in the areas of cardiovascular disease, pain management, diabetes medications and oncology, among others. As one of the largest makers of branded generics in the world, this India-based company has clearly earned emerging blue-chip status.

The company offers a growing number of products in the United States but the majority of its sales are in emerging markets, with India and Russia as its most important markets. China comes next, and its development work there over the last two decades has paid off with a 12% growth rate in revenue.

The company’s manufacturing base in India allows it to manufacture products at very low cost as it consistently delivers 50%-plus gross margins. Dr. Reddy’s typically allocates about 7% of revenue to R&D, creating a very strong pipeline.

Dr. Reddy’s Laboratories has already made a nice run so far in 2019 so I would put this stock on your emerging blue-chip watch list.

Another good multinational play on this growth trend is Abbott Laboratories (ABT).

Abbott has a nice balance in terms of revenue from four areas: nutrition, diagnostics, pharmaceuticals and medical devices. While it has a strong position in the U.S., more than 60% of revenue comes from overseas markets and it is delivering double-digit growth in Latin America and Asia.

Abbott is also at the forefront of cutting-edge research. In an exciting development, a study was just published that showed Abbott’s High Sensitive Troponin-I blood test could predict the chance of a heart attack years before it occurs, even in patients with no symptoms.

Abbott & Dr. Reddy are two great core holdings to capture this high-growth trend.

Now, obviously those are two healthcare stocks, only one of which is based in an emerging market. If you want to know what other emerging market stocks I’m currently recommending, you can subscribe to my Cabot Global Stocks Explorer (formerly Cabot Emerging Markets Investor) advisory by clicking here.

[author_ad]