“Go to Cash!”

That’s what many so-called market experts will tell you as portfolio values start to fall. Whether in the form of bank deposits, money market funds or certificates of deposit, cash has always been the go-to response when market turmoil occurs. It’s no surprise that 2022 has seen its share of “cash is king” headlines.

But this market is entirely different from any other we’ve seen. The rules of navigating volatility have changed, and investors need to adapt. Sure, cash is one way to defend your portfolio. But it’s far from the only way. You won’t hear the big Wall Street financial institutions telling you about other methods, though. So let’s talk about some alternatives to cash here!

The Bears are Back in Town

The stock market is in bear-market territory now, if you look at the S&P 500, Dow or Nasdaq. Steadily deteriorating conditions in mega-cap stocks are a sign that the proverbial wall of worry is getting steeper.

[text_ad]

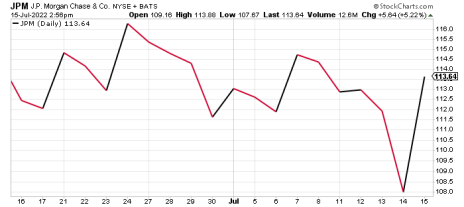

For example, JPMorgan Chase (JPM) gapped down hard on Thursday following a second-quarter earnings decline.

Over in the bond market, it’s anything but business as usual. For more than 40 years, bonds have been considered the “anti-stock” during a bear market, as correlations were historically low.

This time, not so much. Bonds are no longer a legitimate asset class for investor portfolios. One widely held bond ETF, the iShares Core U.S. Aggregate Bond ETF (AGG), is down 10.5% year-to-date.

Investment success for the foreseeable future - and perhaps the rest of this decade – will be the result of balancing offense and defense.

Here are four alternatives to consider if you would like to modernize the way you protect your portfolios, other than simply investing in low-yielding cash accounts.

4 Alternatives to Cash

1. Bonds

When the stock market goes down, what goes up?

Traditionally, the answers to this question have been bonds, gold, and maybe silver. But those are dependent on other factors that might interfere with their defensive qualities.

The current downturn in fixed income is a perfect example.

As the Federal Reserve is increasing rates in an effort to fight high inflation, bond prices are dropping. This means the “cash alternative” feature of bonds is not working as it usually does.

Instead of looking to bonds to offset equity-market weakness, a better strategy has been using investments designed to move in the inverse direction of the stock market.

These come in various forms these days, from inverse ETFs like the ProShares Short S&P 500 (SH) to more volatile ETFs that own CBOE Volatility Index (VIX) call options. An example of the latter is the iPath Series B S&P 500 VIX Short-Term Futures ETN (VXX).

2. Arbitrage

There are various methods to eke out a moderate positive return greater than cash, while still reducing the expected volatility in the wider stock and bond markets.

Arbitrage just means pairing two investments, one short long and one long, with the aim of profiting from the difference in their returns.

If you believe the Dow Jones Industrial Average will outperform the Nasdaq 100 Index in the near or medium term, you could buy an ETF like SPDR Dow Jones Industrial Average ETF (DIA), while buying an equal amount of the ProShares Short QQQ (PSQ), which seeks to return the inverse performance of the Nasdaq 100.

So if the Dow drops 10%, but the Nasdaq falls 15%, you would pocket a 5% gain on this arbitrage pair.

You can also achieve arbitrage with a single ETF. For example, the IQ Merger Arbitrage ETF (MNA) purchases shares of a company being acquired in a deal, while simultaneously shorting the acquiring company.

3. Floating-Rate Bond ETFs

Floating-rate bond ETFs can increase your income yield over that of cash if interest rates rise.

These ETFs track bonds and other debt instruments whose interest fluctuates with the prevailing underlying rates.

Be careful here, though. If you own an ETF like the iShares Floating Rate Bond ETF (FLOT), which holds U.S. Treasuries, credit risk is only as significant as that of the U.S. government. If you opt for a floating-rate corporate bond fund, like the VanEck Vectors Investment Grade Floating Rate ETF (FLTR), you are taking on more credit risk.

4. Long-Short Funds

If you like the arbitrage concept but you’re able to take comparatively more risk while keeping returns in a relatively narrow range, you can use ETFs that buy and short different securities based on a theme.

One example is the AGFiQ U.S. Market Neutral Anti-Beta Fund (BTAL), which shorts more volatile equities and goes long less volatile stocks. This ETF’s aim is to profit from the outperformance of one group over the other.

The ProShares Long Online/Short Stores ETF (CLIX) is another example. This ETF buys online retail stocks, while also shorting traditional brick-and-mortar equities.

Of course, as with any investment strategy, you need to determine whether these fit your risk tolerance and time horizon, but in today’s market, the old advice about selling everything and hiding in cash no longer makes sense.

Any other alternatives to cash that you like to use in down markets? Feel free to share them in the comments below.

[author_ad]