There are plenty of good investment opportunities in the biotech sector right now. But you wouldn’t know it by looking at the performance of one key biotech ETF over the last couple of years. More on that in a minute…

High Prices Hurting Big Pharma

It’s seldom a good thing when business news winds up on the front page of The New York Times, and today’s story about the pharmaceutical industry is no exception to that rule. Today’s front-page headline pretty much told the story: “As Prices Soar, Drug Lobbyists Pass the Blame.”

The story is about the rush by pharmaceutical companies to blame middlemen like Express Scripts (ESRX) and CVS Health (CVS) for soaring drug prices. Fueled by outrage over enormous price increases for EpiPens and insulin, consumers have raised a ruckus, which has motivated some Congressional concern and some grand speeches about reining in prices.

[text_ad]

The only winners in the Blame Game, at least so far, are the lobbyists who are wearing out shoe leather walking from office to office in the Capitol to plead for understanding and protection, and—most importantly—blaming the other guy.

With health care policy and costs being very close to the number-one topic in Washington, D.C., this isn’t the kind of publicity the pharmaceutical industry wants, and they’re willing to pay enormous sums to keep Congress from taking any kind of decisive action. And that’s what Congress does best. And remarks from President Trump that the industry has been “getting away with murder” don’t help.

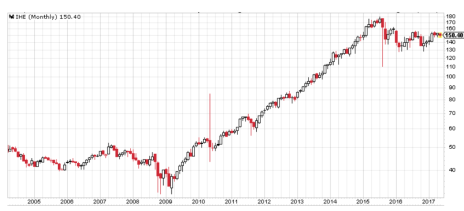

What does this mean for investors? A look at the monthly chart for the iShares U.S. Pharmaceuticals ETF (IHE), a formerly high-flying biotech ETF, tells a story about an industry that’s been losing its appeal since July 2015, when it finally topped out after a run that began in March 2009. That’s a 22-month flat patch, with uncertainty about the regulatory future as the main explanation.

The best advice I can give to investors seeking returns in pharmaceuticals is to avoid ETFs that lump the industry’s risk in one asset.

It’s better to look for individual companies that have a compelling reason for the performance of their stocks. I’m thinking about companies like Parexel (PRXL), a contract pharmaceutical research business that big drug companies are outsourcing their research efforts to. Parexel, which was just featured in Cabot Top Ten Trader on May 22, has been in a program of cost-cutting that has improved its bottom line and set it up as a takeover target.

Another strong biotech stock is Cabot Undervalued Stocks Advisor holding Vertex Pharmeceuticals (VRTX), a medium-sized specialist in treatments for cystic fibrosis and cancer. The company got good news on March 29 from Phase III trials of one of its cystic fibrosis candidates. The good news gapped the stock up from 90 to 107 and it has been walking higher ever since, now trading above 120.

Buy Biotech Stocks, Avoid Biotech ETFs

The lesson, as it always is with growth stocks, is to avoid investing in industries, sectors or indexes, which only average the best and worst of their components. Just because a key biotech ETF is struggling doesn’t mean there aren’t any pharma stocks worth buying.

By looking for the stocks that are outperforming, you can increase your odds of beating the averages of whatever area interests you.

[author_ad]