Last Thursday, I took a look at a couple of investment themes—solar power and 3-D printing—that didn’t pan out the way many experts anticipated. You could have made money in them, but you would have had to have impeccable timing (and a fair amount of luck) to get in at the right time and then out again with a whole skin.

Today, I’d like to look at a third “can’t miss” sector that missed—one that I even tried to dip a toe into—and a fourth investment idea that I think won’t miss, so long as you buy a certain China ETF.

But let’s start with the “can’t miss” idea that did fully hit.

Can’t Miss Sector #3: Lithium

Lithium, aside from being a chemical element with the symbol Li and an atomic number of 3, is a soft, white metal that’s never found in nature in a pure state. Lithium salts are useful for the treatment of bipolar disorders and other compounds show up in heat-resistant glass, lubricants, metal alloys and ceramics. (Thank you, Wikipedia!)

But what makes lithium of interest to investors is its use in batteries.

[text_ad]

When you read about lithium on investment sites, the story is usually summarized like this: Lithium and lithium-ion batteries are the best technology we have for storing electricity. With electric cars clearly the wave of the future [Tesla!], and battery systems for storing solar power gaining traction in home installations [Tesla again!], the demand for lithium will only increase. So you need to invest in it now.

That’s the pitch. And just to raise my credibility, here’s one teaser advertisement that I found just yesterday as I was looking at an unrelated Chinese stock.

I just love the “and will for decades to come” part of that come-on.

But back in August 2017, I was intrigued enough by the story to take a look at a South American company, Sociedad Quimica y Minera de Chile (SQM), which has huge mineral reserves that it sells mostly for fertilizer. But the company is also a big lithium player, mining between 48,000 and 63,000 tons of lithium per year. Sociedad has also made strategic investments in lithium mining in Argentina and Australia.

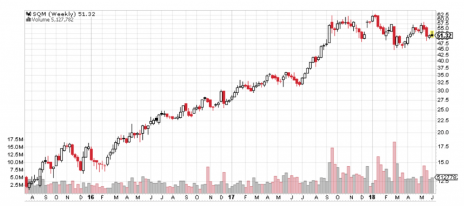

To make a long story longer, I recommended SQM to my subscribers in late August 2017, when the stock was trading at 47. You can see in this weekly chart the stock’s great rally from 14 in early 2016 to 36 in May 2017 and the faster rally that kicked off in late June.

You can also see what happened to SQM after a huge jump higher in September. Since the stock popped to as high as 62, it has been trading sideways in a fairly wide range.

The Cabot Global Stocks Explorer’s (formerly Cabot Emerging Markets Investor) portfolio bought SQM at 47 and sold it in November at 58 for a nice profit.

It may well be that lithium will fulfill its promise as the investment opportunity of a lifetime and SQM may break out of its 10-month stretch of sideways trading. But that’s not a bet I’m willing to take.

As a growth investor, I want to buy stocks that are in active uptrends. Positive momentum is one of the best measures I know of for gauging changes in investors’ attitudes toward a stock. And a rising stock price is always about changing attitudes.

And by the way, the kind of pitch that’s being made for lithium isn’t confined to just that metallic commodity. I also just saw a teaser ad for a completely different product. Here’s a screen shot of the ad.

And no, I won’t be buying that opportunity either.

But I promised one can’t miss bet that I thought actually had a chance of success, and here it is.

My Favorite China ETF: PGJ

I don’t know any stock stories that are bigger than China. It’s already the global leader in population, number of people online, GDP growth among large economies and auto sales.

Now there are a bunch of Chinese stocks that have been rallying for years, and I have several of them in my Cabot Global Stocks Explorer portfolio, including one that’s up over 450% since I recommended it in late 2015.

But individual stocks can be squirrely, and require lots of attention to quarterly earnings and other news stories that can have a big impact on results.

My favorite buy-it-and-forget-it way to play China right now is to buy a position in Invesco Golden Dragon China ETF (PGJ), which tracks the performance of Chinese stocks that trade on U.S. exchanges as ADRs. (ADRs are American Depositary Shares, a dollar-denominated way to invest in Chinese companies.) With an ADR, you get the assurance that a company has been through the vetting processes of the major exchanges and the SEC, which weeds out shady enterprises with suspect reporting.

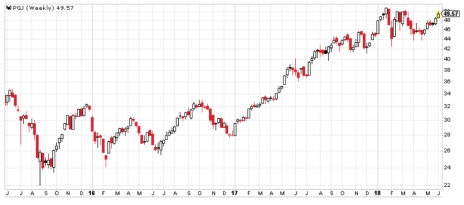

Here’s what a weekly chart of PGJ looks like, showing the Fund’s flat performance in 2016, the big run it made in 2017, and its time in the weeds since it hit a high above 50 in January.

PGJ has been outperforming the broad population of emerging market stocks over the last couple of months, climbing back near its old resistance at 50.

I think this China ETF has a great chance of coming out of its recent consolidation and heading higher in a big way. I’m even willing to say that I think it can’t miss.

You can either buy here or wait for a breakout above 50.

With all that said, I still see bigger opportunities in individual emerging market stocks, which is what I recommend in my advisory, including a few recent IPOs that are shooting the lights out. You can learn more about it by clicking here.

[author_ad]