The Dividend Aristocrats ETF might be one of the surest bets in the stock market. But there’s a dark side to this shining star.

In October 2013, a new ETF hit the scene. This ETF was unlike others; it consisted of at least 40 companies listed on the S&P 500 that had increased their dividends every year for at least 25 years. These stocks were equally weighted and spread across sectors. We know this ETF as the ProShares S&P 500 Dividend Aristocrats ETF, and it uses the stock symbol NOBL.

The ETF is lauded for its stability, even in volatile markets. This is due, in part, to the sector allocation. Consumer Defensive and Industrials make up about 40% of the fund’s assets, with Basic Materials, Healthcare, and Financial Services making up another 33% of assets. You’ll find plenty of household names here, too, like Target Corp (TGT), Stanley Black & Decker (SWK), and T. Rowe Price Group Inc (TROW).

By its very nature, a Dividend Aristocrat is a large and relatively stable blue-chip company with a healthy balance sheet. These are the “gold standard” for dividend stocks. When you invest in a Dividend Aristocrat, you can not only count on receiving a quarterly dividend payment, but you can also rely on those payouts increasing every year. Here’s the catch.

[text_ad]

What “they” don’t want you to know about the Dividend Aristocrats ETF

What’s not to love about a steady increase in stock price with reliable quarterly dividends? Morningstar rates the Dividend Aristocrats ETF as offering below-average risk with above-average returns. A look at the three-year and five-year trailing total returns reveals 15.86% and 13.19% gains, respectively. If there’s a set-it-and-forget-it investment out there, this is definitely in the running. But that’s not the whole story.

NOBL isn’t the only Dividend Aristocrats ETF out there. Nor does it have the best returns. For example, the iShares Core Dividend Growth ETF (DGRO) has trailing total returns of 16.57% and 15.80% over the last three and five years. The gross expense ratio is 0.08% as compared to 0.35% for NOBL, and Morningstar rates the fund as having a below-average risk with high returns. There are also some differences in sector allocation and weighting of stocks.

Similarly, the Vanguard Dividend Appreciation Index Fund ETF Shares (VIG) consists of “common stocks of companies that have a record of increasing dividends over time.” The gross expense ratio is 0.06%, and the three- and five-year trailing total returns are 17.21% and 15.41%. Be aware, however, that the dividend is about three-quarters of a percent lower (1.56%) than what DGRO and NOBL offer.

Clearly, any of these would make a nice addition to your portfolio. In truth, there’s absolutely nothing wrong with investing in these funds. Steady dividends and a history of returns make these an easy way to make some cash in the stock market without too much energy on your part.

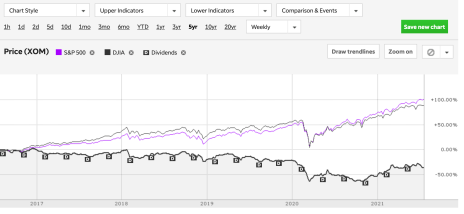

Here’s that dirty secret, though. Not every stock in the Dividends Aristocrats ETF is a super performer. Some of them, like Exxon Mobil (XOM), do have excellent dividend yields, but the stock has underperformed for years as compared to the overall market. Here’s what the stock looks like for the last five years in relation to the S&P 500 and the Dow.

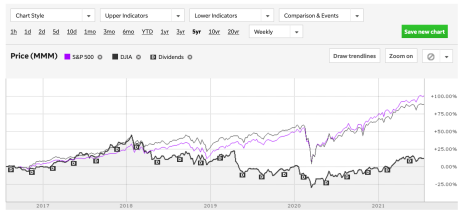

Then there are stocks like 3M Co (MMM), which was doing well but has underperformed the market since 2018.

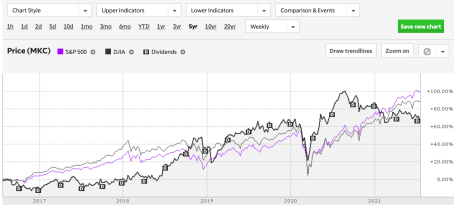

Or you can take a look at McCormick & Company Inc (MKC), which is a bit of a roller coaster, performing both better and worse than the market at times.

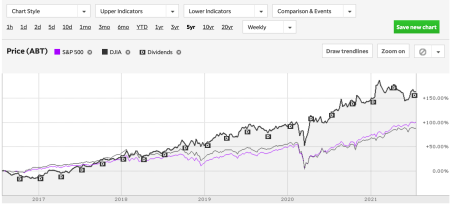

Indeed, these stocks aren’t necessarily “bad.” McCormick’s stock prices have generally, if not consistently, risen for several years. For comparison, however, here’s what Abbott Laboratories (ABT) looks like.

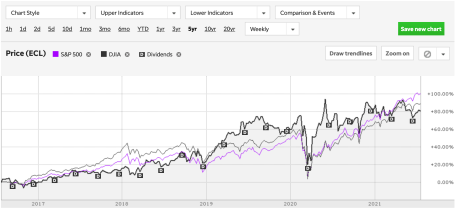

And here’s Ecolab Inc (ECL), which is a bit closer to the market, and along with Abbott, has seen a steady increase in stock price for over a decade.

How to make the most of these dividend stocks

Again, there’s nothing wrong with investing in a Dividend Aristocrats ETF. Even some of the stocks that haven’t performed as well as the market, like Exxon Mobil, can still offer income in the form of those regular dividends. These ETFs offer good exposure to a broad selection of the economy. But if you’re interested in a more hands-on approach and don’t mind watching your stocks a little more closely, you might be better off curating your own Dividend Aristocrats list.

If you’d like some guidance in analyzing and selecting those stocks, check out my Cabot Dividend Investor advisory. The portfolio features three tiers of dividend stocks: a high-yield tier, a safe income tier, and a dividend growth tier. To find out which ones I’m currently recommending, click here.

[author_ad]