The Good, the Bad, and the Ugly is one of the most important films ever made. In case you haven’t seen it in a while, here’s a refresher. Clint Eastwood stars in this Sergio Leone-directed spaghetti western that has three gunslingers competing to find a fortune in buried gold. The cinematography was groundbreaking at the time, and has influenced filmmakers since its release in 1966. And even if you don’t know the film, you are undoubtedly familiar with the brilliant score by Ennio Morricone. Just as the film holds a place in the hearts of budding and successful film directors everywhere, gold as an investment holds a special place in the hearts of investors.

Gold captures our attention and sparks our imagination. In fact, until the 1930s, the gold standard was the basis of our monetary system. Gold is the subject of songs (“Golden Ring,” “Silver and Gold”) and movies (Charlie Chaplin’s Gold Rush, Dora and the Lost City of Gold), and you can find it in your home in the form of rings, watches, and other jewelry. Even the legendary pop star Prince had 67 10-ounce gold bars in his vault.

[text_ad]

But none of that answers the question of whether or not gold as an investment is a worthwhile pursuit.

Gold as an Investment: The Good

For the first decade of the 21st century, gold was a good investment. It lived up to its reputation as a safe haven as investors flocked to it after the dot-com bubble burst in 2000 and the Great Recession of 2008-09. Gold is a nice hedge when stocks are plummeting and the dollar is losing value. We saw it again in the first half of 2020 following the arrival of covid-related shutdowns and are seeing it now with war in Ukraine, high inflation, and bank failures.

Even without a sinking dollar, there are good reasons for investors to hold gold.

- Demand and supply. As demand rises, whether for industrial or personal uses, gold prices generally rise.

- U.S. dollar leverage. When the dollar declines, it creates uncertainty also, and investors tend to sell more dollars and buy gold, making gold increase in value.

- Gold investors. Banks around the world - as well as the companies that dig the gold out of the ground - have tremendous reserves of the precious metal. And they constantly buy and sell large quantities, creating price fluctuation.

Gold as an Investment: The Bad

Starting in 2011, both stocks and the dollar began to rise; the dollar achieved some of its highest values, and stocks hit new record highs on almost a weekly basis. So the value of gold dropped. That can create a pretty volatile situation for gold.

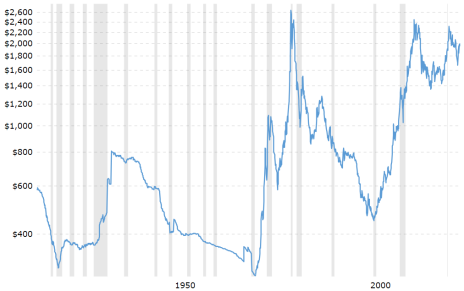

Just look at this 100-year chart of gold, courtesy of Macrotrends:

Now, most people (aside from filthy-rich pop stars known for being a bit … quirky) don’t invest in physical gold; they invest in gold stocks. But when gold prices fall, gold stocks tend to fall even further. Gold is a fickle commodity, and run-ups tend to be cyclical. If you’re investing for the long haul, it’s best to steer clear.

Gold as an Investment: The Ugly

Okay. Ugly is a strong word. This is more the caveat to both sides of the argument on whether gold as an investment is worth the trouble.

Yes, gold has historically been a safe haven, a commodity to buy and hold for a rainy day as a hedge against a market crash and/or a collapsing dollar. That worked well in 2008-2011, when the global recession and its aftermath pushed the dollar to its lowest value in decades, and again in 2020 when covid ground economies to a halt. But those types of cataclysmic events only come along once every now and then.

There may well be another dollar collapse … and then it will bounce back like it always does. Meanwhile, if you do decide to invest in gold, here are four ways to do it:

Gold bullion

True “gold bugs” buy the actual gold bullion bars, as they feel they are the strongest inflation hedge. In the U.S. - as in Canada, Austria, Liechtenstein and Switzerland - investors can buy gold bars through any large bank. Or you can purchase them through a bullion dealer.

Gold coins

The Krugerrand is the most common of the gold bullion coins, but there are other varieties, including the Australian Gold Nugget (Kangaroo), Austrian Philharmoniker (Philharmonic), Austrian 100 Corona, Canadian Gold Maple Leaf, Chinese Gold Panda, Malaysian Kijang Emas, French Napoleon or Louis d’Or, Mexican Gold 50 Peso, British Sovereign, American Gold Eagle and American Buffalo.

Investors may buy coins from the U.S. mint and also from coin dealers but should make sure they are dealing with a reputable dealer, as fake gold coins are plentiful.

Mining shares

Gold exploration and mining is not for the faint of heart. Companies operating in this arena need lots of cash and plenty of time. Gold is scarce, deposits are remote, and bringing the shiny metal out of the ground is time-consuming (sometimes, as much as 10 years) and very costly in terms of capital investments.

There are investors who do buy the shares of mining companies, but they are generally well-versed in the industry. Most investors would be better served to go for diversification and, instead, invest in exchange-traded funds (ETFs).

Exchange-traded funds

ETFs have several advantages for gold purchasers. They give you exposure to the price of gold at a relatively low cost. Furthermore, the largest gold ETFs trade on the major stock exchanges, meaning you can buy and sell them all day long. For most gold investors, buying a solid ETF would be an easy way to get started with gold. It’s as simple as buying shares in any listed company.

What would you like to know about gold investing? Let us know in the comments below.

[author_ad]

*This post has been updated from a version published in 2020.