2022 has been a tough year for investors – inflation is raging, stocks are stumbling, and bonds are no longer serving as a savior when stocks are falling. Diversification has become difficult as almost all the stocks in the U.S. market are positively correlated and are moving in tandem.

For investors, giving your money a passport to the international market can help provide diversification and benefits from the growth in other economies.

Investing in international ETFs may appear complex and unnecessary to some. However, having assets outside of the United States can serve as a vital hedge against domestic market fluctuations and provides the potential for greater returns. The U.S. market represents around 60% of the global equity market; if we only stay limited to the domestic market, we ignore about 40% of the equity universe.

International funds can provide investors with several benefits, including access to high global growth rates and different sector concentrations.

However, investors should be cautious before investing in these funds. Be sure you understand the broad market landscape, and the reason you are choosing to invest globally.

[text_ad]

While putting your money outside the U.S. can sound daunting and often risky, you can avoid the intensive research associated with international markets. One way to accomplish the goal of global investing is with ETFs traded on U.S. exchanges.

There are a number of different types of international ETFs you can choose from based on your own risk appetite and return expectations. Here are a few to consider:

4 Types of International ETFs

Developed Market ETFs

These ETFs focus on holdings within the world’s most advanced economies. They help investors access broad diversification across the globe, outside of the United States.

For example, the iShares MSCI EAFE ETF (EFA) tracks the developed-market securities based in Europe, Australia and the Far East. It excludes the U.S. and Canada, and small caps.

Emerging Market ETFs

These ETFs invest in countries with developing economies. Brazil, China, and India are among the most prominent. These markets are growing toward developed market status, which may allow them to produce potential gains.

The Vanguard FTSE Emerging Market ETF (VWO), which tracks the indexes of emerging-market stocks, except South Korea, is a popular choice for emerging-market exposure.

Regional ETFs

These ETFs invest in a more narrow geographic location, even a single country. The strategy here is to position your portfolio so that allocations are weighted based on the strength of global economies. For instance, you may have an Asian ETF, a European ETF, and an Americas ETF.

The iShares MSCI United Kingdom ETF (EWU) provides exposure to the U.K. equity market. It concentrates on large- and mid-cap stocks.

Global ETFs

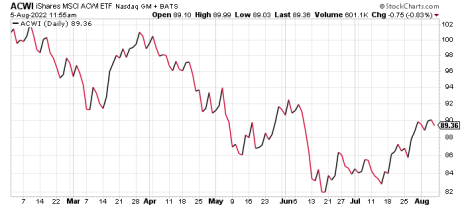

These include securities that invest in the equities of companies from all over the world. Usually, funds in this category invest in a wide range of countries. An example of a global ETF traded in the U.S. is the iShares MSCI ACWI (ACWI), which tracks the most popular, most inclusive global index.

All international ETFs differ from each other. Some have higher management fees, some pursue gains but with greater risk, and others use diversification and hedging in an effort to reduce risk. So before blindly diving into international ETFs, it’s essential to consider a few critical stats for each fund:

Asset Allocation

Research your chosen ETF and all its holdings prior to investing. Even though you are investing in the overall country, market, or sector exposure, that doesn’t mean you shouldn’t examine the equity holdings within that ETF.

Just as you scrutinize any stock before you invest, you should research the assets in the ETF. If an ETF is “concentrated,” meaning it holds fairly large weightings in a smaller number of stocks, this is easier and less time-consuming than if the ETF owns hundreds of small positions.

On the other hand, too large a weighting in a single stock adds more risk to an ETF if there is company-specific news that tanks that particular security.

Fee Structure

ETFs are generally less expensive than mutual funds, but there is a substantial difference between various ETFs.

For instance, expense ratios range from 0.14% to 0.98% in the emerging market ETF segment. Those percentages may sound small, but the more the fund company keeps, that’s less going into your pocket. Once you’ve narrowed the list of ETFs down to a few different options, compare the fee structures between funds.

Historic Performance

Never invest an asset without first understanding it. You should know why you are putting your money into an international ETF rather than a domestic fund. Look for the ETF’s liquidity, past performance, and transparency before including it in your portfolio.

The Takeaway

Adding international funds to your portfolio after doing your due diligence can give you a research advantage over the long term.

However, there are downsides to be aware of. The relative strength of foreign currencies to the dollar can help or hurt returns. For instance, the U.S. Dollar has rallied versus most major currencies lately, benefiting from bets on aggressive Federal Reserve rate hikes. Many non-U.S. ETFs are underperforming their U.S.-focused peers in the short run as a result.

So, if you add international exposure to your portfolio, consider the factors above. In return for your efforts, you’re likely to end up a more confident global investor.

Do you own any other international ETFs not mentioned here? Tell us about them in the comments below!

[author_ad]