Does an agriculture ETF belong in your portfolio? And if so, how do you find the right one?

Agriculture is one of the most critical industries in the world. It can also be quite volatile. Anything from the weather to the cost of fuel to consumption can impact the price of corn, wheat, soybeans, and so on. But for investors, there’s more to agriculture than just what comes from the field, which is why an agriculture ETF can be a good way to invest in this sector.

Agriculture is a truly interesting industry, and in many ways, it bears the brunt of economic and social conditions. The U.S. Chamber of Commerce estimates that the trade war with China and other tariffs cost U.S. farmers and ranchers about $8 billion in the fiscal year 2019. Yet, we all need to eat, and while some of us may be self-sustaining in that department, the majority of us buy at least some agricultural products. You don’t need an economics degree to understand that this situation creates both stability and volatility. It’s quite the conundrum.

Similarly, one bad storm can wipe out millions of dollars worth of agricultural goods. The derecho on August 10, 2020, blew hurricane-force winds across several midwestern states, impacted more than 37 million acres of farmland, resulting in at least $7.5 billion in damages. Again, however, people are not going to stop buying food. Coca-Cola (KO) isn’t going to stop buying corn syrup for its beverages. The Kraft Heinz Company (KHC) will still buy wheat and dairy for those yummy boxes of mac and cheese.

So, where does this leave the investor?

[text_ad]

Adding an agriculture ETF to your portfolio

You may have a hard time finding an agriculture ETF that strictly holds agricultural-based stocks. That doesn’t mean you should avoid them, but it’s always good to know what you’re buying.

The Market Vectors Agribusiness Fund (MOO) is an exchange-traded vehicle that launched in 2007 and provides exposure to companies that derive at least 50% of their revenues from agricultural businesses. Some of their top holdings include Deere (DE), Tyson Foods (TSN), and Zoetis (ZTS), which develops and manufactures medicines and vaccines for livestock and companion animals.

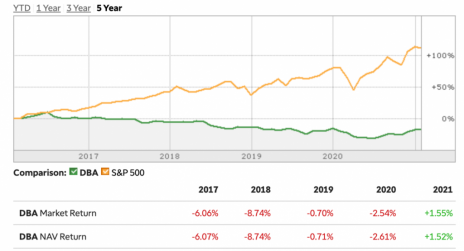

Another food play is the PowerShares D.B. Agriculture Fund (DBA), an exchange-traded fund. This ETF offers direct exposure to a basket of 15 agricultural commodity futures covering cattle, hogs, wheat, corn, soybeans, sugar, cocoa, coffee, and more. However, the returns on this ETF are in the negative, for the most part, as you can see in this chart from T.D. Ameritrade.

There’s more than one way to invest in agriculture

There is undoubtedly room for ETFs in any portfolio. We are partial to individual stocks, however, as we feel there’s more potential for greater returns.

Companies that make agricultural planting and harvesting equipment are expected to grow at a 9% annual clip until 2025. AGCO Corp. (AGCO) is the world’s largest manufacturer of machinery and equipment focused solely on the ag industry, and its tractors and combine harvesters are widely used by farmers globally.

Through its subsidiaries, AGCO serves nearly all major facets of food production, and several major farm machine makers operate under its umbrella, including Challenger, Fendt, and Massey Ferguson.

Archer Daniels Midland (ADM) is one of the world’s largest agricultural processors and food ingredient providers. It is a monster company with 40,000 employees spread across 200 countries. As with most food companies, profit margins are pretty thin, but growth is steady, if not spectacular. This is a conservative stock that will hold its own in the toughest of markets.

You can also look at agriculture-related stocks, like fertilizer. Fertilizer producers admittedly aren’t among the sexiest segments of the market. But they produce a product that is vital to modern farming. While farmers are among America’s unsung heroes, agrichemical producers are equally underappreciated.

Denver-based Intrepid Potash (IPI) is the United States’ largest producer of potassium chloride (muriate of potash, or MOP), which is exceptionally water-soluble. Global demand for such environmentally-friendly fertilizers is increasing as growers in several major countries must now comply with government-mandated sustainable farming guidelines. One warning, however, is that IPI does carry some risk and is not for the faint of heart.

In the meantime, if you want the best-performing growth stocks right now, we recommend subscribing to our Cabot Top Ten Trader advisory, where every week chief analyst Mike Cintolo provides you with 10 of the market’s strongest growth stocks from both a technical and a fundamental perspective.

To learn more, click here.