The generically named Conference Board unveiled its monthly consumer confidence survey data on Tuesday, and the results were eye-popping. U.S. consumer confidence jumped to 125.6 in March, up from 114.8 in February and the survey’s highest measure since December 2000. The consumer confidence index is now up 31% in the last year. Retail stocks, however, have gone in the other direction.

Retail Stocks Struggling

The SPDR S&P Retail ETF (XRT), whose 100 retail holdings include Amazon (AMZN), Costco (COST), CarMax (KMX) and Netflix (NFLX), has fallen nearly 11% in the last year, including a 6.5% drop-off so far this year. In other words, while the American consumer feels more confident about the U.S. economy than at any point since before 9/11, investors don’t want any part of the retailers who would logically stand to benefit from all that consumer confidence.

[text_ad use_post='129622']

That’s quite a contrast. Here’s what that contrast looks like in two charts:

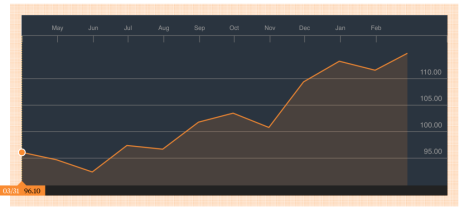

Conference Board Consumer Confidence Index (One-Year Chart)

SPDR S&P Retail ETF (XRT), One-Year Chart

Why the discrepancy? After all, U.S. retail sales have improved month-over-month every month since last August, and haven’t declined since last March. The 0.47% average monthly growth in the past year is ahead of the index’s historical average (0.36%), which dates back to 1992. On a year-over-year basis, retail sales are up 5.7% from last February.

So with no lack of consumer confidence and retail sales growing at a more consistent clip than they have at any point since the recession, why are retail stocks lagging? Part of it could be that the entire retail sector is in flux. As consumers shift their spending habits from big-box stores and malls to their laptops or mobile phones, many traditional retail giants—Sears (SHLD), J.C. Penney (JCP) and Macy’s (M), to name a few—are struggling to keep their heads above water. Even Wal-Mart (WMT) and Target (TGT), the two largest U.S. retailers, have seen their sales slip significantly of late.

Because those companies have historically been among the highest-profile retail stocks, it seems they’re dragging down the entire sector. AMZN and NFLX are doing just fine, each up more than 40% in the last year. But the retail sector is still mostly comprised of those struggling big-box stores and mid-priced department stores. Over time, that should change as more online retailers come public—and perhaps as some of these increasingly outdated department stores fold. When that happens, retail stocks will be a more accurate representation of where consumers are actually spending their discretionary income.

Retail is for Stock Pickers

In the meantime, few sectors cater more to stock pickers. While you wouldn’t want to buy the XRT or any other retail ETF, there are plenty of great retail stocks to buy, and not just online behemoths like AMZN, NFLX and eBay (EBAY). Best Buy (BBY), for example, is up 48% in the last year after managing to improve earnings by 49% thanks in part to effective cost-cutting.

So you shouldn’t discount the entire retail industry just because retail stocks as a whole are down sharply in the last year. There are plenty of diamonds in the retail rough—especially now that retail sales are growing and consumer confidence is at a 16-year high.

[author_ad]