“Safe” Investing and Lagging Indicators

We Have Met the Enemy, And He Is Us

Stock Market Video

In Case You Missed It

---

A few weeks ago, I saw a documentary film called “Frontrunners,” about the election of a student union president at Stuyvesant High School in New York City. My wife and I both love a good documentary, and this was easily one of the more interesting ones we’d seen. (I also heartily enjoyed “Freakonomics” awhile back, but that’s a different topic.)

Anyway, I mention “Frontrunners” because one of the campaign promises of the winner of the student union election was the establishment of a completely safe investment account for the student union. This would allow the student union to grow their income without having to spend money putting on fundraising events. One of his opponents criticized the idea on camera prior to the election, commenting there was no such thing as a completely safe investment account---an idea that’s both true and false at exactly the same time.

Let me explain: It’s well known that every investment account or investing system involves some element of risk. What changes is the amount of risk built into the system. Value investing systems, for example, can be very low-risk. Investing in growth and momentum stocks, on the other hand, can entail higher risk. (Growth and momentum stocks also have the highest profit potential, which for many investors justifies increased risk.)

Because of this risk built into every investing system, the statement that there is no such thing as a safe investment account is 100% true. There’s always a risk when you put money in the market, and you always have the potential to lose money.

However, you can lower risks with investment vehicles such as mutual funds and exchange-traded funds (ETFs) which have built-in diversification by having small positions in dozens or hundreds of stocks.

Today, I want to focus on ETFs, arguably the most sensible of the no- or low-fee investment vehicles out there today. The reason for this is right in the name--they’re traded on the open market, so you purchase an ETF the same way you’d buy stock in Apple (AAPL) or Caterpillar (CAT).

There are ETFs tied to the performance of indexes like the Dow Jones or the S&P 500, ETFs tied to sectors such as energy, health care and basic materials ... and even ETFs tied to individual countries such as the Market Vectors China ETF (PEK).

With so many options, how do you choose? You could spend hours poring over each and every ETF on the market before you decide where to place your money ... or you could enlist the aid of someone like Robin Carpenter, editor of Cabot ETF Investing System, who follows ETFs for a living.

---

The Bureau of Labor Statistics released the March jobs report on April 6, revealing the U.S. economy only added 120,000 new jobs in March while the unemployment rate held more or less steady. This is a drop from February, which had net growth of 240,000 new jobs (the initial number was 270,000 but the government cut about 30,000 employees after the report came out).

Stocks closed sharply lower on Monday after the lower-than-expected jobs numbers (analysts had expected roughly 205,000 new jobs), because the market was closed for Good Friday when the jobs numbers came out.

I admit to a certain fascination with the Pavlovian response to lagging indicators such as the jobs report. If an economic report is released and it’s below expectations, then the broad market declines. If it’s above expectations, then the broad market increases. It’s as if the whole of Wall Street is the dog in Pavlov’s experiment and when the “dinner bell” of a good economic report rings, they immediately start salivating for their meal.

My problem with lagging indicators, however, is two-fold. My first issue is that, in my opinion, a broad economic indicator such as a jobs report doesn’t tell a specific-enough picture to warrant trading on. Better to look at the performance of your individual holdings before making a decision whether to buy or sell.

For example, Google (GOOG) reported first-quarter results this past Thursday that beat expectations on earnings per share--$10.08 versus expectations of $9.65. If I had holdings in Google, which I don’t, it’s results like this that would govern my trading decision more than a broad-market indicator like the jobs numbers.

My second problem with lagging indicators is right in the name. Trading on lagging indicators is one of the clearest examples of the old phrase “hindsight is 20/20,” wherein you recognize the decision that should have been made well after the situation has passed.

I prefer to look forward, rather than back, when it comes to the market. That’s when the SNaC (story, numbers and chart) method, which I’ve talked about before, comes into play. Better to look at the fundamental aspects of your stock than a broad-market indicator to see how your portfolio will perform.

---

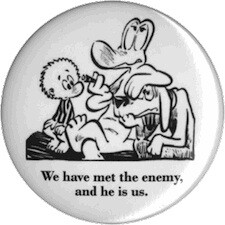

Here’s this week’s Contrary Opinion Button. Remember, you can always view all of the buttons by clicking here.

We Have Met The Enemy, And He Is Us

Walt Kelly first used the quote “We have met the enemy and he is us” on a poster for Earth Day in 1970, expressing his belief “that we are all of us responsible for our myriad pollutions, public, private and political.” For investors, the button is a clear reminder that we are our own worst enemies, continually allowing the mirror emotions of fear and greed to over-rule our intellect.

---

In this week’s Stock Market Video, Cabot Top Ten Trader Editor Mike Cintolo says to expect choppiness in the short term, but higher highs are coming. Stocks discussed: Apple (AAPL), Priceline (PCLN), Equinix (EQIX), Chipotle Mexican Grill (CMG), Salesforce.com (CRM), LinkedIn (LNKD), Rackspace (RAX), Sourcefire (FIRE), Continental Resources (CLR), Pioneer Natural Resources (PXD) and National-Oilwell Varco (NOV).

In case you didn’t get a chance to read all the issues of Cabot Wealth Advisory this week and want to catch up on any investing and stock tips you might have missed, there are links below to each issue.

Cabot Wealth Advisory 4/9/12 -- Suggestions for How to Keep Jobs in the U.S.

On Monday, Cabot China & Emerging Markets Report Editor Paul Goodwin shared 17 of the best suggestions from readers about how to keep jobs in the United States. The ideas touched on six main themes: Tariffs/Protectionism, Education, Deregulation, Innovation, Curbing Greed and Anti-Union sentiment

Cabot Wealth Adivisory 4/12/12 -- The Conservative Aggressive Investor

On Thursday, Cabot Market Letter and Cabot Top Ten Trader Editor Mike Cintolo wrote about the Conservative Aggressive style of investor, and also discussed the two ways to go about managing your portfolio during a market decline. Featured stock: LinkedIn (LNKD).

Happy Investing,

Matt Delman

Editor, Cabot Wealth Advisory

[author_ad]