The Chinese Internet sector is a rich hunting ground for aggressive investors looking for strong returns. I’ve been following the ups and down of this dynamic industry for more than 12 years, and I have seen both the tremendous runs that companies can make and the painful corrections they can fall into when investors get scared and decide to go risk-off by selling China. With that in mind, I recently got a question from a subscriber to Cabot Global Stocks Explorer (formerly Cabot Emerging Markets Investor)about a Chinese ETF that offers exposure to the Chinese Internet sector. The fund is KraneShares CSI China Internet ETF (KWEB), and it looks to match the performance of the CSI China Overseas Internet Index.

The point of an index-matching ETF is to get the benefit of a hot market, sector or industry without the risk of owning individual stocks, and that’s a popular strategy. There is probably more retirement money either 1) invested, in one way or another, in the S&P 500 Index and the Dow Jones Industrial Average, or 2) using those indexes as a benchmark for performance, than in any other assets.

[text_ad]

And that generally works pretty well. Except when it doesn’t. (No, I’m not going to rail against index investing again, although anyone who looks at a chart of the market that shows both the year 2000 and 2008 will probably be able to make that argument all by themselves.)

Chinese ETF Chart Looks Good - to a Point

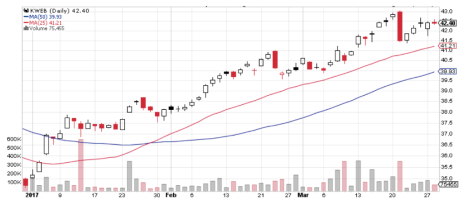

But this is about KWEB and getting exposure to the Chinese Internet sector. Here’s a daily chart showing how this Chinese ETF has been doing since the beginning of 2017.

I think you’ll agree that it looks like a pretty good investment, with a few big down days, but pretty rapid rebounds after its corrections and a great central tendency. It started the year in rally mode and didn’t so much as dip to its 25-day moving average along the way.

The trouble with KWEB comes when you extend the time line a bit. Here’s what it looks like using a weekly chart that extends back to May 2014. (The fund has been in existence only since August 2013.)

What the longer-term chart shows is that KWEB has been in a constant roller coaster mode, zipping up and down for a few months at a time, which means that unless you picked the right time to buy in—and believe me, it’s an emotional nightmare thinking about buying anything after a three-month correction—you will probably be buying an overbought asset.

I have a different idea, of course. While KWEB includes exposure to great Internet names like Tencent Holdings (TCEHY), Alibaba (BABA) and Baidu (BIDU), it has no way to reduce the exposure to Chinese Internet stocks when those stocks are out of favor with investors. So when you buy this Chinese ETF, you take the corrections in Chinese Internet stocks right along with the advances.

On the other hand, if you had a trusted partner who could show you the performance of the best stocks in the Chinese Internet sector, including when to get in and when to get out, you could invest in stocks like NetEase (NTES), a leading Chinese web portal and online gaming giant.

I wish I could claim to have bought NTES back in 2014 and held onto it for the duration, but that’s not true. But I did advise my subscribers to buy in June 2016, and they are enjoying gains of over 60% now. And gains in other Chinese stocks have been even bigger.

But the biggest service I offer is to tell people when to get out of the pool.

Follow the Trend

There are times when the trend in Chinese stocks is negative, and anyone who sticks around when that happens can get killed. So I am always alert for changes in momentum that can give a red light or green light to increased exposure to China.

If you’d like to see how you can include more stocks like NetEase in your portfolio while keeping risk under control, you can take a look at Cabot Global Stocks Explorer by clicking right here.

[author_ad]