After years of under-funding, a U.S. infrastructure boom is coming. Here are four stocks and ETFs that stand to benefit most from it.

For years, political gridlock on Capitol Hill led to inaction on the U.S. infrastructure spending front. But with a politically unified Congress just sworn in, many economists expect to see a significant uptick in infrastructure spending in the coming years. Here we’ll examine a few of the companies and ETFs that stand to benefit from new construction and maintenance projects for America’s critical transportation, power and water facilities.

For years, economists and political pundits have lamented that spending on U.S. infrastructure wasn’t sufficient to keep roads, bridges and public transport in repair. In 2017, for example, it was estimated that spending on the local, state and federal levels for infrastructure was a mere 2.3% of GDP—the lowest percentage ever recorded.

Disagreements among a gridlocked Congress on how public funding was to be allocated kept several approved infrastructure projects in the last two presidential administrations from getting off the ground. But with a one-party Congress newly sworn in, many observers are hopeful that nationwide infrastructure projects will finally become a reality.

[text_ad]

A recent edition of The Economist asked the question: “Is an infrastructure boom in the works?” The article answers its own question:

“Covid-19 may temporarily divert funds: governments may need to bail out struggling urban-transport systems, for instance, meaning there is less to spend on other projects. But the pandemic also explains governments’ enthusiasm for infrastructure: it can boost growth, both in the near term and further out.”

Moreover, the International Monetary Fund (IMF) maintains that “increasing public investment by 1% of GDP across advanced and emerging economies would create 20-to-30 million jobs and lift GDP by 0.25-0.5% in the first year, and up to four times that after the second.”

With gridlock no longer an obstacle, infrastructure spending projects will likely meet with limited resistance, especially with interest rates coming off multi-decade lows. This will make it easier for Congress to finance the spending. Further, as experts have noted, insurance companies and pensions funds in desperate need of yield will likely welcome—even encourage—the attractive cashflows that typically result from infrastructure-related assets.

A final consideration is that public works spending will almost certainly be a top priority of the new Congress, especially given the economic recession underway. Such projects are widely regarded as a panacea to quickly boost employment and stimulate economic activity.

With these considerations in mind, let’s examine a few select stocks (including an ETF) that are poised to appreciate in the coming months and years from increased infrastructure spending.

4 Stocks and ETFs for a U.S. Infrastructure Boom

The Best Infrastructure ETF

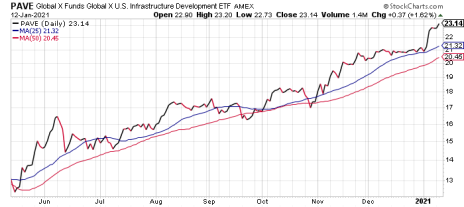

One of the best ways for having comprehensive exposure to companies that provide infrastructure-related equipment and services is through the Global X U.S. Infrastructure Development ETF (PAVE). This fund invests in companies that stand to benefit from a potential increase in infrastructure activity in the United States, including those involved in the production of raw materials, heavy equipment, engineering and construction.

Infrastructure Stock #1: Jacobs Engineering (J)

Jacobs Engineering Group (J) provides technical, professional and construction services and support for a several major industries and government agencies.

Indicative of the strong outlook for Jacobs is its impressive string of project backlogs, including a $24 billion backlog for the firm’s consulting services at the end of 2020 (up 6%). The backlog for Critical Mission Solutions (which serves the aerospace and defense industries) at the end of 2020 was up 3%.

Of even greater significance, however, is the firm’s qualified new business pipeline of $30 billion, which reflects increased investment from various government programs (including the U.S. Defense Department), as well as various nuclear, cybersecurity and 5G-related projects.

The strongly diversified Jacobs also recently announced an intent to acquire a majority stake in PA Consulting as a way to increase its reach in the fields of 5G, robotics, autonomous technology and machine learning automation. Analysts expect PA to post sales of around $715 million for 2020, which makes the acquisition potentially attractive for Jacobs’ bottom line.

Infrastructure Stock #2: Trimble Inc. (TRMB)

Trimble Inc. (TRMB) is a leading provider of advanced location-based solutions (GPS, laser, optical and wireless communications) that maximize productivity and enhance profitability. The company serves a variety of industries including agriculture, engineering and construction, transportation and wireless communications infrastructure.

Two of its largest business segments, Buildings & Infrastructure and Transportation, were negatively impacted by COVID-related headwinds in early 2020. But things are turning around for the company, with earnings expected to see 7% growth for 2020, followed by 7% and 13% growth in 2021 and 2022, respectively.

Trimble also recently completed the acquisition of a business that further expands its positioning services network to cover over a million square miles in North America. Management is further committed to making investments in the areas of cloud enablement, data management and artificial intelligence that will enable scaling to meet the huge opportunity it sees ahead.

Infrastructure Stock #3: Eaton Corp. (ETN)

Eaton Corp. (ETN) is a multi-industry power management company that provides sustainable solutions to help customers manage electrical, hydraulic and mechanical power. Eaton’s business provides it with exposure to the red-hot residential construction and data center markets, as well as utility infrastructure and the electric vehicle market.

While the top and bottom lines for Eaton are expected to be down for 2020, a sign that things are turning around for Eaton can be seen in its total backlog for the third quarter, which was up 11% from last year thanks to strength in data center orders (up 40%) and utility markets (which are benefiting from increased investment in smart grids).

Analysts foresee a strong rebound for Eaton starting in 2021 and continuing for several years on the back of an anticipated U.S. infrastructure spending bump.

If you want the best-performing growth stocks right now, regardless of industry, I highly recommend subscribing to our Cabot Top Ten Trader advisory, where every week Chief Analyst Mike Cintolo provides you with 10 of the market’s strongest growth stocks from both a technical and a fundamental perspective.

To learn more, click here.

[author_ad]