Stock Market Video The Three Monsters Under Growth Investors’ Beds

In Case of Doubt Sound Convincing

Stock Market Video

Moderation In Growth Investing

Your Ears Will Never Get You in Trouble

In Case You Missed It

---

In this week’s Stock Market Video, I looked at the past week and basically liked what I saw. Markets were flat, but didn’t give up any of last weeks’s gains, indicating that buyers remain in control. All the worries that are dancing in the back of investors’ minds haven’t been able to turn them into sellers. Stocks discussed were leaders in several sectors: Greenhill (GHL),Tesoro (TSO), Lululemon (LULU), Pulte (PHM) and Rackspace (RAX). Click below to watch the video!

I’m a big fan of moderation. I drive fast during my commute to Cabot, but I never want to be the fastest car on the highway. I like to watch television, but my family makes do with a 32-inch screen. And while I certainly like to eat and drink, I avoid restaurants with unlimited buffets; I can’t eat all I can eat.

The so-called Doctrine of the Mean is usually attributed to Aristotle in his Nichomachean Ethics. Aristotle saw moderation as the moderate position between two extremes. So, for example, courage looked to him like the laudable middle way between the extremes of rash action and cowardice.

And this theme of the middle way makes its way through Western thought via Marcus Aurelius (and through Chinese thought with strong roots in Confucian thought).

Moderation always takes a beating at the hands of young people, especially (let’s face it) young men. Extremism has, indeed, come to be seen by many as an admirable display of character. (In young men, endeavors such as beer consumption, hazardous sports and automobile driving spring to mind.) It may or may not be a good thing that young women seem intent on narrowing the gender gap in the avoidance of moderation.

But we can complain about that some other time. (And I will, in the interest of civility and maintaining good relations with everyone, keep my mordant thoughts on extremism in politics and religion to myself.)

Today, what I really want to write about is the path of moderation in growth investing.

By its very nature, growth investing requires a higher amount of risk tolerance and at least a pinch of optimism. Growth investors are willing to bet that economies will grow, that technology will make advances and that stocks will (in the long run) increase in price. And growth stocks usually exhibit higher volatility than value or income stocks.

So how can growth investing be moderate? Let me count the ways.

1) It’s moderate to use all the available information. Some investors (fundamentalists) buy stocks based solely on their historic and projected revenue and earnings. Others (technicians) use only chart analysis. And still others (enthusiastic idiots) look only at the company’s story before buying. The more moderate position is to use all sources on information and require that they all give positive signals before hitting the “buy” button.

2) It’s moderate to invest in sync with the market. Bull markets are profitable; bear markets aren’t. Anyone who maintains the same amount of exposure to growth stocks in a bull market as in a bear market, just isn’t listening to what the odds are telling them. If there were a little light over a roulette wheel that let you know when the odds were in your favor, sensible gamblers would wait for the green light before putting down big bets. Increasing your buying during strong market conditions and going to cash during market corrections just makes sense.

3) It’s moderate to limit your losses. Just as one or two great stocks can make up most of your gains for the year, one or two big losers can sink them. Of all of the standard wisdom about investing, the one that growth investors should have tattooed on their forearms is “Cut your losers short; let your winners run.”

4) Finally, It’s moderate to learn from your mistakes. Sometimes the only thing that will get people to change their behavior is to be forced to swallow a big old loss. Often it’s a string of mistakes that begins with an impulsive stock selection and ends with a stubborn refusal to sell at a loss. Fortunately, the market is happy to teach its lessons over and over ... for a fee.

I could, of course, say something at this point about how it’s nice to have an experienced mentor to teach you about these potholes and the discipline that can tame the ups and downs of the market and its stocks. But I won’t.

---

Here’s this week’s Contrary Opinion Button. Remember, you can always view all of the buttons by clicking here.

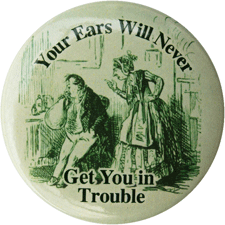

Your Ears Will Never Get You in Trouble

Attributed to Frank Tyger, who wrote, “Be a good listener. Your ears will never get you in trouble.” That this is pertinent to many spheres of life is obvious. In the investment business, the more you talk, the less opportunity you have to learn. So listen. Be receptive to the wisdom of others ... including the wisdom of these buttons.

[Editor’s Note: Listening is a rich vein in proverbs. Compare the one above with: “You have two ears and one mouth, so you should listen twice as much as you talk,” and “Even a fish wouldn’t get caught if he kept his mouth shut.”]

---

In case you didn’t get a chance to read all the issues of Cabot Wealth Advisory this week and want to catch up on any investing and stock tips you might have missed, there are links below to each issue.

Cabot Wealth Advisory 9/17/12 -- Paying With Your Phone

In this issue, Chloe Lutts, who edits the Dick Davis Investment Digest, writes about the coming payment revolution of using your mobile phone to pay for purchases using Square, or waiting for PayPal. Stock discussed: eBay (EBAY), which owns PayPal.

Cabot Wealth Advisory 9/18/12 -- Prediction, Probability & Knowability

Robin Carpenter of Cabot ETF Investing System uses this issue to explore the limits of market predictions and how using probability ranges can give a more accurate sense of what’s actually being predicted and how likely it is.

Cabot Wealth Advisory 9/20/12 -- The Truth About Witch City--Salem, Massachusetts

Tim Lutts uses this issue to clear up some misconceptions about Salem (his home town), and comments on the town’s witch-based tourist economy and all the other cultural resources it offers. Stock discussed: NetSuite (N).

Have a great weekend,

Paul Goodwin

Editor of Cabot Wealth Advisory

[author_ad]