Marijuana may be getting more publicity these days as it emerges from a long spell as a criminal substance, but alcohol never really goes out of style. And neither do alcohol stocks.

In fact, alcohol has been enjoying a surge of enthusiastic appreciation that’s lasted years. Cocktail culture is encouraging otherwise sane people to pay $15 or more for a mixed drink, and a bartender with imagination and a flair for innovation can find work anywhere drinkers appreciate home-made celery bitters. Microbreweries and their inventive (and sometimes inexplicable) beer ingredients are finding willing drinkers, as are craft distilleries, makers of flavored vodkas and the like.

And savvy marketers, recognizing that there is a taste among the well-to-do for exclusive (expensive) brands and special bottles have relentlessly hyped the myth of hard-to-get names. A 23-year-old bottle of Pappy Van Winkle bourbon can set you back a hair over $3,000 online. I assume somebody will buy it, but not anyone I know. And probably not anyone with a lick of sense.

[text_ad]

I’m not advocating for alcohol; I know the price it can exact when it’s abused. But it has woven itself deeply into the fabric of our society for a reason, and I have to believe that, on balance, it does more good than harm. It will even allow an old man like me to dance occasionally, which would be extremely unlikely without it.

Alcohol may be the social relaxant-of-choice for most of the world, but it’s also a huge industry whose members have been growing through mergers and takeovers. Mighty Anheuser-Busch, the parent company of Budweiser, merged with Belgian-Brazilian brewer InBev in 2008 and AB-InBev just paid more than $100 billion to take over SABMiller. The resulting brewing titan will be the source of about 30% of the beer in the entire world.

But how does the company’s stock look to a growth investor? It’s one of three alcohol stocks worth investigating…

Alcohol Stock #1: Anheuser-Busch InBev (BUD)

The newly expanded Anheuser-Busch behemoth trades on the Brussels stock exchange, but if you’re eager to back up your beer choice with a portfolio slot, you can buy the company’s ADR (American Depositary Receipt), which trades in the NYSE under the symbol BUD.

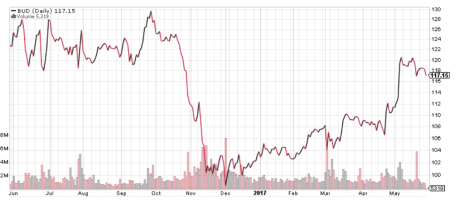

AB InBev is huge (market cap of $194 billion) and produces a number of high-profile brands besides Bud and Bud Light, including Corona (Find Your Beach!), Michelob and Stella Artois. The company just reported excellent Q1 results, with a 37% jump in revenue and a 45% increase in earnings, which is a relief after shrinking earnings in six of the last seven previous quarters. The problem is that the chart for BUD isn’t very reassuring, given its plunge last October and November. Even though the stock has rebounded from below 100 last December to over 120 this month, that’s not really a home run in this kind of market. (The stock’s rise from its December low may look impressive, but until its May 4 gap up, it was essentially matching the rise of the S&P 500.)

The real attraction of BUD is the stock’s 3.6% dividend yield, which makes it a reasonable choice for an investor looking for income and a chance to own bragging rights to those amazing Clydesdales, but not a growth investor.

Here’s a one-year chart of BUD.

Alcohol Stock #2: Diageo (DEO)

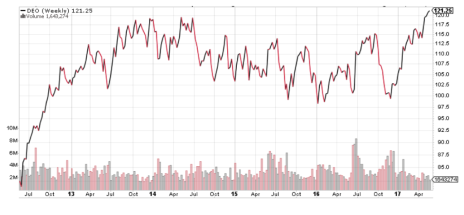

Any growth investor looking for a stronger chart might think they had found a friend in Diageo, a British firm whose brand lineup is packed with heavy hitters like Smirnoff vodka, Johnny Walker scotch, Guinness, Captain Morgan rum and Tanqueray gin. The company has a market cap of $76 billion and a global footprint and its stock has jumped from below 100 in late 2016 to over 120 in recent trading.

But while the recent action of DEO has been strong, when you look at the bigger picture, you see a stock that has been in a downtrend since late 2013. (The company’s 12 quarters of negative or zero revenue growth may have something to do with that.) DEO was a monster from the March 2009 Great Recession bottom through late 2013. And its possible that the stock’s nearly three-year time-out has reset it for further advances. DEO has shown a little speed and is now trading at new all-time highs. It also offers a 2.5% dividend, it’s still not cheap (P/E is 24) and its fundamentals are uninspiring.

Here’s what the longer-term chart looks like.

Alcohol Stock #3: Castle Brands (ROX)

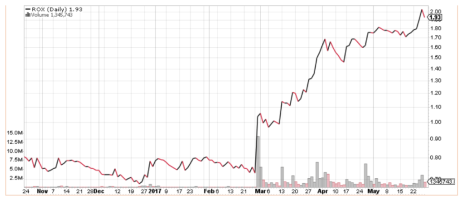

Aggressive growth investors, who are always looking for stocks that are decisively outperforming the market, might want to check out Castle Brands, a much smaller spirits company with minimal support from institutional investors. This is a low-priced stock (now trading just under 2), but it has a number of positives going for it.

First, the company’s revenue growth has been on the rise, up from 16% in 2014 to 19% in 2015 and 26% in 2016 (the company’s fiscal year ends in March). Analysts expect the company to turn profitable in 2017, a prediction supported by the 200% increase in earnings in the latest quarter. ROX rocketed out of penny stock status on February 28 after signing a national supply agreement with Wal-Mart, and continued its rise after announcing an increase in its stake in Gosling-Castle Partners, which owns the popular Goslings rum brand. No stock this cheap will attract much attention from mutual funds, but with great momentum and projections of profitability this year, a small position in Castle Brands could pay off big.

Here’s what the daily chart looks like.

Cabot’s growth advisories are always on the lookout for stocks that offer a combination of a great story, excellent numbers and a strong chart. You probably won’t find Castle Brands recommended in any of them until its price gets closer to double digits. But if you want a guide to red-hot Chinese stocks (I write Cabot Global Stocks Explorer) or just the best stocks of the previous week (Cabot Top Ten Trader does that every Monday), you can find reliable, responsible advice and profitable recommendations at www.cabotwealth.com

[author_ad]