Metal producers are benefitting from the ongoing economic recovery. And these three aluminum and steel stocks look especially attractive.

Spring is nearly upon us and signs of growth are emerging everywhere, including the economy. After a harrowing recession last year, the U.S. economy is steadily clawing its way back and recovering its former vigor. And the economy’s momentum is widely expected to accelerate in the months ahead.

Showing particular strength are cyclical industries that tend to outperform when the economy is heating up. Among the leaders right now are industrial metal producers—particularly aluminum and steel—which are benefiting from a combination of short supplies, increased construction-related demand and strong domestic automobile consumption. That’s been good for aluminum and steel stocks. More on those in a minute.

One of the key drivers of the bull market in aluminum involves supply-related problems, with the shortfalls due to collection and transport system breakdowns during global lockdowns.

For instance, even before last year’s pandemic, China had some major import-related troubles in securing needed copper and aluminum supplies in 2018 and 2019 (both metals were moved to China’s restricted import list in 2018). This was a major impetus in propelling the prices of both metals higher starting last year.

[text_ad]

In fact, China is still busily trying to fill the so-called “scrap gap” from the last couple years of shortfalls. Meanwhile, news reports inform us that Chinese traders are hoarding scrap for both metals as the supply imbalance continues.

There is also an ongoing aluminum can shortage in the North American food and beverage industry related to the pandemic. Ball Corp. (which makes metal and plastic packaging for the food and beverage industries) anticipates “demand continuing to outstrip supply well into 2023,” which should keep aluminum prices (currently at 30-month highs) buoyant for some time.

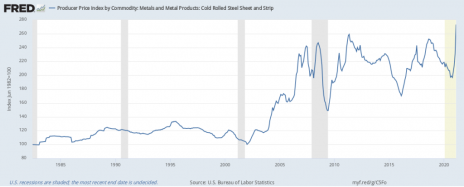

Even more critical to domestic industry is steel, which has also been in short supply ever since the pandemic broke out (due to mill outages, etc.). Automakers and aerospace parts manufacturers have had to scramble to secure steel supplies, with inventories at their lowest levels since 2004 and hot-rolled steel prices recently hitting highs not seen in decades.

Given the bullish global economic backdrop for these industrial metals, let’s take a look at some of the companies involved in their production and sale. Below are what I consider to be among the strongest U.S.-listed aluminum and steel stocks (from both a technical and a fundamental perspective) and which stand to benefit from this year’s anticipated economic resurgence.

Aluminum Stock: Alcoa (AA)

Rising use and tightening supplies are boosting the white metal’s outlook, and Alcoa (AA), one of the world’s largest aluminum producers, should benefit. Its operations include bauxite mining (aluminum ore), alumina refining (for smelting) and the primary aluminum manufacturing. With top user China on the mend, and with a boom underway in the global electric vehicle (EV) market (where it’s now the fastest growing automotive material), aluminum is expected to be in heavy demand this year.

As an indication of this demand, Alcoa reports that net imports of the metal have risen steadily in recent quarters in China in what the company calls an “unusual reversal” of normal trade flows. Moreover, the firm expects vigorous sales in 2021, including from higher anticipated demand in U.S. residential construction.

Looking ahead, the consensus expects the company’s bottom line to turn around in the coming quarters and accelerate higher in the next few years as China’s economy continues to grow, while the U.S. and Europe are predicted to consume more aluminum. The company also plans to pay a dividend as cash flow increases from its refinery and smelting operations.

Steel Stock #1: Steel Dynamics (STLD)

Steel Dynamics (STLD) is one of America’s largest producers of carbon steel (used in buildings, bridges, rails and pipelines, which makes this company an infrastructure play). It reported record levels of nearly 11 million tons of steel shipments for 2020, while revenue of almost $10 billion was the fourth highest in its history.

The company also reported record fabrication volume, strong earnings and steel shipments that were only 1% shy of a record, which management described as a “phenomenal performance” in view of prevailing economic conditions last year (and despite below-capacity steel mill operations).

Liquidity is also plentiful, with cash and equivalents north of $2.5 billion as of the end of Q4, so there’s plenty of reserves in case the industry faces an unforeseen headwind in the coming months. It’s worth noting, however, that Steel Dynamics uses highly scalable electric-arc furnaces to produce its steel, which should give it lots of flexibility in dealing with the volatility of the steel market.

Looking ahead, analysts expect a 35% increase in the firm’s top line for 2021, along with a sterling 82% bottom-line bump.

Steel Stock #2: Insteel Industries (IIIN)

Insteel Industries (IIIN) is the nation’s largest manufacturer of steel wire reinforcing products for concrete construction applications (making it a play on the domestic construction boom).

In Insteel’s fiscal Q1, revenue was an eye-popping 23% higher while per-share earnings rose to 42 cents (from 3 cents a year ago), reflecting a very favorable demand backdrop for the company’s products across several key industries.

In particular, public construction was a key demand driver, with spending well above expectations in 2020. Highway and street construction, one of the largest end-use applications for Insteel’s products, were even with 2019 levels (despite dire predictions of an infrastructure-related spending collapse).

Going forward, management expects a strong financial performance over the next few months driven by current robust demand trends for its products and “rapid significant escalations” in steel costs, which the company is passing through the supply chain.

Insteel also expects the new administration and Congress to come to terms on a long-term infrastructure investment program, which should inspire confidence in the domestic steel market and drive increased consumption of the metal. It’s a solid growth story, and a good-looking steel stock.

If you want the best-performing growth stocks right now (including industrial metal stocks like the ones mentioned here), I highly recommend subscribing to our Cabot Top Ten Trader advisory. Each week, Chief Analyst Mike Cintolo provides you with 10 of the market’s strongest growth stocks across all major industries from both a technical and a fundamental perspective.

To learn more, click here.

[author_ad]