Amazon (AMZN) is my wife’s favorite place to shop—and she’s not the only one. All across America, you can meet people who will testify that Amazon—especially Amazon Prime—has changed their life for the better. They can’t imagine living without it.

And the way Amazon is going (snapping up Whole Foods (WFM) most recently), it seems as though the company is on the way to becoming the dominant retailer in the country. In fact, many people expect that the company will eventually deliver things by drone within minutes from when you order by smartphone!

However, I’ve learned over the years that taking a contrary viewpoint can be very profitable. So, when I hear analysts—including people here at Cabot—get so bullish on a stock that they say, “You can leave that stock to your children,” as one analyst did recently about AMZN stock, I start to wonder if maybe, just maybe, the stock is overly loved, and it might be profitable to look at the possibility that Amazon is due for a major setback.

[text_ad]

But before I get to that, first let me recap my early experience with AMZN stock.

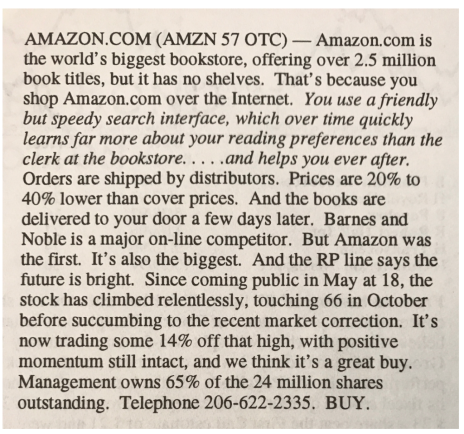

It was January 1998, just eight months after the stock had come public, that I added AMZN to the portfolio of Cabot Market Letter, which is now Cabot Growth Investor.

Here’s what I wrote back then:

At the time, Amazon sold books, nothing more, and the company was losing a ton of money. Pundits left and right believed that founder and CEO Jeff Bezos was on a suicide mission, and that Barnes and Noble (BKS) would soon squash the company.

But the stock was soaring, telling me forward-looking investors were bullish. Plus, I was a happy early customer. I bought lots of books, and in return Jeff Bezos sent me coffee mugs for Christmas the first two years. So I bought the stock, even though public opinion was against it, and watched happily as AMZN, along with many other young internet stocks, soared higher and higher over the next two years.

Finally, in March 2000, just after the market top, as the stock’s technical action turned negative, I sold AMZN stock for a profit of 1,185%.

(Note: If I had held on to AMZN stock until today, my profit would be greater than 17,000%. However, holding on would have been REALLY tough; AMZN lost 95% of its value from its 2000 top to its 2001 bottom.)

AMZN Stock Today

So, back to the present.

First, AMZN is extremely well loved today. Virtually every institutional investor in the world owns it.

Second, the stock’s Price/Earnings Ratio is a lofty 249. This doesn’t bother me a lot, because I know that Amazon’s earnings trends are very bumpy, thanks to its occasional big investment; earnings are expected to jump 114% in 2018. Still, the P/E ratio is definitely high, reflecting the great expectations investors have for Amazon’s future.

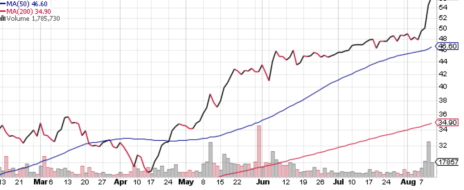

Third, AMZN stock has more than tripled since early 2015, while pausing for only one major correction in early 2016.

Fourth, the stock’s short-term chart shows growing selling pressures since early June, pressures that could easily grow larger if the broad market weakens further.

When I put it all together, my conclusion is that at the moment, AMZN has greater potential—both short-term and long-term—on the downside than on the upside.

- Precisely because the company is so well loved.

- Precisely because the stock is so well loved.

- Precisely because no one appears to think that Amazon stock can do wrong.

- And precisely because there are so many more potential sellers than buyers.

Now, I’m not saying that Amazon (the company) is going to do anything wrong—though integrating Whole Foods will certainly be a challenge. But I am saying that the stock is ripe for a cooling-off phase, and if the broad market’s current weakness grows, that cooling off could be dramatic indeed.

Long ago, I remember reading the advice of a wise old trader, which was basically this: “When the bull market turns to bear, sell the stock that has advanced the most, as it has the farthest to fall. Also, sell the stock that has advanced the least; if it couldn’t go up in a bull market, it may truly suffer in the bear market.”

An Alternative to AMZN

So, if I don’t like AMZN stock today, what do I like?

How about this stock?

I recommended this stock to you right here back on July 3, when it was trading at 46, telling you I liked the stock’s story. It serves a mass market in China, and revenues were up 62% in the first quarter.

I also liked its chart, which was building a base for a renewed advance.

Plus, I liked the fact that, unlike Amazon, almost no one in the U.S. knows this company’s name! Thus, it has many more potential buyers than sellers.

If you’d bought back when I recommended it, you’d be looking at a tidy little profit today. But it’s not too late. The trend is still up.

This stock, along with other favorite stocks of mine, was recently recommended in my own investment advisory service, Cabot Stock of the Week.

And the way I select these stocks is interesting. Every week I comb through all the recommendations of all the Cabot analysts and select one to highlight for my readers.

And then I manage a concentrated but diverse portfolio of up to 20 of those stocks, always working to keep the top performers and weed out the laggards.

As I write, the average profit in the portfolio is 81%.

If you can’t say the same, perhaps you’d like to join my happy subscribers. For details, click here.

[author_ad]