Remember the Hindenburg disaster?

Thirty-six people died when the German airship caught fire and crashed in New Jersey in 1937, an event which received enormous publicity in the U.S. but not so much in Germany.

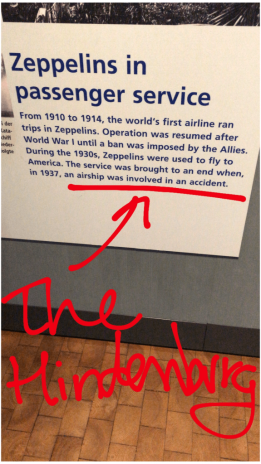

In fact, here’s a photo which my son took earlier this year —and notated—of a sign in a museum in Berlin, Germany that he judged guilty of understatement.

Another Hindenburg

And now we have a new mini-crash to discuss, thanks to the efforts of a short-selling firm named Hindenburg Research (which appears to consist mainly of Nate Anderson) and another named Quintessential Capital Management (which appears to consist mainly of Gabriel Grego), who collaborated on a hatchet job last week on the third-largest marijuana producer in Canada, Aphria (APHA).

[text_ad use_post='137724']

With the title “A Shell Game With a Cannabis Business on the Side,” their report claimed that Aphria had invested unwisely by buying companies in Jamaica, Colombia and Argentina, in some cases paying vastly inflated prices that rewarded insiders rather than shareholders. After laying out in great detail the specifics of these transactions, the short-sellers concluded, “We believe the conduct of Aphria’s executives and deal partners has been deeply unethical and possibly criminal. With a slew of highly questionable transactions, negative operating cash flow, and a low-quality product, we ultimately see no credible path forward for this company.”

Aphria’s management quickly rebutted the story, noting that its acquisitions had been done with due diligence and with guidance by financial advisors and that these acquisitions would enable the company to continue to be one of the leaders of the industry as it expanded internationally.

Additionally, the company’s management team stepped up to personally buy more than $3.1 million of its own stock—which lost nearly half its value last Monday and Tuesday—and fell even further Thursday morning when markets reopened after being closed a day for the funeral of President George H. W. Bush.

Here’s the daily chart.

So who is right? Is Aphria a scam or is the company the target of a smear job?

Well, time will tell, obviously, but before I get to that, I want to remind you of a lesson I’ve preached before: The goal is not to be right; the goal is to make money.

The short-sellers have almost certainly made money, so they have succeeded—in the short term.

And they have done so masterfully by following these steps:

- They waited until the broad market’s trend was negative, which meant investors as a whole were more likely to sell than buy.

- They waited until the sector’s trend was negative, which meant investors in the sector were more likely to sell than buy.

- They chose a young company with little institutional following and no earnings —which is true of most companies in the young marijuana sector.

- And they published a lengthy and detailed “exposé” full of facts and figures—and pictures. (And at the end they ducked all liability by warning, “Hindenburg Research makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use.”)

In short, they jumped on a trend and they accelerated it, at least temporarily. And painful as it is if you’re on the other side of the market, this is what happens from time to time with low-priced stocks with little institutional following in hot sectors.

So how do you protect yourself from such activities?

I can suggest five main strategies.

- You can restrict your investment activity to heavily traded stocks that are priced above $10 and that have good institutional following. (That’s what most of Cabot’s advisory services do, but that would preclude investing in most cannabis stocks.)

- You can diversify. In fact you should diversify. That’s the number one rule of investing, in my book. On the very same day that APHA fell apart, another Canadian marijuana stock, Cronos Research (CRON), surged 30% on the news that the company had been in talks with Altria (previously known as Philip Morris. (Note: both APHA and CRON have been in the portfolio of Cabot Marijuana Investor since 2017.)

- You can work hard to buy low and sell high, even taking partial profits when stocks are out of trend to the upside—as we did in Cabot Marijuana Investor on October 16, the day before Canadian legalization.

- You can start with small investments when you invest in young, volatile stocks and build your position over time if the stocks perform as expected.

- You can adopt a long-term perspective. In my opinion, many investors are too close to the market, and trade too often, when they would be better served by simply holding long term and playing golf.

What to do with APHA Now

But what if it’s too late? What if you’ve already been hurt by the attack on APHA?

My short and sweet advice is to hold on; that’s the advice I’m giving to readers of Cabot Marijuana Investor. These short-sellers triggered a plunge and now they’ve got to cover—if they haven’t already—because the odds are very good that this stock is not going to zero.

In fact, those Latin American assets that the short-sellers focused on are a minor part of Aphria’s business, which is primarily growing marijuana in greenhouses in Canada.

At the end of the last quarter, the company had $273 million in cash and the third-largest revenue of the cannabis growers in Canada, behind only Canopy Growth (CGC) and Aurora Cannabis (ACB).

Going forward, Aphria is projected—by a reputable outside analyst—to have revenues of $271 million next year and EBITDA of $0.20 per share.

So I’m quite confident that in the long run, APHA will be higher.

And there’s a technical argument for the stock to bottom here as well. Looking at this long-term chart, you can see that the stock bottomed consistently in this area in May through July of 2017.

I’ve been writing about the marijuana sector since early 2017 in Cabot Marijuana Investor, and I’m going to keep on writing about it, as the cannabis industry as a whole has the potential to become a $3 trillion industry by 2030.

Today, my recommended portfolio holds 13 marijuana stocks, and is well diversified, with stocks both in Canada and the U.S; both in marijuana and hemp; and both in production and retail. With many stocks moving as much as 10% on many days, you need diversification to smooth out the bumps.

You also need specific expert guidance, which is what I give my readers in every issue and every update. Last year the portfolio gained 121% and this year it’s up 18% as I write.

For more info, click here.

[author_ad]