Netflix (NFLX) is still king of the streaming video mountain. It has 158 million subscribers worldwide, way more than Amazon Video (96.5 million) and Hulu (75.8 million), its two closest rivals (for now). It has the deepest library of quality content, with wildly popular shows such as Stranger Things and Orange is the New Black and critically acclaimed movies like Roma and the soon-to-be-released Martin Scorsese epic, The Irishman. And it’s still growing, with sales and earnings expected to improve more than 25% this year.

But Netflix (NFLX) stock has had a bad year. Meanwhile, shares of Apple (AAPL) and Disney (DIS), both of which are launching their own, cheaper streaming video services this month, are having very good years. It’s not a coincidence.

With the so-called streaming wars officially hitting a fever pitch this month, which streaming stock is worth buying for the coming years? Let’s break down Apple vs. Disney vs. Netflix, examining them each from several different angles.

[text_ad]

Apple vs. Disney vs. Netflix: The Content

Apple’s new streaming service, Apple TV-Plus, launched earlier this month … to mixed reviews. Its signature show, The Morning Show, starring Jennifer Aniston, Reese Witherspoon and Steve Carell, has been both panned and praised, though it has certainly sparked a lot of conversation, which is good for Apple. It also has See, starring Jason Momoa, and Dickinson, starring Hailee Steinfeld, and several others, plus a well-reviewed documentary called The Elephant Queen. But that’s about it, for now. More projects are in the pipeline, but right now Apple’s lineup is quite thin.

Disney doesn’t have the same problem. When it launches today, subscribers will gain access to an entire library of Walt Disney movies and cartoons, Star Wars movies, the Marvel universe and more. Avatar, Frozen, Star Wars: A New Hope, Iron Man, Bambi and Avengers: End Game are just a few of the many blockbuster titles Disney Plus will boast, many of which it pulled from Netflix in preparation for its own streaming service.

That said, Netflix still has the widest variety of offerings—with 198 originals alone, not to mention big-ticket favorites like Friends, Cheers and, coming soon, Seinfeld. If you’re going purely for the most quality content, Netflix is still the clear winner.

Edge: Netflix

Apple vs. Disney vs. Netflix: The Price

Apple’s share price got a big boost in September when the company announced Apple TV Plus pricing: just $4.99 per month. Disney Plus is cheap too, at just $6.99 a month. Netflix, on the other hand, is no longer cheap, and is starting to enter HBO territory after the company hiked prices again at the beginning of 2019. It’s now $12.99 per month for a standard plan (up from $10.99). The Premium Plan, which offers up to four Ultra HD streams, is up to $15.99 per month (up from $13.99 previously). A Basic Plan, which offers a single, non-HD stream, is now $8.99 – so even that’s more expensive than either Apple TV Plus or Disney Plus.

You might not get a ton of bang for the buck just yet. But for now, Apple TV Plus has the price advantage, which makes it attractive for people who are either new to streaming video or people wanting to tack on one more service without taking on many extra costs.

Edge: Apple

Apple vs. Disney vs. Netflix: The Growth

It’s obviously too early to know how Apple and Disney’s streaming services will grow, because they just launched. So let’s take the temperature of Netflix’s growth compared to its two current closest rivals, Amazon Video and Hulu.

As I mentioned, Netflix is projected to achieve both top- and bottom-line growth of more than 25% (but less than 30%) this year, which is pretty good considering how saturated the service is, particularly in the U.S. Thanks to rapid expansion in international markets, however, Netflix is projected to grow its user base by 7.6% this year.

Amazon Video is growing faster, but not that much faster, at a projected 8.8% clip, according to eMarketer. Hulu, with just 40% market penetration to start the year (compared to 86.5% penetration for Netflix and 52.9% for Amazon Video), is growing the fastest, with the individual viewer tally expected to jump 17.5% this year.

So, Netflix is lagging a bit in growth, though perhaps not as much as you’d expect given the large gulf in terms of subscriber numbers between it and the other two. But with considerably more competition suddenly entering the fray, you’d expect Netflix’s growth to further wane in the coming years. Given its ready-made library of content (as opposed to Apple, which has never been a content creator and is essentially starting from scratch), I’d give Disney the growth edge if we’re talking about the coming year. Here’s betting its subscriber base will grow more than Hulu’s 17.5% between today’s launch and next November.

Edge: Disney

Apple vs. Disney vs. Netflix: The Stocks

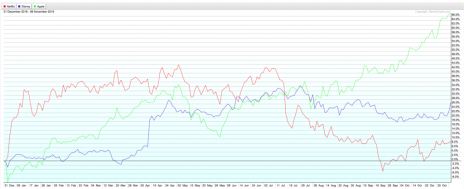

For us investors, there’s only one thing that matters in this much-hyped streaming war: the charts. The rest of essentially noise. But the chart is a reflection of investor perception, and right now the big money is flowing into Apple stock (green line, below) and Disney stock (purple line) – and out of Netflix stock (red line).

Year to date, NFLX is up more than 10%, but it’s down 23% from its May peak above 385 per share.

DIS stock is up more than 24% this year, with most of the gains coming from the huge gap up in April after the company unveiled its Disney Plus streaming price.

AAPL has been the biggest mover by far, up 66% in 2019 and on a steady incline since it announced that Apple TV Plus would be even cheaper than Disney Plus. The stock is currently at all-time highs.

Obviously, there’s a huge difference between Netflix and Apple and Disney; streaming is all Netflix does, while Apple TV Plus and Disney Plus are just the latest pet projects for otherwise well-diversified companies. If those two streaming services fail, it won’t be the end of Apple or Disney.

However, the fact that the biggest jumps this year for Apple stock and Disney stock came after the two companies announced their streaming prices tells you how important these new streaming wars are in the eyes of Wall Street. Streaming video is increasingly the main way we consume television and movies, putting Blockbuster Video out of business, making cable TV companies like Comcast (CMCSA) seem like dinosaurs, and now taking dead aim at movie theaters.

DVDs and movie stores used to be big business. Television has been enormous business. The film industry may be the biggest of them all. Streaming video has forced one of three into extinction; now it’s putting a serious dent in the other two.

So yes – who wins this streaming war is a big deal. You’d be wise to pick a winner and invest in it. Right now, Netflix is the clear winner. But who will be the big winner five years from now?

My money’s still on Netflix. It began this streaming video revolution and is thus the most synonymous with the industry, like Coca-Cola (KO) is with soda. It has the farthest reach internationally, and is expanding at a rapid clip overseas despite reaching a near-saturation point in the U.S. It’s proven quick to adapt as technology has changed. And it’s the only pure play on streaming video, including Amazon (AMZN).

Given that NFLX stock has perked up in the past couple of months, bouncing from a low of 254 to 295 as of this writing, and yet still trades well below its 385 highs, I think this is a great entry point. The worst of the Netflix selloff is already over; anticipated competition from Apple TV Plus and Disney Plus has already been baked into the cake, and blowback from the January price hike is long over.

It may not feel like it perception-wise, but this is the best time to buy NFLX stock in years.

[author_ad]