Nearly five years ago in this space (February 20, 2012), I wrote about automotive stocks and recommended Tesla (TSLA).

The stock is up more than 700% since then, and I still like its prospects long-term, as the automotive revolution continues to move the industry away from polluting internal combustion engines and toward electric—and eventually self-driving—cars.

But in the interest of keeping up with the competition, I took a thorough look at all the other publicly traded automotive stocks recently, and today I’d like to share my findings with you.

First, though, I want to mention that despite the recent good news from the industry (mainly domestic sales), the future is going to bring a lot of changes. It begins with the movement away from the internal combustion engine and the improvement of self-driving technology, but it matures with the growing movement away from car ownership by individuals and toward shared usage via ZipCar, Uber, Lyft etc. Which brings us to a future where there are fewer cars needed per person.

[text_ad use_post='129622']

If your business model is simply making and selling cars, and you’re already a huge corporation, that’s a tough future to contemplate. In fact, I think a lot of these companies are afraid to contemplate it.

And I think a lot of automotive stocks are selling at what appear to be cheap valuations precisely because investors know that the road ahead for the industry is full of challenges.

With that preamble, on to the stocks.

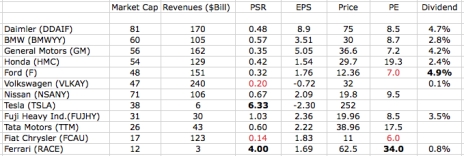

Breaking Down 14 Automotive Stocks

Of the 14 publicly traded automotive stocks, I eliminated the two Chinese stocks, Kandi (KNDI) and BYD (Build Your Dream) (BYDDF), right off the bat because they’re trading under 10. Risk is greater for stocks under 10 dollars, and I don’t need extra risk.

A quick look at the numbers, however, showed that Kandi is struggling, while BYD, which gets its revenues fairly equally from both mobile handsets and automobiles, is growing. It’s worth keeping an eye on, especially because the Chinese automobile market has such huge growth potential.

Turning to the remaining 12 automotive stocks, the biggest thing I noticed was that only one of the 12 companies has been able to grow both revenues and earnings over each of the past three years. Only one! In short, this is a mature industry with big established players, and thus investors shouldn’t expect any big successes.

However, there are always opportunities, so after the table, I discuss them all, in order from biggest market capitalization to smallest.

DAIMLER (DDAIF)

The parent company of Mercedes Benz has been growing slowly in recent years, though in 2016 it saw revenues shrink 3%. Daimler gets 55% of its revenue from cars, with the remainder from trucks and other commercial vehicles and financial services. 84% of its revenues come from outside the U.S. The stock hit a high of 102 in early 2015, and is now working to return to that level, but doesn’t display notable strength.

BMW (BMWYY)

The company’s full name is Bayerische Moteren Werke AG, but everyone knows it as BMW. The company, which also owns the Mini and Rolls-Royce brands, gets 77% of its revenue from cars and a huge 21% from financial services. Like Daimler, it’s very much a global company. Interestingly, the stock outperformed the market from its IPO in 2008 until early 2011, but has underperformed since then. And the reason is clear—growth at the company has pretty much stopped. BMW does pay a modest dividend but shares the same problem as Daimler—finding a way forward as the vaunted German superiority in automobile engineering is slowly eroded.

GENERAL MOTORS (GM)

GM gets 73% of its revenues from North America, and a large part of that from trucks and SUVs, whose sales have been strong as gasoline prices have remained low. GM has not been a growth company in recent years, as revenues have stagnated in the $150 billion range since 2011. But this year the company is on track for $160 billion in sales, much of which will fall straight to the bottom line as it comes from higher-priced vehicles. Investors have been bidding the stock up lately, though it has yet to break out above the resistance that has constrained it since 2013. In the meantime, the big 4.2% dividend is comforting.

Note: Readers of my Cabot Stock of the Week owned GM for less than 10 months last year and reaped profits of 14%, not including dividends.

You can join them today by clicking here.

HONDA (HMC)

Honda gets 73% of its revenues from cars, 13% from financial services and 12% from motorcycles. And while the Japanese company did manage to bring in record revenues in 2016, growth has been pitifully slow. Honda pays a modest dividend, but its stock, like BMW’s, has been underperforming the market since 2011. And while its relatively high P/E ratio might be assumed to signal that investors are looking forward to growth, in fact it’s only because earnings took a temporary dip last year.

FORD (F)

Ford is notable for both its fat dividend (see table) of 4.9% and its low PE ratio of 7, both signs that this is a very mature company that’s going nowhere fast. And its stock looks terrible, signaling that even though the industry has been strong recently, investors as a whole are skeptical about Ford. One factor in this perception: the fact that GM is now marketing the all-electric Chevy Bolt, positioned as the first mass-market car to challenge Tesla, while Ford is lagging far behind.

VOLKSWAGEN (VLKAY)

The facts of Volkswagen’s cheating on diesel emissions are in the books; the uncovering of the cheat chopped roughly 60% off the company’s market capitalization. Now wise investors are asking if Volkswagen stock is cheap. Certainly the low 0.2 price/sales ratio suggests that’s the case, and the stock’s action so far this year—roughly equivalent to the market—is encouraging. But I’d feel more confident if I could see the company return to profitability and see real revenue growth. Right now I don’t, and I’m skeptical that Volkswagen, with the highest revenues in the industry, can grow at all.

NISSAN (NSANY)

Nissan is expected to earn record revenues in 2017 and 2018, but the cold hard fact today is that the company’s revenues peaked in 2012. The company is truly a global player (Nissan gets just 13% of revenues at home), but its brand lacks a strong identity. The stock has been basically range-bound since 2011, underperforming the market. And it doesn’t even pay a dividend.

TESLA (TSLA)

Tesla stock is still very expensive, selling at six times revenues—but when I recommended it four years ago it was selling at 18 times revenues! And unlike most of its competitors, Tesla has real revenue growth—though earnings aren’t expected to arrive until 2018. Fundamentally, the company not only continues to lead the way in both electric cars and self-driving cars, it has also expanded into both the solar panel business and the battery storage business—on both a household scale and utility scale. In fact, Tesla just dropped the word “Motors” from its name. Technically, the stock is still in the base-building range it’s occupied since it completed its massive 2013-2014 advance. It’s a healthy pattern, and I’m still bullish on the stock long-term.

FUJI HEAVY INDUSTRIES (FUJHY)

Fuji is the company that makes Subarus and it’s the one company of these 14 that has managed to grow both revenues and earnings over each of the past three years. In fact, the company has posted nine consecutive years of sales growth! Interestingly, Japan accounts for 61% of the company’s revenues, but U.S. volume has been increasing for the past five years, and the stock’s “high” price/sales ratio of 1.03 tells us investors expect growth to continue, perhaps because the practicality of the company’s cars resonates with younger buyers. At any rate, the company is changing its name to Subaru (effective April 1, and that’s no joke), which makes sense given that 91% of the company’s revenues come from the cars (the rest is aerospace and defense). FUJHY hit a record on the first week of this year but sold off sharply last week.

TATA MOTORS (TTM)

Tata is the Indian car and truck company that owns Land Rover and Jaguar, and it’s not doing badly, all things considered. Revenues have grown every year of the past decade, while earnings have been more variable. Also, while there have been periods of great and prolonged strength, the stock has underperformed the market since 2010. Still, the company has great potential as those big old manufacturers at the top of the list struggle to grow.

FIAT CHRYSLER (FCAU)

Fiat Chrysler is a Dutch multinational corporation with headquarters in London that is controlled by Italian shareholders and sells the majority of its cars in North America. That arrangement seems to be working, finally. Last summer the company’s shares were trading at 6, but now they’re up into double-digit territory and analysts are looking for earnings growth of 11% in 2017 and 19% in 2018. Lastly, it’s worth remembering that management would like Fiat Chrysler to be acquired by one of the bigger players—at the right price. (It’s those big companies’ best route to growth.)

FERRARI (RACE)

Spun off by Fiat Chrysler a year ago, Ferrari beat analysts’ estimates when it reported earnings last week, and the stock gapped up to new highs! It’s not cheap, as attested by its price/sales ratio of 4.0 and its price/earnings ratio of 34, but as the smallest company here, and one with a very strong brand, it has great potential for growth.

So, Which One of these Automotive Stocks Should You Buy?

If you want to keep up to date on Tesla (TSLA), my Cabot Stock of the Week is your ticket. I provide updates on the stock every week—after recommending one new stock that’s already been recommended by one of the other Cabot analysts. Click here to join.

If you’re interested in small growth stocks like Ferrari and BYD and Tata, your best bets are Cabot Top Ten Trader, edited by Mike Cintolo, or Cabot Global Stocks Explorer, edited by Paul Goodwin. Neither of these editors has recommended these stocks yet, but they are definitely considering them.

But if you really want to track the big boys, GM, Ford, Daimler, Nissan, Honda, etc, I seriously recommend that you take a look at Roy Ward’s Cabot Benjamin Graham Value Investor. In addition to those automotive stocks, Roy also has opinions (all based on cold hard numbers), on Autonation (AN), Delphi Automotive (DLPH), Group One Automotive (GPI), Penske Auto (PAG) and Ryder System (R).

Thus, if you want to do any investing at all in automotive stocks, I think you’ll find Roy’s numbers a great help.

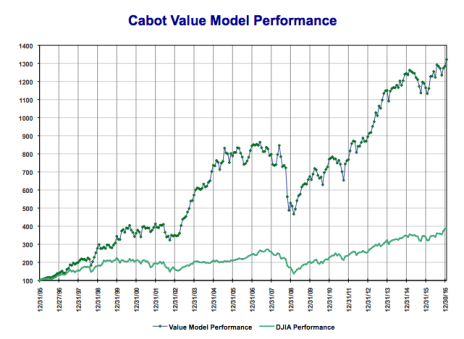

Note: since inception in 1995, Roy’s Cabot Value Model has provided an impressive return of 1,221% compared to a return of 666% for Warren Buffett’s Berkshire Hathaway! During the same 21-year period, the Dow has gained just 288%.

To find out more about Cabot Benjamin Graham Value Investor, click here.

[author_ad]