Of the many valuable aphorisms about investing, one of the most valuable for growth-oriented investors is, “Trends tend to last longer and go further than originally anticipated.”

In my lifetime, for example, the defining example of such a trend was the decline of interest rates from nosebleed levels in 1980, when one-year T-bills yielded 17%, down to what experts proclaimed were “normal” levels in 2000, when they yielded 4%—and where the consensus was that they should stay. Instead, as you know, rates kept falling, with the trend lasting far longer and going far lower than virtually anyone originally expected, until they basically hit zero.

I remember this trend very well, in fact, because when I got my first home mortgage in 1986, I chose an adjustable-rate mortgage that reset annually, and I rode that mortgage rate down and down and down, resisting all calls to “lock in now” until the mortgage was paid off.

[text_ad]

So when I look at a trend, particularly a new and strong trend like the trend that’s affecting energy stocks today, I always keep in mind the possibility that it may last much longer and go much further than virtually anyone expects.

Now, inquiring minds will wonder, “How could that happen?” And the correct answer to that is, “You don’t need to know; all you need to do is follow the trend.” If pressed, I could easily concoct a scenario involving soaring global demand for energy, a failed Russia, and enhanced regulation (driven by climate change concerns) that limited supply and thus led to a long imbalance of supply and demand. But it’s hardly worth thinking about. Instead, it’s better to simply watch the trend.

In that spirit, here are five energy stocks that are in strong uptrends now—and thus might be in uptrends for many years to come.

5 Best Energy Stocks Today

Best Energy Stock #1: Arch Resources (ARCH)

Arch Resources provides thermal coal that powers electric utilities and other industries as well as metallurgical coal used for steel production; all in all, it’s the second-biggest coal supplier in the U.S, producing over 13% of the coal used domestically. Arch’s flagship Leer mine ranks among the lowest-cost, highest-quality U.S. metallurgical mines, and because the company’s thermal mining operations are being phased out, steelmaking coal will be Arch’s focus going forward—and because steel use is on the rise worldwide as economies reopen, Arch’s metallurgical coal is in high demand. The fourth quarter saw revenues of $806 million, an astounding 123% gain from the the year-ago quarter and 13% above the consensus, while per-share earnings of $11.92 were up from a loss a year before. And such big cash flows are going to be turned into dividends! Arch says it will begin paying out 50% of the prior quarter’s discretionary cash flow through its existing fixed dividend, along with a new variable quarterly cash dividend. The result is that some analysts estimate Arch could pay out as much as $20 per share in dividends in 2022! The company has been public only since 2016 and the stock is hitting all-time highs.

Best Energy Stock #2: Chesapeake Energy (CHK)

Chesapeake Energy was one of the highest-profile energy firms to essentially go belly-up during the last down cycle, suffering from years of low natural gas prices and, of course, too much debt. Ironically, though, it was that process that’s created what could be the sector’s greatest cash flow story today. Chesapeake now operates in three basins: The Marcellus is super low cost (wells return 150% at $3 natural gas!) and makes up 45% of output; Haynesville is also a cash cow (105% returns at $3 gas) and makes up 33% of output; while the Eagle Ford (110% returns at $3 gas and $62 oil) cranks out the rest. Despite a now-healthy balance sheet, the firm does hedge quite a bit (north of 60% of output hedged for 2022), but that only gives more certainly to the spigot of cash that’s coming. In Q4, Chesapeake cranked out $372 million in free cash flow (north of $3 per share), leading to a variable-plus-base dividend of $1.77 for the quarter. And 2022 should be even larger; at current prices, the firm sees a jaw-dropping $2 billion of free cash flow which will lead to $1 billion of dividends (10%-yield-ish) as well as $500 million of share buybacks. The stock (reborn after the prior implosion) has been trading for just one year and is hitting new highs.

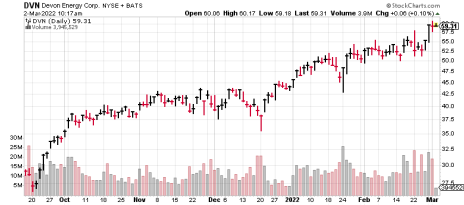

Best Energy Stock #3: Devon Energy (DVN)

Devon’s assets are spread out among the Delaware Basin, the Williston, the Powder River and Anadarko Basins, and the Eagle Ford. And those areas provide a diversified output mix, with half oil, a quarter natural gas and a quarter gas liquids. With those assets, Devon is cranking out ridiculous amounts of free cash flow, a lot of which is being returned to shareholders. Devon pays an 11-cent fixed dividend, but has been returning about half of the rest, too. In December, it paid 84 cents per share total to shareholders, and in February it paid a dollar! Moreover, 2022 looks even brighter. If oil averages $70 next year and natural gas averages $4, Devon believes it will earn about $6.30 in free cash flow per share, which in turn will lead to (a) something around $3.25 in dividends, (b) share buybacks that total 3% to 4% of all shares, (c) $500 million more of debt reduction and (d) the rest boosting the already-large cash balances. As investors grasp the significance of these numbers, they’ve been boosting their holdings, which has boosted the stock. It’s not at a record high yet—the high was 127 way back in 2008—but it looks like it’s on the way there!

Best Energy Stock #4: Halliburton (HAL)

Halliburton is one of the largest and broadest oil service companies, helping clients with reservoir evaluation, well construction and completion, production and more. Halliburton saw earnings double in Q4 as higher oil prices and drilling activity boosted demand for the firm’s offerings. Fourth-quarter revenue of $4.3 billion expanded 32% from the year before, while full-year sales were up 6%. The improved performance led Halliburton to push its then-tiny dividend up quite a bit (now a 1.5% yield) with plans to reinstitute share buybacks. Management further guided for continued growth and expects a multi-year energy upcycle. As for the stock, it’s not at a record high yet—the high was 74 in 2014—but it’s on the way there!

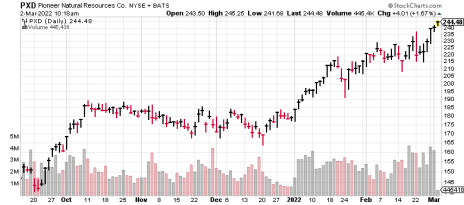

Best Energy Stock #5: Pioneer Natural Resources (PXD)

Pioneer is the largest pure-play oil and gas explorer and producer in the high-margin Midland basin area. Moreover, the firm has been busy reducing debt and shoring up its balance sheet for a while; by year-end, its net debt position will likely be zero. And that means it can fatten its dividend payments. The firm offers a modest base dividend (1.1% annual yield), but then aims to pay out 75% of its remaining cash flow as a variable dividend, too. It cut a dividend check in eight separate months of 2021, and management thinks if oil prices remained in the low- to mid-$80s for the next five years the firm would likely be paying out north of $20 per share in dividends annually! Interestingly, management doesn’t think prices are going to sag meaningfully. In fact, they’ve closed all the company’s remaining 2022 oil hedges (and most of its gas and liquids hedges), thinking supply/demand dynamics should keep oil prices elevated for a long time to come, possibly even moving into triple digits. As for the stock, it recently broke out above its 2014 high of 234 so is now trading at all-time highs.

Do you own any energy stocks not on this list? Tell us about them in the comments below.

[author_ad]

*This post has been updated from an original version.