If the expectations of investors since Trump became President come true, America’s infrastructure will get a big boost in the years ahead. There’s no secret about that. It’s why infrastructure stocks (stocks in the infrastructure industries) have been strong since election day.

But I think this is just the beginning. I think this trend could last a lot longer and go a lot further then people expect. We’ve got an awful lot of infrastructure to fix! So today I’m going to give you an update on four infrastructure stocks that I wrote about here in November. I think they could be big winners in the years ahead.

[text_ad]

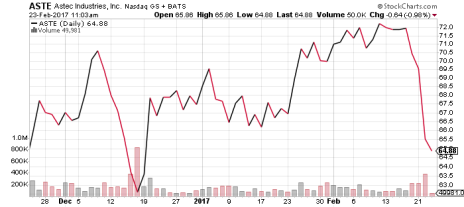

Infrastructure Stock #1: Astec Industries (ASTE)

Astec, headquartered in Chattanooga, Tennessee, is the company that makes the Roadtec asphalt paver that paved my cul-de-sac a month ago. But that’s not why I’m recommending it.

I’m recommending it because the company is clearly well managed. It makes a profit every year. It has no debt. It pays a small dividend that amounts to 0.6%. And its stock is just coming down from new highs above 70.

In addition to asphalt pavers, Astec makes aggregate processors, oil and gas drilling equipment, mining and wood processing equipment, wood pellet processors, impact crushers and more. Importantly, it boasts that it’s the leading manufacturer of hot-mix asphalt plants.

In the third quarter, Astec’s revenues grew 52% to $326 million, while earnings grew 237% to $0.54 per share. For 2017, analysts are expecting earnings growth of 14%, but that’s almost certainly conservative.

Infrastructure Stock #2: Navistar International (NAV)

Navistar, headquartered in Lisle, Illinois, makes trucks and buses. The company, which was formerly known as International Harvester, traces its roots back to 1893.

But whereas Astec has had great management in the past decade, Navistar has suffered from one problem after another. These include failed acquisitions, accounting errors (and civil penalties related to that), delisting from the NYSE, penalties for EPA non-compliance, a severance package of roughly $15 million paid to the departing CEO, declining military sales, layoffs, plant closings, asset sales and an underfunded pension plan.

2016 will be the fifth consecutive year that Navistar loses money.

But the stock is going up!

And analysts, believing the company finally has its costs under control and is now lean and mean, are estimating that Navistar will earn $0.20 per share in 2017 and $1.44 in 2018. That’s a real turnaround!

Infrastructure Stock #3: Old Dominion Freight Line (ODFL)

Old Dominion, headquartered in Thomasville, North Carolina, traces its roots back to 1934, when Earl and Lillian Congdon ran a single truck between Richmond, Virginia and Norfolk, Virginia.

In the years that followed, Old Dominion grew steadily, both organically and through acquisition.

The company came public in 1991, but 82 years after its founding, guess who’s running the company? Earl, Jr. is the Executive Chairman and his son David Congdon is the Vice Chairman and CEO. The Congdons clearly manage for the long term. Also, Old Dominion is a union-free company.

The one blip in the record of Old Dominion over the past decade was 2009, when the horrible economy led to a 19% decline in revenues. But the company still made a profit that year, and every year since, both revenues and earnings have grown.

Earnings actually slipped more than 3% in the fourth quarter, though sales improved 1.5%. But in 2017, analysts are looking for earnings growth of 11%.

As for the stock, ODFL has been on an uptrend for the past year and broke out to new highs earlier this month!

All three of these infrastructure stocks could be good buys here, especially now that each of them has pulled back a bit after hitting new highs.

Investors with shorter time horizons may want to focus on Navistar, which is enjoying a turnaround but still risks bad management in the long run, while long-term investors will want to look at the two well-managed companies.

My Favorite Infrastructure Stock

And then there’s my favorite stock in the sector.

It’s a steel manufacturer, headquartered in Indiana, and very well managed, just like Astec and Old Dominion.

As a commodity manufacturer, this company has less control over its destiny than the three companies discussed above. As a result, revenues at the company have declined in three years of the past decade.

But management has made a profit every year! And (here’s a sign of confident management) the stock pays a dividend of 1.5%.

Here’s the chart.

I’m not banging the table for the stock right now; as with the other infrastructure stocks, there’s a short-term risk of some retracement. But long term, I have no doubt that this well-managed company will be a major beneficiary of the coming boom in infrastructure spending, and my goal is to help my readers nail down big profits in the sector.

If you’d like to join them (and get regular advice on investing in this steelmaker and the 16 other growth stocks, value stocks and dividend stocks in my portfolio) you can learn more here.

[author_ad use_author="125408"]