There’s no question that many stocks have taken hits during the past couple of weeks; my intermediate-term market timing measure (we call it the Cabot Tides) has turned negative, telling us the trend has turned down and some caution is in order. But that doesn’t mean you should lose sight of the big picture. And in the big picture, many of the best long-term stocks remain intact.

That’s because the long-term trend is solidly up and many long-term studies (some of which I’ve written about here, and others I’ve detailed in Cabot Growth Investor) point to higher prices down the road. Thus, I’m playing things carefully right now, but am certainly not advising subscribers to stick their head in the sand.

In fact, there’s another bullish longer-term factoid that I’ve mentioned in Cabot Growth Investor, and it struck me again as I was doing research over this past weekend. Flipping through a few hundred stock charts, I’m impressed with how many well-traded growth stocks have lifted off from major, multi-year consolidations so far this year—such action doesn’t mean much in the short run, but over time, it bodes well, as these leaders are still somewhat early in their overall moves.

[text_ad]

Six of the Best Long-Term Stocks

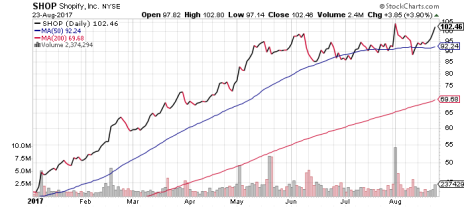

For example, a big reason I added Shopify (SHOP) in January was its breakout from its huge 18-month post-IPO base, which has led to a terrific advance. Given that SHOP ran up “only” five months from its multi-year breakout to its June peak, the odds are that it hasn’t seen its ultimate highs.

Tesla (TSLA) is another example—it spent 30 months below 290, but broke out in April and, despite a couple of tough shakeouts, has held the 300-ish level and is in good shape.

PayPal (PYPL) built a 21-month post-IPO consolidation before breaking out on earnings in April. It remains in a relatively smooth uptrend.

Alibaba (BABA) topped at 120 in late 2015 and didn’t decisively clear that level until May of this year, and of course it’s been a great performer since.

Arista Networks (ANET) hit a post-IPO high of 94 in September 2014 and was still at that same level in January of this year, before the stock exploded higher on earnings. It’s had a huge move since.

ServiceNow (NOW) hasn’t been as dynamic, but it also topped in late 2015 (near 91) and didn’t leave that level behind until it broke out in April on earnings.

From a chart perspective, these are some of the best long-term stocks I’ve found. I could go on, but the point is that, you have a lot of institutional-quality leading stocks that might be extended in the short term (a correction is possible after 10 months of no pullbacks in the market), but long-term, few can argue that these stocks are truly “late stage” and obvious to the crowd.

Moreover, I see some others that are setting up big, long-term breakouts if things go well.

One More Promising Chart

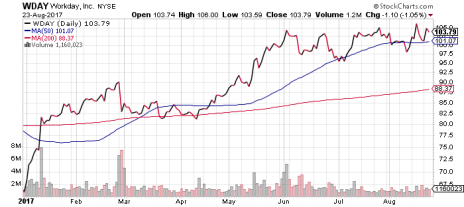

One stock I’m watching closely is Workday (WDAY), a potential liquid leader from the cloud software sector. It made its name in human capital management (HCM) products and is an emerging blue chip stock—management has deep experience in the industry, and the company has been growing sales at 30%-plus rates for many years, while cash flow and earnings are ramping up (analysts see earnings booming 450% from a small base this year, and another 42% next year).

Like most stocks, WDAY has been choppy recently, but it’s set up a nice pattern both in the short- and long-term. The stock lifted above long-time resistance in May, but didn’t get far before it tightened up, as it’s now chopped sideways in a relatively tight range over the past 11 weeks. And it’s held up decently despite the market’s recent wobbles.

The next big event is earnings, which are due out August 30. A bullish reaction (say, a leap above 108 or so, or ideally a push to new all-time highs above 115) would be a sign the stock has changed character and a major advance could be starting. Until the overall market gets healthy, I wouldn’t advise taking a big position in it, but if nothing else, WDAY is one for your watch list right now—and if it does gap up on earnings, you can consider taking a small position on what could soon become one of the market’s best long-term stocks.

For additional stock ideas you can add to your portfolio, consider taking a trial subscription to Cabot Growth Investor which I edit.

For more information, click here.

[author_ad]