As Australia burns, the acceleration of climate change has never been more obvious. Perhaps 136 bush fires incinerating 14.7 million acres, killing 480 million animals (!) and 24 people will be a wake-up call for the world; perhaps not. But momentum in renewable energies has already accelerated in the last decade, and now it’s finally showing up in solar stocks.

Investing in renewable energy stocks is far from a novel idea, of course. Solar stocks peaked more than a decade ago and have been a genuinely bad investment for the last five years. But that seems to be changing.

[text_ad use_post='129623']

Solar stocks, as measured by the Invesco Solar ETF (TAN) (clever ticker symbol), are up 59% in the last year and the fund is threatening to hit its highest level since 2015.

What have been the best solar stocks? Mostly the usual suspects, though they’re not names you’ve heard much positive about in years. Here are the top five performers over the last year:

The Best Solar Stocks to Buy Now

Enphase Energy (ENPH): +454% in the last year

SolarEdge Technologies (SEDG): +167%

JinkoSolar Holding Co. (JKS): +103%

Vivint Solar (VSLR): +91%

Hannon Armstrong Sustainable (HASI): +50%

Note that all five of those are either small-cap stocks or mid-cap stocks, topped by SolarEdge Technologies’ $4.8 billion market cap. It’s interesting to also note that only one of those companies (JinkoSolar) made our list of the best solar stocks the last time we wrote about them, nearly four years ago. These are mostly upstarts; the First Solars and SunPowers of the world have continued to sputter.

But their charts look good—all five stocks trade comfortably above both their 50- and 200-day moving averages.

And then there’s the earnings growth. Three of them are expected to grow their bottom line by double digits in 2020; another (HASI) is predicted to post 6.5% EPS growth. Only Vivint Solar fails to turn a profit, though its losses are supposed to narrow significantly this year.

That’s a big improvement from five or six years ago, when almost none of these companies turned a profit (JinkoSolar being the long exception). They’ve matured. Solar stocks bottomed two to three years ago. And the strong stock market of the past year has provided a nice tailwind.

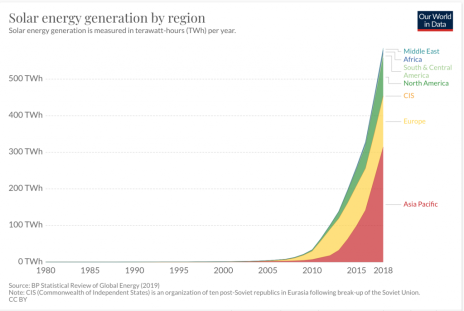

Meanwhile, solar energy production and demand has accelerated. Look at this chart of solar energy generation (broken down by region), courtesy of the BP Statistical Review of Global Energy:

There was a noticeable upturn in 2015. It didn’t carry over to solar stocks at the time. But now that these small companies have (mostly) shored up their bottom lines, and the stocks became oversold, the sector as a whole is thriving.

The takeaway? It appears safe to buy solar stocks—for the first time in years. The charts finally match up with the narrative of advancing global demand for renewable energy. If you want to dip a toe just buy one, JinkoSolar appears to have the best combination of chart, growth (double-digit sales and earnings growth expected this year) and value (it trades at a mere 17 times trailing earnings).

But you could put a little money into any one of these five solar stocks and feel pretty good about it.

It would make you feel even better if you donated a few bucks to Australia’s relief effort.

[author_ad]