If you’re among the hordes of shoppers who search out online bargains and bricks-and-mortar sales, it will come as no surprise that today is Black Friday, the biggest day of the U.S. retail calendar, which supposedly got its name because it was the day that pushed U.S. retailers into the black for the year.

It’s a great story, and the only thing wrong with it is that it is complete hogwash. Most profitable retailers make money in each quarter of the year, not just the last. Plus, Black Friday is being challenged by Cyber Monday as the top spending day.

And while it’s not technically in the running, Singles Day in China puts both of the top U.S. spending days in the shade. Singles Day (November 11) used to boast about $3 billion in gross merchandise volume. This year, that number approached $17 billion, and Alibaba (BABA), the Chinese e-commerce giant, has turned the day into a telethon extravaganza with celebrity appearances and big-name bands.

[text_ad]

But Black Friday is universally recognized as a bellwether day for U.S. retail sales. It’s regarded as such a big deal that people who don’t pay attention to the fortunes of retailers at any other time of the year actually follow news reports about holiday spending as a way to gauge consumer confidence and, indirectly, the strength of the U.S. economy.

For investors, there are a few stocks that stand out when they look at retail for investing opportunities, with Amazon (AMZN) at the top of the list. Amazon has always been a big deal, but the company had a reputation for caring more about gaining market share and building out its infrastructure than booking profits. When the bottom line finally started to improve in early 2015, AMZN responded with real energy. Here’s a weekly chart.

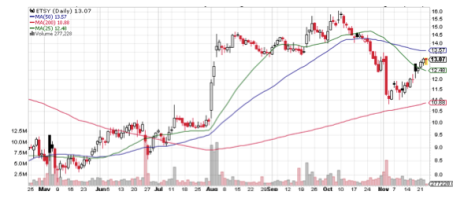

Cabot Top Ten Trader, which presents the 10 strongest stocks in the market every Monday, hasn’t featured a true retail stock in a long time. But back in September, Etsy (ETSY) did pop up. This online store specializes in artisanal and one-of-a-kind items, which is a niche market. The stock made a nice off-the-bottom move starting in January. ETSY soared from 6 in the middle of January to 16 in early October, with much of the energy supplied by a great quarterly report in early August. As you can see from this daily chart, the stock caught a downdraft in October and sank to 11 earlier this month.

But ETSY has been bouncing off that low and is back to 13 and back on top of its 25-day moving average. And if buyers mob the site on Black Friday, it could be a name to watch.

Still, if you’re curious about what kind of winners the market is producing, a subscription to Cabot Top Ten Trader will give you the answer every Monday, including revenue and earnings figures, chart analysis and a clear write-up of why the stock is strong. For students of the market and dedicated growth investors, it’s a vital tool for digging out leading stocks and identifying the top growth stocks early in their advances. Click here for more details.

[author_ad]