Today, I have a great long-term growth stock I’d like to recommend—one that I recently recommended to my Cabot Top Ten Trader subscribers. But first, I’d like to give you a brief follow-up to my Wall Street’s Best Daily of two weeks ago, when I talked about the difference between the bubble peak of 2000 (when even the UPS delivery guy was giving stock tips) and today, when sentiment among most investors remains apathetic.

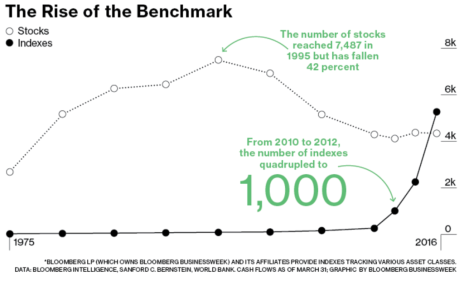

Here’s another big-picture chart that suggests enthusiasm among investors has a long way to go. An article on Bloomberg.com said there are now more stock indexes than there are individual stocks. According to the chart below, there’s something like 4,200 individual stocks, but over 5,000 stock-based indexes.

[text_ad]

Why are there so many indexes? Because so many investors want to invest in them (usually through exchange-traded funds, or ETFs). That certainly doesn’t sound like greed to me—even stock investors are looking for safer, less volatile indexes, not the higher risk/reward of individual stocks. I think that’s likely to change in a big way by the time the bull market hits a major top.

Last point on this: The decrease in the number of individual stocks is, in itself, a bullish thing for the market due to supply and demand—with fewer stocks out there, every dollar that comes into the market can push the market that much higher. Again, this is very long-term, big picture stuff; it doesn’t have much to do with the intermediate-term. But it’s another reason to think the uptrend could last longer than most investors expect.

In the News: Cyberattacks and Fidget Spinners

Another article I saw early Monday morning concerned the WannaCry cyberattacks carried out over the weekend. I didn’t dig too deeply into the details, but I know the news got a lot of headlines, and many investors used it as a reason to bid up cybersecurity stocks on Monday, even ones whose business had been struggling.

Separately, I heard from one of my loyal subscribers, who told me an analyst or two had opined that demand for so-called fidget spinners would drive the company’s bottom line higher. I have no idea why, but apparently these things are incredibly popular, even approaching fad/collectable status, and thus are driving sales and traffic to outlets that carry them.

Both these headlines have affected a handful of stocks in a couple of different sectors. But neither one really interests me, at least when it comes whether to buy-hold-sell a particular stock.

Why is that? Because history has shown me that these sort of short-term demand (or supply) drivers aren’t what interest big, institutional investors—the ones who really drive stocks up or down.

The classic example of that is a union strike. The headlines will say that the strike (and the accompanying lost sales that go with it) is a bad thing; indeed, stocks will often sag when there’s a broad-based strike. But time and again, big investors will support a stock during a strike, knowing that, once it’s resolved, shares are likely to rally back.

The story is similar with shorter-term events. Sure, it’s possible that we’re just starting a multi-month wave of cyberattacks that permanently increases demand for protection, or that demand for fidget spinners remains super-strong for many years and bolsters certain firms’ earnings. More likely, though, none of us will be talking about either one of these events in two or three months—and that’s usually enough to dissuade big investors from acting on the news.

Better Choice: A Long-Term Growth Stock That’s Dependable

Instead, it’s important to have conviction in a company’s major growth story that, ideally, can play out over many years. One of my favorite ways to find these stories is through Cabot Top Ten Trader—as we’ve continuously refined and improved the system, I’ve found my own research has greatly improved.

Top Ten starts its screening process by looking for the best stocks in the market—our proprietary screens look for a mix of great short- and longer-term relative strength, as well as recent trading volume and some other tidbits. That usually narrows down the list to about 100 stocks—from there, I look through all of them for encouraging chart patterns, growth numbers and, if I don’t already know the story, that as well. That produces each week’s list of 10 ideas, complete with buy ranges, loss limits and one potential long-term growth stock highlighted as our Top Pick.

One recent Top Ten idea that has a great story and is near a good entry point right now is GrubHub (GRUB), a firm which many investors have heard of (and use), but few own. It made the Top Ten cut because of its recent earnings gap, its consistent, dependable results, and the fact that fears of competition are fading.

Here’s what I wrote in Top Ten on May 1.

“GrubHub is the leading online and mobile takeout and delivery ordering platform, which is a true mass market, with $75 billion of takeout and delivery from independent restaurants every year, and that doesn’t include chain restaurants, which would triple that figure. Better yet, GrubHub should remain on top mainly because of the network effect, with the firm’s huge restaurant base (more than 50,000, including new chains like Chili’s, Maggiano’s and some initial rollouts with Subway, Buffalo Wild Wings, Denny’s and more) attracting more customers (8.75 million at the end of March), which in turn leads more restaurants to sign up, and so on. As mentioned above, first-quarter report put competition fears to rest—not only did sales (up 39%), earnings (up 45%) and EBITDA (up 32%) top expectations, but so did user growth (26%), daily orders (up 21%) and gross food sales ($898 million, up 26%). Interestingly, management made a point of saying its growth in Tier 2 and Tier 3 markets outpaced its Tier 1 locations, a sign that GrubHub’s appeal is strong outside the major cities, in part due to a successful national advertising program. Best of all, GrubHub is a win-win for everyone, providing a wide choice for diners and proving to be additive to restaurants’ top line. …”

It’s a very good story, and the stock has settled down nicely after its earnings ramp. I think GRUB is buyable around here and can do very well as a long-term growth stock as the bull market progresses.

To learn more about Cabot Top Ten Trader, click here.

[author_ad]