In Canada, marijuana stocks are all the rage.

I know this not only because I’ve now produced two quarterly issues of Cabot’s Marijuana Investor and the stocks are doing great, but also because I was recently in Toronto with my wife, and one morning, while reading the Globe and Mail at breakfast, this is what I saw.

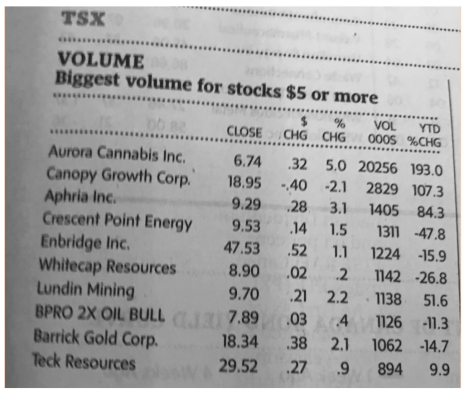

The three most heavily traded Canadian stocks on the Toronto exchange were marijuana stocks, and all three have had a fantastic year!

[text_ad]

And you didn’t even have to invest at the very start of the year to get great performance.

In fact, if you’d simply invested in these three stocks back in August, when I recommended them in my first issue of Cabot’s Marijuana Investor, you’d have a profit of 473% in Aurora Cannabis (ACBFF), a profit of 349% in Canopy Growth (TWMJF), and a profit of 270% in Aphria (APHQF).

You Don’t Even Have to Be Canadian

All three of these companies are Canadian marijuana growers, and all three companies are working very hard to get big fast—because full legalization of marijuana is coming to Canada next summer. But you don’t have to be Canadian to buy these stocks. All three of these stocks are available on U.S. stock exchanges—though the trading symbols are different here.

And you can get all the details on these three stocks—and learn about my other seven favorite marijuana stocks—by clicking here.

If you do, I guarantee that you’ll be in the early wave of U.S. investors in marijuana stocks, and as we all know, the early bird gets the worm.

Why Aren’t U.S. Investors Excited About Marijuana Stocks Yet?

Partly it’s because there are no big U.S. companies succeeding in the industry—though there is one that’s traded on the NYSE that’s in Cabot’s Marijuana Investor—and right now my profit in that one is just 8%, so you can still get on board.

Partly it’s because the big pharmaceutical companies are not getting involved with marijuana—for the simple reason that it’s a commodity, and thus they can’t make a big profit on it.

Partly it’s because cannabis is still technically illegal in the U.S. at the federal level—and institutions are reluctant to invest in companies that might fall foul of federal laws.

And partly it’s simply that cultural attitudes take time to change. Just as many people would never invest in “Communist” China, where Cabot investors have made huge profits on Chinese stocks, many people will never invest in “illegal” or “immoral” marijuana.

Nevertheless, the trend toward legal marijuana is very clear.

Medical marijuana is legal across Canada, and full recreational use is expected to be legal next summer.

In the U.S., marijuana is legal to some extent in 29 states. It becomes fully legal in California in January, and it’s only a matter of time before it becomes legal across the country, first for medical use, and eventually for recreational use.

And the best part of that trend is this.

Reversing the Opioid Epidemic

Because of federal law, it’s long been illegal for researchers to even study the medical effects of cannabis.

Because of that research ban, misinformation about the drug is rife. Many people are still under the misimpression that all marijuana does is make you high. They don’t realize that there are two major components to the drug that do very different things.

In short: CBD is the acronym for cannabidiol, one of at least 113 active cannabinoids found in cannabis, while THC is the acronym for tetrahydrocannabinol.

CBD has no intoxicating effects, while THC is the main cause of the typical marijuana high.

CBD, however, does have calming effects on anxiety and an anti-psychotic effect. When the main goal of users was to get high, growers selectively bred marijuana to boost concentrations of THC while lowering the amount of CBD. But today, growers are developing the opposite to serve the growing medical marijuana market.

And while their efforts are far from complete, the spread of medical marijuana has already impacted the market for opioids!

In fact, states that have legalized medical marijuana have found that their opioid problems are shrinking faster than in states where marijuana is still illegal.

Ultimately, I believe that researchers will develop and market high-CBD cannabis that is safer than opioids.

It’s Not Too Late

Now, shortsighted investors might look at the performance of marijuana stocks this year and say, “It’s too late; I missed it.”

But these investors don’t appreciate one of the most important truisms of growth stock investing: “A trend, once established, lasts longer and goes further than most investors expect.”

Sure, there will be corrections along the way; that’s normal in every bull market. But 10 years from now, even five years from now, I’m confident that the top stocks in the industry will be a lot higher—and you’ll be wishing you followed my advice this year.

However, I don’t recommend that you simply jump on those three leading stocks. As I said, corrections are normal, and all three of those stocks are ripe for a correction.

Instead, I recommend that you invest in some of the other stocks in Cabot’s Marijuana Investor, the stocks that haven’t run away to the upside yet. Any one of them could be the next Aurora Cannabis.

[author_ad]