Thanks to China’s swift recovery from COVID-19, chemical stocks are on the rise. And these three are leading the charge.

With each passing month, it seems, a growing number of stocks join the swelling ranks of important business segments on the rebound. This month, the economically-sensitive chemical makers have assumed a leadership position in the expanding list of recovering industries demanding our attention. Here we’ll take a look at some major chemical stocks that have upside potential in the months ahead, particularly in light of China’s economic rebound.

Chemicals are of paramount importance to the modern world, as many of the everyday materials we take for granted are results of modern chemistry. From rubber to plastics to paint, chemical companies convert raw materials into countless thousands of consumer products which lower costs and improve living standards for everyone.

The chemical industry constitutes 15% of the total U.S. manufacturing sector. And while the industry was seriously impacted by COVID-related shutdowns, chemical producers have been gradually resuming shuttered operations in the U.S. and around the world. What’s more, the supply-chain disruptions that were problematic for the overall industry in the last few months are finally being alleviated as production returns to normal.

[text_ad use_post='129623']

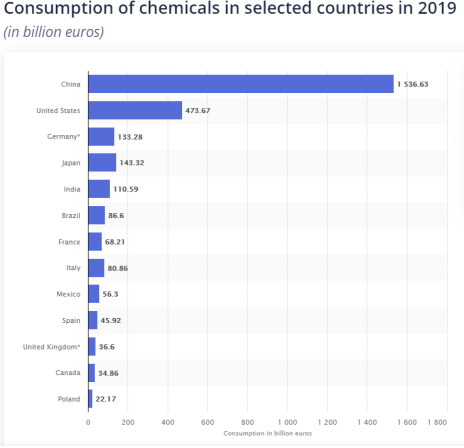

No discussion of the chemical industry would be complete without mentioning China, the world’s largest user of commodity chemicals. With China’s economy impressively bouncing back from the coronavirus (its economy grew over 3% in the second quarter, compared to a 7% contraction in Q1), there’s even more reason to hope for booming business ahead for chemical companies with international exposure.

Source: Statista

With that in mind, let’s take a look at some of the most attractive U.S.-listed chemical companies with exposure to China.

3 Chemical Stocks to Buy

Chemical Stock #1: Eastman Chemical (EMN)

First up on the list is Eastman Chemical (EMN), which makes a broad range of plastics, chemicals and fibers for everyday purposes. The company has done well to focus on its higher-margin products (such as textile operations) in the wake of pandemic-related disruptions, and it has increased its footprint in key markets, including China (the firm has nine factories in the country with long-range plans of expanding into its lower-tier markets).

Management remains focused on free cash flow, and the company reported resilient revenue in the second quarter and first half of 2020. Eastman also reported that Q3 was off to a strong start and was seeing volume recovery due to the inventory management actions it took in the second quarter. Consequently, the firm expects to post a “substantial” sequential increase in earnings. Wall Street agrees, predicting per-share earnings of $1.28 for Q3 (compared with 85 cents in the previous quarter). Analysts also anticipate steady improvement to Eastman’s top line in the next few quarters.

Eastman Chemical is also a reliable dividend payer and has steadily increased its dividend over the last several years (the current yield is 3.4%).

Chemical Stock #2: Albemarle (ALB)

Albemarle (ALB) manufactures additives to or intermediates for plastics, polymers, agricultural chemicals and pharmaceuticals. Earnings in Q2 for Albemarle were negatively impacted by COVID, but the firm topped revenue estimates by 7% and beat EPS estimates by 14 cents. Moreover, analysts foresee a steadily rising growth path for both the top and bottom lines, beginning in 2021 and in the coming years.

Additionally, Albemarle’s lithium and lithium derivatives segment – with a sizable toehold in China – should be helped by increasing battery demand from China (ranked #1 in the world among countries most heavily involved in the lithium-ion battery supply chain in 2020).

The consensus on Wall Street concerning Albemarle seems to be “wait ‘til next year,” but the impressive strides that ALB and other chemical stocks have made this summer are encouraging and suggest investors may not have to wait that long to see worthwhile returns. If you’re long ALB, I suggest using the 50-day line on a weekly closing basis as a rolling stop-loss guide (as with all stocks covered here).

Chemical Stock #3: Dow Inc. (DOW)

Dow Inc. (DOW) is the result of a 2019 spinoff from DowDuPont. The firm designs and manufactures specialty chemicals, polymers and related products. Dow has a broad portfolio of commodity chemicals and this diversification should serve it well in facing any adverse economic headwinds that may lie ahead.

During the pandemic, Dow shifted its strategic focus to take advantage of increasing consumer demand for cleaning and disinfectant products. The company has also seen more business from its food packaging, health and hygiene and pharma application segments. And orders for chemicals used in the automobile and construction industries have had a noticeable uptick.

The economic improvement in China should further benefit Dow. (Indeed, management indicated as early as March that demand for its products in China were already on the rebound.) Dow also features a healthy dividend yield of 6.1%. From a technical perspective, the stock is a bit stretched from its 50-day line and could use a pullback. But the intermediate-to-longer-term trend for this stock looks healthy.

In summary, the chemical industry is rapidly rebounding from this year’s virus-related shutdowns and appears to be on a solid growth path going forward. Although some degree of uncertainty surrounds the economy in the months ahead, the companies mentioned here are poised to benefit from a continued economic recovery both in the U.S. and (especially) in China.

If you want the best-performing growth stocks right now, I highly recommend subscribing to our Cabot Top Ten Trader advisory, where every week chief analyst Mike Cintolo provides you with 10 of the market’s strongest growth stocks from both a technical and a fundamental perspective.

To learn more, click here.

[author_ad]

*This post has been updated from an original version.