Marijuana: Another Prohibition Bites the Dust

On December 5, there will be an anniversary of a major change in the history of the United States. We probably won’t actually celebrate it, but it might be a good thing if we did.

December 5 will mark the 85th anniversary of the ratification of the 21st amendment to the U.S. Constitution. Or, in less technical terms, it was the day that Prohibition ended.

The U.S. passed the 18th Amendment to the Constitution (the one that prohibited the manufacture, sale and consumption of alcohol) in January 1919 and Prohibition went into effect a year later. But, as we all know from decades of movies and TV shows, the results of our controversial and troubled 13-year experiment in temperance wasn’t quite what we expected.

Certainly there were benefits. There was a rapid drop in hospital admissions (and deaths) from cirrhosis of the liver, alcohol poisoning and alcoholic dementia. And, contrary to the amendment’s critics, the rate of drinking in the U.S. actually declined.

[text_ad]

But those who had predicted a period of universal calm, rationality and spirituality from the country’s rejection of Demon Rum were sorely disappointed. Prohibition of legal alcohol set the stage for a boom in the production and sale of illegal alcohol. And whether or not Prohibition was a major factor in the rise of organized crime, it certainly sparked a wave of enthusiastic defiance of the Constitution.

And that brings me to the real topic of today’s piece, which is the state-by-state dismantling of laws prohibiting the production, sale, possession and use of marijuana.

While some states decriminalized weed decades ago, the first full legalization laws were passed in Colorado and Washington state in 2012. Since then, while it hasn’t been quite a stampede, the number of states with full legalization has risen to 10 (plus Washington, D.C.), with many more passing laws legalizing medical uses and decriminalizing other uses.

As soon as legal pot started to happen, investors began to look for ways to cash in on the wave. After all, one of the stronger arguments for legalization has always been that it would divert money flowing into criminal pockets into private hands, with government coffers getting a very useful cut.

The industry still has some problems to deal with, including the very thorny fact that marijuana is still against Federal law. And that creates a real problem for marijuana businesses that can’t secure banking services to protect and move their cash.

The Easiest Way to Invest in Marijuana

But there’s no doubt that the marijuana industry has attracted an enthusiastic group of investors, and the investment industry has moved quickly to provide marijuana ETFs and other instruments. (Cabot Marijuana Investor has been one of our fastest-growing investment advisories over the past year-plus.)

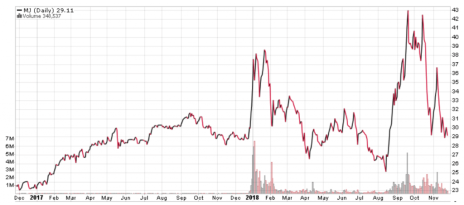

Here’s a daily chart showing the price of ETFMG Alternative Harvest ETF, which tracks the marijuana industry generally, but doesn’t invest directly in any growers or distributors. The ETF’s symbol is MJ, which I think is kinda cute.

I’ve always thought legalization was the right thing to do; it just seemed stupid to lock people up for doing something so relatively trivial. Back in the Sixties, we all knew that the big tobacco companies had trademarked “Maui Wowie” and “Acapulco Gold” and other popular weed names, so we all thought commercialization was pretty much inevitable. The opposition, we thought, came from generations of people who thought drinking was fine, but that toking was the first step to the end of civilization. It may be that the wave of legalization is just my generation finally getting around to doing the right thing.

Anyway, after a long stretch of demonizing marijuana, “The Devil Weed with Roots in Hell!”, it looks like another prohibition is finally biting the dust. And that means that fewer people are going to be punished for breaking laws made by legislators who thought they knew better than their constituents. It’s about time.

Just a few words about the chart for the MJ ETF. You can see that the general trend has been up since the start of 2017, but that the volatility has been extreme. Marijuana stocks are extremely news dependent, with legalization in Canada and California and the big investment from Constellation Brands (STZ) providing the fuel for massive spikes in December 2017/January 2018 and again in August/September 2018.

The Best Way to Invest in Marijuana

The marijuana picture in the U.S. (and Canada) is always changing rapidly, with the tantalizing possibility of eventual Federal approval the biggest roadblock on the way to normalization. If you’re interested in having a trustworthy partner to guide you to the best pure marijuana plays, I think Cabot Marijuana Investor is still the best bet to surfing this wave.

To surf the wave with us, click here.

And don’t forget to enjoy a celebratory taste of your favorite alcoholic beverage to celebrate Repeal Day on December 5!

[author_ad]