The Fed’s posture on interest rates continues to be the biggest barrier to beginning a new bull market. As rates continue to rise, we are seeing outflows from equity and cryptocurrency markets. However, meaningful signs of inflation reduction in the form of lower CPI will prompt huge inflows. Therefore, it does not make sense to pull all of your risk assets out of the market.

The Lindy Effect

Despite the so-called “winter,” crypto is benefitting from something called the Lindy Effect. This is a theory that says the longer a non-perishable thing survives, the more likely it will survive in the future. For example, iconic songs that we hear all the time are more likely to continue to be played when compared to recent hits because these classics have demonstrated longevity.

The longer Bitcoin and Ethereum lead cryptocurrency markets, the more ingrained they become, and the harder they are to replace or eradicate. As silly or as simple as this sounds, it becomes truer every day. Both BTC and ETH are first movers for their respective purposes. Bitcoin is a scarce, digital, commodity than can be stored and held indefinitely. It has a fixed supply governed by the code that powers it.

[text_ad]

Ethereum instead is a technology platform that provides the base layer of all decentralized financial applications. This Layer One blockchain powers most successful cryptocurrency projects using Ethereum smart contracts. Ethereum has created its own programming language called Solidity!

Key Elements:

- Security

- Decentralization

- Scalability or scarcity

These two blockchains represent important technological creations. Each has demonstrated the ability to replace other “centralized” databases. For example, people can now transact over the internet, using Bitcoin or Ethereum and that data is not held on a bank server, it is instead held on an immutable public blockchain that keeps record of the transaction data.

Data Observations

New data is out from Tomasz Tunguz, Managing Director of Redpoint Ventures.

- There are 2.5 million daily active cryptocurrency wallets with 80 percent of these being Ethereum, Binance, Polygon and Solana.

- Centralized exchanges like Coinbase, Binance, and FTX globally manage 100 million active wallets.

- Trading volumes across crypto markets are currently down around 60%.

- 250 million dollars is still flowing into Layer Two solutions each month.

- ETH smart contract rate per month has remained flat but is not declining.

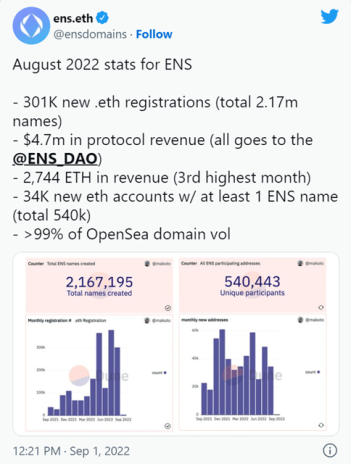

Despite this, Ethereum Name Service (ENS) continues to outperform almost all other crypto projects.

Ethereum Name Service (ENS) – A Promising Layer Two Cryptocurrency

ENS is turning complicated wallet addresses (0xA858DDc0445d8131daC4d1DE01f834ffcbA52Ef1, for example, is the wallet address of Yuga Labs) – scrambled numbers and letters – into readable human text names. This improves the user experience by making things feel more human and reduces the chance of typos where you could send cryptocurrency to the wrong place.

ENS has captured 99 percent of the Ethereum domain name market. Many people believe that ENS is only used for securing a .eth web address as opposed to .com, however, ENS integrates fully with the existing DNS. This means if you have an existing domain name you can import it into ENS and issue subdomains.

Unstoppable Domains – an adjacent competitor to ENS – was just valued at $1 billion in a private $65 million dollar Series A funding round led by Pantera Capital. Unstoppable is also registering websites with addresses such as .crypto .bitcoin .blockchain etc. They claim to have over $80 million in sales at an undisclosed take rate.

This recent raise by Unstoppable is bullish for ENS, trading at only $300 million in non-diluted market cap despite a monopoly on the .eth market, which is the largest blockchain ecosystem. ENS also runs a subscription service that will generate more stable and recurring revenue over time when compared to Unstoppable Domains, which does not operate a GoDaddy-like subscription model.

ENS is trading at just 4X forward revenue.

ENS has been less volatile when compared to other cryptocurrency tokens. It has traded in a range between $13-16 USD suggesting relative strength and price stability.

Investors who are buying early blockchain domain names are picking up extremely valuable pieces of the internet. This conquest appears to be far more fruitful when compared to buying land in a metaverse…

For example, University of Pennsylvania professor Matt Blaze bought crypto.com in 1993 and sold it in 2018 for $12 million.

ENS domains are retaining value and appreciating across secondary NFT markets such as OpenSea.

[author_ad]