For a few years now, Facebook (FB) has been my answer to the question: What’s the one stock you would invest in for the long term? And Facebook stock has done little to sway my faith in it, despite a sharp comedown during the last two months of 2016. But since the calendar flipped to 2017, FB stock is back knocking on the door of all-time highs.

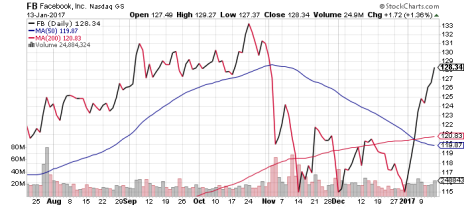

Facebook stock peaked in late October, touching new records above 133 on the heels of a steady four-month rally. A short-term pullback was inevitable, but the dropoff was probably more pronounced than most growth stock investors expected: FB plummeted to 115, a 13% decline in just three weeks. It was the stock’s sharpest decline in more than a year.

Quick Recovery for Facebook Stock

Facebook’s face plant came in spite of a strong earnings beat in early November, which included record third-quarter results that were fueled by continued growth in its mobile advertising. But investors focused more on the social media giant’s warnings of slower sales growth and higher expenses in 2017 and punished FB accordingly.

[text_ad]

Facebook wasn’t the only blue chip tech stock to get slammed in late October and the first half of November, however. Amazon.com (AMZN) tumbled more than 100 points over the same span, Netflix (NFLX) dipped 11%, and Google (GOOG) fell 9.5%. Together, those four big-tech companies (Facebook included) comprise the so-called FANG stocks. Their collective descent in the fourth quarter was partly a correction after months of big gains, and partly knee-jerk reaction to Donald Trump’s election since the President-elect is not viewed as being particularly tech friendly.

No matter. All four FANGs are back on the uptick now, even as Trump is set to take office this week. Facebook stock is leading the charge, jumping 11.3% in the first two weeks of the new year. At 128, FB is back trading above its moving averages (see chart below), and is in shouting distance of new highs. Analysts think it will blow well past 133 highs: according to Yahoo! Finance, the average FB price target (among 42 analysts) is 153, with a high of 180. Clearly, it didn’t take FB long to shake off the cobwebs of a couple of rare down months.

Growth Stocks Showing Signs of Life

Other growth stocks are following suit, as investors rotate out of Trump-y sectors such as infrastructure stocks, bank stocks and energy stocks. The Vanguard S&P 500 Growth ETF (VOOG), whose holdings include Facebook, Google, Amazon, Apple (AAPL) and Microsoft (MSFT), is up 4.5% since the beginning of December, outpacing the 3.8% gain in the S&P 500.

Growth stocks should rise as far as the FANGs and other large-cap growth leaders carry them. That could depend a lot on fourth-quarter earnings results; Facebook’s are due out on February 1.

In the bigger picture, I expect the ascent in Facebook stock to continue for years to come thanks to the company’s ongoing global expansion, mobile advertising growth and diversification into other business ventures. As we’ve seen in the last few months, FB typically doesn’t stay down for long, and dips like we saw in November and December represent great entry points for long-term investors.

[author_ad]