Which Way Does the Market Go From Here? What Happens with these Two FANGs Could Be Telling.

Today, I want to talk about two FANG stocks whose charts are setting up quite well, and what that could mean for the market going forward. But first, I want to look back a bit.

As most of you know, I’m not a big prediction guy—I tend to follow what the market says as opposed to endlessly predicting what it’s going to do. But sometimes the stars align, and back on January 25, I wrote a Cabot Wealth Daily titled, “3 Reasons You Should Buy Stocks in 2019,” highlighting the historic oversold readings in December, the extreme pessimism at those lows and a rare indicator (we call it the 2-to-1 Blastoff indicator) that flashed in early January and has a pristine history of portending higher prices.

That turned out to be a pretty good call (if I do say so myself), with stocks moving straight up through April, shaking out in May and then putting on a good show to end June. And with the second half of the year getting underway, what am I seeing now?

[text_ad]

Market Rally: Sizzle or Fizzle?

I’m still bullish! Of course, now that we’re six months into this rally, it’s fair to say risk is higher—gone is the outright panic of late last year, replaced by milder worries (economy, what the Fed will do, the endless U.S.-China trade war), and the market has obviously come a long way.

But, surprisingly, many of the same (or similar) bullish factors are still in place. First and foremost, my trend models (both intermediate- and longer-term) are positive. And even better, it looks like the S&P 500 may be lifting off from a big year-and-a-half long period of no progress—the chart below shows that, after a ton of ups and downs since January 2018, this major index is breaking out.

Second, I continue to see some relatively rare market occurrences that portend higher prices ahead. One that just popped up, courtesy of Ned Davis Research: Over the past six months (ending in June), stocks and long-term bond prices each rose at least 10%. Turns out that’s pretty unusual, happening just 10 other times since 1970, and while it’s led to mixed results for bonds, it’s been great for stocks—six months later, the S&P 500 is up about 11% on average, with nearly 19% gains after a year. It looks like a very bullish sign to me.

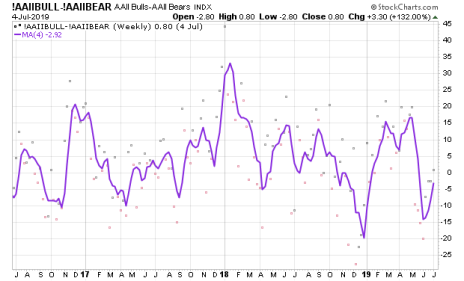

Finally, we have sentiment. It obviously isn’t panicky like it was back in December and January, but it is extremely apathetic. For instance, take a look at this chart: It’s the four-week moving average of net bullishness in the survey from the American Association of Individual Investors.

You can see that, at the early-June market low, pessimism was nearly on par with what was seen last December, and even as we’ve rallied to new highs, most are still neutral or bearish on the market! Money flows are painting a similar picture, with investors continuing to yank money out of equity funds and ETFs.

I’m not going to predict any sort of year-end price, and short term, there’s no question that the combination of the aforementioned uncertainties, Q2 earnings season and summer itself could lead to some wobbles. But my main thought on the market is pretty straightforward: The path of least resistance remains up, and while a straight-up rally (like this January-April) is unlikely, the odds strongly favor nicely higher prices for the major indexes when looking out six months.

2 FANG Stocks with Great Charts

Another potential gust of wind in the market’s sails (it’s summer and I live in an ocean town, so be prepared for a ton of tedious beach/boat analogies in the weeks ahead) involves a couple good-looking long-term setups among the FANG stocks. Granted, I’m not hugely bullish on these names since they’re so well known, and I’m sure earnings reports over the next three weeks or so will be vital.

But it’s hard to ignore the charts, with two of these key mega-cap stocks setting up nicely. If they get going, it should only help the overall market.

The first of the two FANG stocks that I like is Amazon (AMZN), which, if I had to pick, is my favorite mega-cap growth name at the moment. You all know the general story, and as opposed to some of the old leaders, the firm is still cranking out excellent growth, with high-teens revenue growth and surging earnings (up 35% to 40%) expected both this year and next.

And look at the weekly chart:

AMZN has etched a really nice-looking base (a cup-with-handle pattern, if you want) over the past 10 months, with the May shakeout possibly wiping out the last of the weak hands. Now the stock is beginning to flex its muscles, lifting above resistance in the 1,965 area, moving north of 2,000 this week and taking aim at its all-time high near 2,050.

The other intriguing FANG stock is Netflix (NFLX), which actually topped out back in June of last year, so it’s been etching a new launching pad for just over a year. The two things that catch my eye here are (a) the stock’s multi-month rest between 330 and 380 (give or take) since March, and (b) the persistent dry-up in trading volume during the past three months—the combination of which often suggests that the weak hands have been worn out.

Still, as with most things, NFLX’s next major move will likely come down to earnings—as with AMZN, a decisive gap higher (north of 400, or even better, above last year’s nadir of 423) would be a solid sign for the stock—and, likely, for the market as a whole.

[author_ad]