Today, I’m going to write about how to find early-stage stocks, and list a few stocks that look promising now. But first, let’s examine what’s happening with the stock market...

When it comes to the market, we’re three and a half months into this downturn, and frankly, when looking at the primary evidence (things like the trends of the major indexes, growth funds and individual stocks; basically the rubber-meets-the-road kind of stuff) not much has changed. The vast majority of stuff is still trending down, and that goes for the indexes, growth fund and the vast majority of individual stocks.

Thus, I continue to think being cautious is your best course of action—yes, there are some things that look OK (mostly commodity-based), but overall, there’s been a lot more money lost than gained in recent months. Sitting on your hands isn’t the most exciting thing, but it beats getting whacked in the market.

That said, I am starting to see some rays of light appear, the first time since the decline really began. The first thing that’s happened is, at least to this point, fewer stocks are participating in the downside—when the Nasdaq recently retested its January low on news of the Russian invasion, far fewer stocks hit new lows, and just looking through a ton of charts, more and more beaten-down names (like, say, SNAP, SQ, CRWD) seem to have drawn lines in the sand. That doesn’t mean they’re in uptrends or look “good,” but after crashing 50% to 70%, buyers seem to be saying “enough” … at least for the near-term.

[text_ad]

Moreover, one of the things I’m watching closely, which I call the Growth Tides (basically an intermediate-term trend measure of some key growth funds), isn’t far from a green light.

None of that means I’m buying just yet, but it does mean that, after 15 weeks of generally painful action, I’m keeping my eyes open for more definitive signs that the market is ready to test higher ground.

Some Growth Stocks aren’t Coming Back

However, while market timing is important to be able to get in when the tide has turned, what’s far more important is stock selection—and I think that’ll be doubly true this time around. Why? Because so many of the popular growth stocks of the past few years, especially the big winners of the past couple of years, look like they’ve topped … permanently.

Don’t get me wrong—a name like, say, Shopify (SHOP), which was an all-time great stock the past few years, could easily rally 20% to 40% in a few weeks. But, I’m sorry, a drop from 1,760 in November to a low 585 in February (down 67% in three-ish months!) is completely abnormal and tells you SHOP’s point of peak perception is behind it.

But in my 22-plus-year experience at Cabot, despite the fact these names have likely topped for a long time (at the very least their time of leadership is over), many investors will still put most of their focus on them because of their familiarity and because these names will drive the headlines. Sure, maybe one or two out of 10 will come back and regain their former glory, but the vast majority will likely leave investors wanting.

That brings me to the title of this issue—during the next sustained uptrend, I want to focus (mostly) on early-stage stocks, which tend to be newer names that are less well-known. I’m not talking about the junk pile here, with thin, low-priced, speculative stuff; I’m referring to firms that have all the fundamental qualities of big winners, and the stocks haven’t already made a huge move, meaning perception has room to run on the upside and big investors are still early in their position-building phase.

3 Early-Stage Stocks to Consider

I’m not going to get into all of the early-stage stock names I’m looking at, but a good place to start looking is in relatively recent IPOs (stocks that have come public during the past six to 24 months). Many leaders of the past, like Meta (FB) and PayPal (PYPL), lifted off from huge post-IPO structures that kicked off massive advances. Or there could be some stocks that have basically been dead as a doornail for a few years, but something big has changed that’s leading to a change in character. And the third thing to look for is simply a stock that might have had a good run in 2020 or 2021 but has effectively gone sideways for many months, if not longer.

For IPOs, I continue to enthuse about the story from Dutch Bros. (BROS), which owns a few hundred beverage locations but is expanding its store count rapidly (20%-plus a year) and aims to have 4,000 or more down the road. The stock is very volatile, but after a brief rally, BROS has been trying to build a bottom north of 40 for the past few months—a strong move in a new, confirmed uptrend would be interesting.

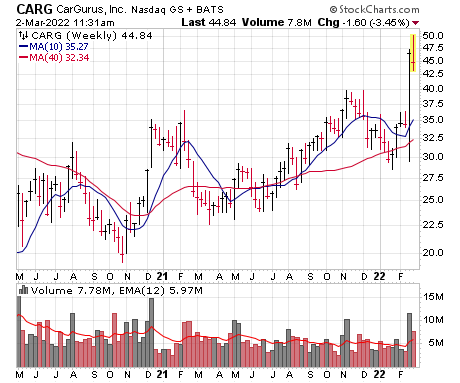

Then there’s CarGurus (CARG), which isn’t a new stock (public in 2016) but actually is etching a giant, multi-year IPO base. More important to me is the recent moonshot after earnings, which came because a subsidiary the firm purchased early last year (called CarOffers) is growing like mad as it aims to replace the traditional dealer-to-dealer auctions, not to mention allow any old dealership the ability to make instant offers for cars (like Carvana and CarMax are known to do), which is vital these days as inventories remain crimped. CARG probably needs to settle down but it quacks like a new leader.

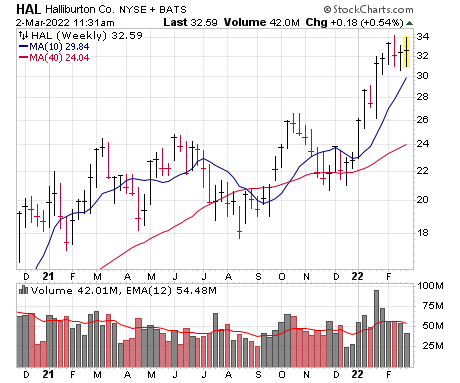

Finally, when it comes to names that have chopped around for a while and worn out the weak hands, I continue to like the look of Halliburton (HAL). Yes, it’s a mega-cap stock, but the industry was the dog’s dinner for years, and last year, shares made no net progress from mid-January through year end. It’s had a good run since then, but has actually been consolidating as the 10-week line approaches. While I do think oil names could pull in (they’re a bit frothy right now with $100-plus oil), my guess is something like HAL will find support on its first trip toward the 50-day line.

Do you have any holdings not listed here that you think could be strong early-stage stocks? Tell us about them in the comments below.

[author_ad]