In a typical year, the list of top-performing stocks is heavily larded with ambitious biopharmaceutical stocks that have experienced a big win, either a candidate drug that hit a home run in a clinical trial or a new approval from the FDA. And typically there will be one or more foreign names on the list of top performers as investors pile into an attractive emerging market stock.

2016 wasn’t a typical year.

Last year was a year of rebounds by beaten down commodity and industrial stocks, with specialty chemical companies putting four names in the top 14. Oil & gas concerns scored two, as did steel producers, fabless chip designers and coal companies.

As I do every year, I limited my search for the top-performing stocks to weed out penny stocks and other high-flying, quick-dying issues. Cabot growth disciplines are designed to identify and recommend stocks that are attractive to the big investors who can drive long-term price gains. By looking only at stocks that are liquid (averaging 300,000 shares traded a day at year-end) and somewhere near the lower limit of most whales’ investment guidelines (finishing the year trading above 10), I hope to make the list both more realistic and more useful.

I featured The 3 Top-Performing Stocks of 2016 in this column on January 5.

[text_ad]

And here’s my next installment of the top-performing stocks of 2016. This edition will include five additional stocks; I’ll review the final six tomorrow.

Top-Performing Stocks #4 and #5: AK Steel (AKS) +356% and U.S. Steel (X) +314%

If you follow the market at all, you know that a ton of stocks got a huge boost from the results of the U.S. Presidential election. But steelmakers like AK Steel and U.S. Steel had pretty good years going on even before November 8. I’m writing the two companies up together because their charts are so similar and their advances were powered by the same three factors.

First, steel stocks had been through ruinous corrections with AKS falling from 11.4 in August 2014 to 1.6 in January 2016. In about the same period, X fell from 45 to 6. So there was a good value setup to begin with.

Second, the broad market put in a double bottom in January and February before starting a muscular rally. You can see it reflected in the charts for both AKS and X. Reinforcing that rally for steel stocks, was the March 1 announcement of 266% tariffs on steel imports from China and six other countries. And only after all that good news came the election and the assumption that infrastructure projects would keep steel sales jumping.

AKS may have made the bigger gains because it started at a lower price. But the higher price for X allowed it to be featured three times during the year in Cabot Top Ten Trader (in April, May and August). All steel producers in the U.S. were forced to pare expenses to the bone and upgrade manufacturing processes in order to survive, and that has paid off. 2016 was a perfect storm for the U.S. steel industry.

Top-Performing Stock #6: Chemours Company (CC) +312%

Chemours carries its heritage in its name. The company was formed in 2013 when DuPont Nemours spun off three of its DuPont Performance Chemicals divisions —Titanium Technologies, Fluoroproducts and Chemicals Solutions—into a company called Chemours. The company’s product lines are used in a huge range of products, so a general strengthening of industrial activity and consumer spending provides excellent revenue growth opportunities.

CC was a great stock in 2016 at least partly because it had a terrible 2015, falling from its July 2015 IPO price at 16 to a low of 3 in January 2016. The stock rebounded to 11 in May, then took a three-month breather before getting back on track in August and driving to a peak near 27 in December before a correction into the end of the year. There’s nothing like a low starting point to make an impressive rally.

Top-Performing Stock #7: Clayton Williams Energy (CWEI) +303%

Having a great year doesn’t mean you’re a great company, and Clayton Williams Energy is a good example. The company started losing money in Q1 2015 and is still losing money. Word has it that management wasn’t prepared for the dip in oil prices and got cash crunched because of high debt levels. But sales growth turned positive in Q3 2016, the company raised cash during the year by selling some of its high-quality Eagle Ford acreage (for $400 million), and the company still has some excellent Delaware Basin drilling acres.

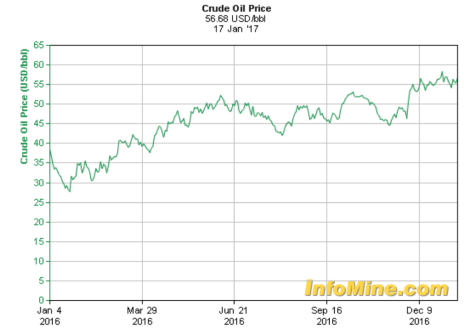

The stock may also have gotten a boost from rumors that its portfolio of real estate might make it a takeover target. Speculative stocks often show bigger gains than their higher-quality brethren, often because they were driven down more sharply. I’m including a chart of crude prices in 2016 so you can see the correlation, although there are lags of course. CWEI was covered twice in Cabot Top Ten Trader, in September and November.

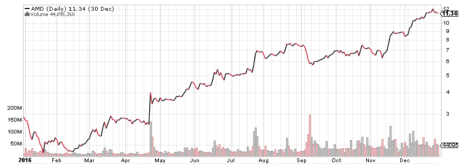

Top-Performing Stock #8: Advanced Micro Devices (AMD) +295%

Advanced Micro Devices is a bit of a mystery. It’s a low-priced stock, which often keeps institutional investors on the sidelines. It’s also a designer of a wide variety of microchips, but has had years of underperforming the chip industry (compare with SOXX, a semiconductor ETF). AMD traded at 42 in early 2006, but fell for three straight years (aided no doubt by the Great Recession), finally bottoming at 1.6 in November 2008. The stock rebounded to 10 in 2009, but was beaten down again in 2012; got back to 5 in 2014, but bottomed again under 2 as 2016 began.

So why did AMD have such a great year in 2016? Maybe it’s because the company learned how to be profitable again, booking increases in revenue and earnings in Q2 and Q3 after a string of six bad quarters. Whatever the cause, AMD followed the rule for the big winners of 2016 by coming off a very low base and driving higher from February to the end of the year, with a three-month consolidation from August through October. It will be interesting to see if AMD can continue its rally in 2017.

Watch for tomorrow’s Wall Street’s Best Daily in which I’ll complete my review of the Top-Performing Stocks of 2016.

[author_ad]