The fourth stock in our Forever Stocks series reminds me a lot of Home Depot (HD). Do you remember what life was like before Home Depot existed?

Before Home Depot, most Americans relied on their neighborhood hardware store for the essentials of home maintenance.

For me, that local store was Waters & Brown, a store that has been serving Salem since 1895.

But after Home Depot moved in, running those little hardware stores became a lot more challenging for their owners. Waters & Brown has survived only by morphing into a high-end paint and design store.

Meanwhile, Home Depot has mushroomed into a colossus, with more than 2,200 stores spread across the U.S., Canada and Mexico.

[text_ad]

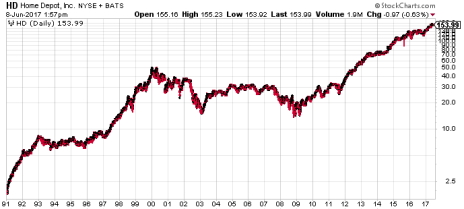

Suffice it to say, Home Depot has been a good investment.

But how good?

If you’d put $10,000 into the stock 10 years ago, just before the Great Recession hit, you’d now have more than $37,000.

If you’d put $10,000 into the stock 20 years ago, three years before the 2000 market top, you’d now have more than $128,000.

If you’d put $10,000 into the stock 30 years ago, just before the market’s 1987 Crash, you’d now have more than $1.7 million.

And if, by some wild improbability, you’d put $10,000 into the stock at Home Depot’s 1981 IPO (and you’d held onto it all this time), you’d now have nearly $35 million.

Here’s a chart of HD since 1991.

But Home Depot isn’t the only stock that’s done that well. In fact, the S&P is full of big companies (still growing slowly) that were once little companies growing fast.

If you’d bought any of them when they were small, and simply held on as they grew larger, you’d be in very good shape today. And you’d be feeling like these were stocks to hold forever. So how do you find these forever stocks?

How to Find Forever Stocks

The simplest way to find a stock you can hold forever is to look at a list of blue-chip stocks, like Johnson & Johnson (JNJ), DuPont (DD), Coca-Cola (KO) and Nike (NKE). Those are the stocks to own if you’re a conservative investor working to keep your wealth.

But my goal is to identify stocks that can make you rich!

I want to identify the next Home Depot (HD), the next Amazon.com (AMZN), the next Apple (AAPL), the next Alphabet (GOOG) and the next Tesla (TSLA)—and to get my readers on board these stocks when they’re still small and fast-growing.

The key attributes I look for to find these forever stocks are these:

- A product or service or business model that is revolutionary.

- A product or service or business that serves a mass market.

- A company that’s still small enough to grow rapidly.

- A company that is not respected—perhaps not even known—by the majority of investors.

- Last but not least, I look for a chart that shows that other investors have begun to recognize the company’s potential as well; that tells me that my thinking is on the right track.

For the record, stock #1 in this Forever Stocks series was Autohome (ATHM), the Chinese company working to be the center of all consumer-oriented automobile information in China.

Forever Stock #2 was Zillow (Z), the world’s largest online organizer of real estate information.

Forever Stock #3 was Twitter (TWTR), supplier of a revolutionary new communications platform.

And Forever Stock #4 is SiteOne (SITE).

SiteOne (SITE): The Landscaping Home Depot

SiteOne is working to do for the landscape supply industry what Home Depot did for the building materials and home improvement industry—create a national brand that uses economies of scale to provide a better experience for the customer.

The difference, however, is that while Home Depot grew by building new stores, SiteOne grows by acquiring existing businesses.

SiteOne was spun off from Deere & Company in May 2016, and it’s now the largest (and only national) supplier of landscape products in the U.S. With 478 stores, the firm offers about 100,000 items, including irrigation products (33% of sales), fertilizers (17%), nursery items (12%), pest and weed control products (17%), landscape accessories (11%), hardscapes like paver stones (6%) and outdoor lighting (4%). It’s the only one-stop shop for commercial and residential customers. In total, SiteOne has four times the market share of its next largest competitor.

Yet despite its dominant position in the landscape supply field, SiteOne has just 10% of the market (estimated at $17 billion). Said another way: 90% of the industry’s sales come from smaller, often local competitors. SiteOne tops them by using its scale (buying power) to attract customers, and often, by simply acquiring these local and regional competitors.

SiteOne made four acquisitions in both 2014 and 2015, six in 2016, and already this year it’s purchased Aspen Valley Landscape Supply (a leader in hardscape and landscape supplies in the Chicago area with three locations), Stone Forest Materials (the leading supplier of hardscape supplies in the Atlanta area), Angelo’s Supplies (two locations in the Detroit area), American Builders (10 locations in metro Los Angeles and two in Las Vegas) and Evergreen Partners (two locations in Raleigh, NC and Myrtle Beach, SC). As these firms are integrated, synergies kick in, leading to higher margins and an overall stronger competitive advantage. Right now, SiteOne is the only industry consolidator.

Leading the way at SiteOne is CEO Doug Black, a West Point graduate who for 18 years headed up OldCastle, a huge building-materials supplier. Black took that company from $900 million in sales to $12.6 billion, with acquisitions playing a key role. He’ll be doing the same for SiteOne in the years ahead.

As for the stock, it soared from its IPO in May 2016 right through September, pulled back into November and has been marching higher since. The big acquisition of American Builders Supply in mid-March (along with a great quarterly report) sparked a big-volume pop higher, which was followed by a normal period of basing between 48 and 50. But that base was left behind in late May, as the stock resumes its uptrend. Try to buy on pullbacks and keep the Home Depot story in mind.

Maybe you can hold it forever!

In the meantime, for expert advice on stocks you don’t hold forever, using the classic, buy-low and sell-high methodology, you can’t go wrong with Roy Ward, chief analyst of Cabot Benjamin Graham Value Investor, who uses a strict quantitative system to get his readers in and out of quality stocks like General Motors (GM), Ulta Beauty (ULTA), FedEx (FDX), AT&T (T) and Starbucks (SBX).

Since inception on 12/31/95, Roy’s Cabot Value Model has provided an impressive return of 1,112% compared to a return of just 309% for the Dow.

To get started, click here.

[author_ad]