When Apple (AAPL) released the first iPhone in June 2007, shares of Microsoft (MSFT)—Apple’s closest rival—were trading in the low 30s. Less than two years later, MSFT stock had lost half its value, though that was largely due to the 2008-2009 financial crisis. By April 2010, MSFT had climbed all the way back to 30 … then Apple unveiled the iPad. Within two months, Microsoft stock had sunk to 23. It was becoming a forgotten stock.

For years, Microsoft remained overlooked on Wall Street, where Apple’s unprecedented ascent cast a long shadow over its chief rival. As a result, MSFT stock didn’t get above 32 again until 2013, with shares mostly living in the 20s.

[text_ad]

Fast forward six years, and MSFT stock trades at 134—more than triple its 2007-2013 peak, and a new all-time high. In the last two years, MSFT is up 92%, and the only real dip came during the fourth-quarter 2018 market correction (see chart below).

Despite the run-up, Microsoft remains largely overlooked; institutional ownership is actually down since 2017, and weaker performers like Apple, Facebook (FB) and Tesla (TSLA) still dominate the financial headlines, with Microsoft largely an afterthought. In that respect, MSFT is still a forgotten stock.

With the stock having fully recovered from the Q4 market correction, this looks like a good time to buy MSFT, perhaps on dips. The price-to-earnings ratio (29 times trailing earnings) might be a bit steep, but with double-digit sales and earnings expected this year and a 1.5% dividend yield, the valuation isn’t outlandish. Trading well above its 50- and 200-day moving averages, MSFT looks like a strong momentum buy that could continue to rise unimpeded for months.

What other forgotten stocks should capture your attention? Here are two more that stand out:

Forgotten Stocks: Bank of America (BAC)

Bank of America wasn’t so much a forgotten stock as a hated one. Perhaps the biggest big-bank victim of the financial crisis, BAC stock lost more than 95% of its value from late 2006 through early 2009. As recently as 2016, BAC was still trading at a mere 12 per share, less than a quarter of its late-2006 peak.

Since then? Well, just look at this two-year chart of BAC:

Despite the steep fourth-quarter 2018 dip - and a smaller retreat in May - that’s a pretty good-looking chart. Going back further, BAC has nearly doubled in the last three years, far outpacing the performance of any of the other five biggest U.S. bank stocks. Five straight quarters of double-digit EPS growth have helped. And with a P/E of just 10, Bank of America stock is still cheap, especially after the recent pullback. And the regulatory winds at the back of the entire sector (and its 2.1% dividend yield) are also plusses.

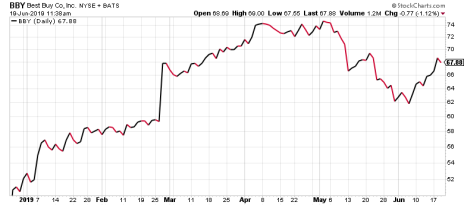

Forgotten Stocks: Best Buy (BBY)

Best Buy was supposed to be dead and buried years ago, the latest in a long line of big-box electronics stores to be wiped off the planet by Amazon (AMZN). And yet here BBY is, up 125% in the last three years and 22% in the last two years despite getting hit as hard as just about any retail stock in the last three months of 2018. The stock is still digging out from that massive retreat, but is trending well, trading above its 50- and 200-day moving averages.

Profit growth is uneven, but sales have picked up in the last year, though they’re expected to flatten out a bit this year. Still, with three times as much cash as debt and a very reasonable P/E (12.38), BBY appears to be in pretty good shape. I wouldn’t expect shares to double again in the next three years. But rumors of its demise were certainly exaggerated, and the stock remains quite cheap after its Q4 cratering.

It’s at least worthy of being on your radar—along with the other two forgotten stocks mentioned above. If you’ve dismissed these three stocks as has-beens or dinosaurs the last couple years, you’ve missed out on some big profits.

[author_ad]

*This post has been updated from an original version.