What Really Matters to Growth Investors

Growth investors are, generally speaking, information hogs. When you’re investing in fast-moving companies, you never know which news item will provide the crucial insight that will put you on the scent of the next big thing. So the best growth investors are always trawling for data drops, commentary, press releases and any other bit that can provide insight or perspective on how things are going, and especially how the broad economy is performing.

One major engine of the U.S. economy is people buying stuff, which makes American consumers a very important population. The University of Michigan has been keeping tabs this group for almost 80 years, and its reports on how consumers are feeling—from optimistic and acquisitive to discouraged and penny-pinching—are an important resource for economists, market analysts and investors.

[text_ad use_post='129627']

So when the University’s Center for Social Research (the group that actually does the ongoing polling and analysis) revealed that the August consumer sentiment index came in at 97.6, it was big news. The index was at 93.4 in July and economists surveyed before the data was released had anticipated that it would come in at around 94. (The 97.6 number was the highest since January.)

You would think that that kind of number should be good news for the retail sector, but that isn’t how it’s working out. A quick look at the year-to-date chart of a popular retail ETF—SPDR S&P Retail ETF (XRT)—shows a sector that’s been bumping downhill all year. (The recent bankruptcy filing by Toys-R-Us is another big tipoff.)

You might ask how consumers can be so confident and retailers so feeble. Good question. And one answer for growth investors comes in the form of Amplify Online Retail ETF (IBUY), which tracks only online purchasing. There are a few features in common, especially the significant dip in August, but the trend is clearly down in retail and clearly up in online retail.

Now I’m going to add a third chart to the mix, and I think you’ll see my point immediately.

This chart is the daily chart of Amazon (AMZN), the online retailer that many analysts believe is the villain behind the demise of Toys-R-Us, as well as the serial killer of Borders Books and dozens of other businesses. You can see how closely the two charts resemble one another.

This comparison might lead you to a hasty conclusion that brick-and-mortar retail is dead and online retail is building a delivery superhighway over its grave. And that may be true.

But then there’s the news that Amazon has been opening brick-and-mortar bookstores in selected cities, putting in its seventh store in New York City in May. Each store uses Amazon star ratings and Kindle statistics to stock only the most popular titles. Each store stocks about 3,000 titles.

Real bookstore afficionadoes aren’t impressed with Amazon’s stores—McNally Jackson, another N.Y. bookstore stocks about 60,000 titles—but that’s okay with Jeff Bezos. Jeff just wants to sell stuff, and he will experiment with whatever he thinks might work.

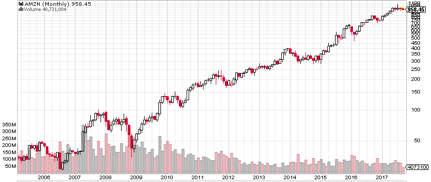

And what Jeff thinks might work has worked just fine for growth investors. (As evidence, I offer a longer-term chart for Amazon that shows the stock’s performance since a few years before the Great Recession.)

From its low at 35 in November 2008, AMZN has been a monster, and is now trading near 960. There were periods when you wouldn’t have wanted to own Amazon (2014, for instance), but growth investors know that a good story, good execution and skillful leadership can make a stock a perennial favorite with the potential to break out at any time.

The moral of the story is that while you’re monitoring the market, the Fed, the White House, the economy and its sectors, global macroeconomic trends and the torrent of headlines that fill the internet day and night, you should always remember that the ideal outcome for a growth investor is to find just a handful of stocks that are pushing their prices uphill. The rest is just details.

[author_ad]