We’re wrapping up our latest Cabot Wealth Summit (this year dubbed the Smarter Investing, Greater Profits conference), and all has gone well. But I wanted to start today with something I began my presentation with this week: I’ve been at Cabot now for just over 22 years, and this was our ninth conference, and I’ve seen a lot of people come and go during that time.

But right now, there’s no doubt in my mind that we have the best collection of analysts we’ve ever had. And while I don’t pretend to know every company’s talent stack, I’d put our group of guys and gals up against any in the industry when it comes to stock picks and market timing, but also customer service and clear writing, helping subscribers gain conviction and confidence in our methodologies. We’re not perfect, of course, but I’m proud of the content we put out, the value we provide and glad to have you on board.

OK, with that out of the way, let’s get to the market, which has been unable to break free of the chop and rotation that’s been in place for months. The latest action has seen another sharp bout of rotation out of growth and generally into the broad market, and while we’ve seen this before, this one has brought a bunch of things I watch to key levels.

So today, let me go over a handful of growth stock charts, funds and indicators I’m watching closely—if these things hold up and rebound nicely, I think it could signal some great buying opportunities, but much more weakness could crack more than a few current leaders and tell us tougher times are coming as September rolls around. So let’s get into it.

[text_ad]

Growth Indicators/Indexes

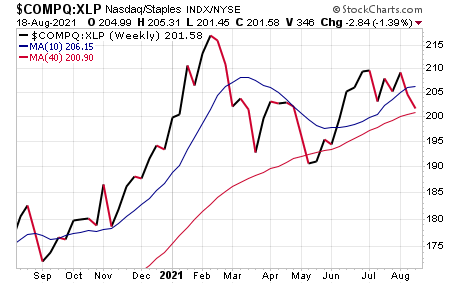

Cabot’s Aggression Index: I like to look at the relative performance of the growth-heavy Nasdaq to the defensive-oriented consumer staples sector on a longer-term basis to give me insight into what big investors are favoring. This indicator came right down (actually a bit below) its 40-week line in May but bounced where it was “supposed” to. It did the same in mid-July on that shakeout. And now it’s testing the 40-week line yet again. A strong bounce could mean the third time is the charm (to produce a sustained advance), but much more weakness would be the first “sell” signal from this measure (for growth stocks) since last year’s crash.

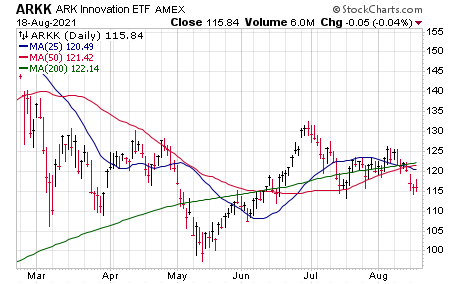

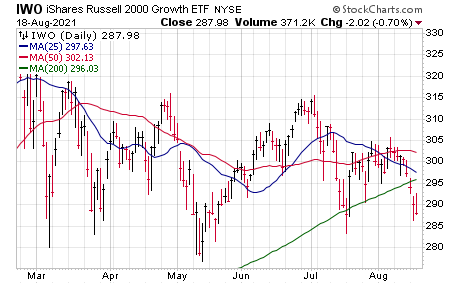

ARK Innovation Fund (ARKK) and the Russell 2000 Growth Fund (IWO): I’ve probably been cluing more off these two funds than most major indexes in recent months given how bifurcated the market has been. This week, both the ARKK and IWO cracked moving averages and have dipped close to multi-month support—ARKK in the 115 area and IWO in the 280 to 290 area. Strong rallies would make this look like yet another shakeout, but continued weakness wouldn’t be the best sign.

5 Growth Stock Charts I’m Watching

Leaders Near Support: This is really what I’m focused most on right now—not as much top-down stuff, but bottoms-up evidence. The chop of July and the recent growth selloff has many pseudo-leading stocks down to key support, often near the 25-day or 50-day lines. Again, strong bounces could provide solid pullback/resumption entry points, but decisive cracks would open things up to further declines.

Now, let’s get to a few growth stock charts...

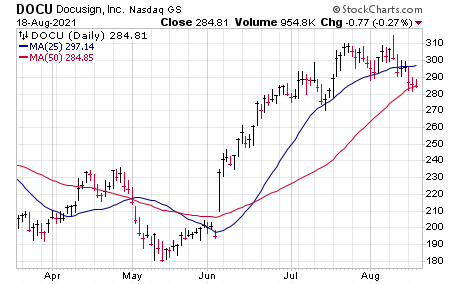

DocuSign (DOCU) was one of the first liquid growth names to get going after the May low, breaking out above 235 and surging to over 300 before chopping around and now pulling in. The overall correction hasn’t been fierce, but DOCU is testing its 50-day line for the first time since getting going from its 10-month dead period—it “should” find support in this area but the action will be telling.

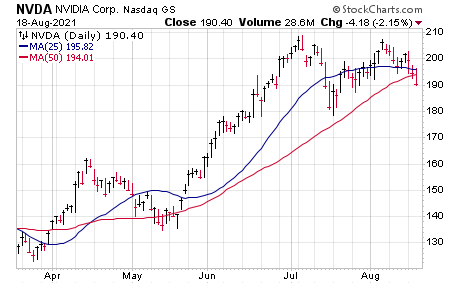

Nvidia (NVDA), like DOCU, was another name that got going right quick after the May low—shares enjoyed a super-bullish volume cluster as they raced out of a multi-month range. The pullback in early July was sharp, but found support above the 50-day and rebounded back toward its highs. Now it’s down to the 50-day line again—a little dip below it wouldn’t be the end of the world, but if buyers want in, they should show up relatively soon.

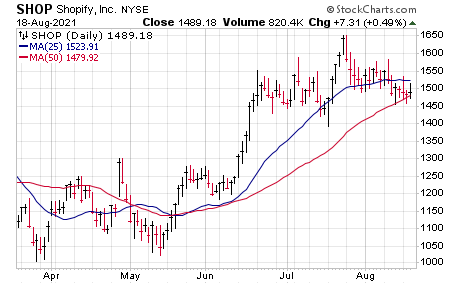

Shopify (SHOP): SHOP is a bit of a different animal as I don’t consider it early-ish stage, but the stock did show a nice volume cluster in June, but has now chopped around for the better part of two months while the 50-day line has caught up.

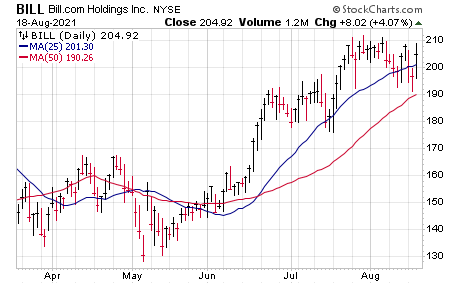

Bill.com (BILL): BILL has earnings due August 26, which will tell the tale, but like many others, it’s made little net progress since late June and the 50-day line is catching up quick.

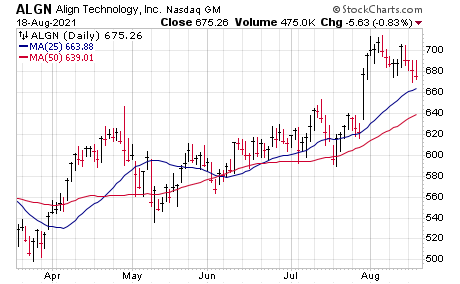

Align Technology (ALGN): ALGN spent months setting up a nice early-stage base and, after a few false starts, finally broke out on earnings and had a few good days. But since then, lots of chop and further weakness this week. A drop all the way back to 650 (the breakout area) wouldn’t be ideal.

There are others, but this is a good list to watch if nothing else. As one famous investor put it, you have to use the market as a feedback mechanism, and the action of the above indexes, funds and leading stocks should tell us a lot about the health of the growth area of the market.

Do you own any of these stocks? What other growth stocks are you interested in these days?

[author_ad]