How to Proceed in the Midst of this Historic Market Crash? Positive Signs are Out There. And These 2 Growth Stocks Look Well Positioned for the Eventual Rebound.

It’s been a historic month, both in the market and in the real world, and given that so many of us are glued to the financial and regular news, I won’t rehash all the gory details. But I do want to touch on a couple of common themes in questions I’m getting, about growth stocks and the market in general.

First, I’m getting some questions on whether or not “the bull market is over.” I think that misses the point, as labels sort of pigeonhole you into a certain way of thinking. After all, when did the bull market really start? Back in 2009? 2016? What about the 20% plunge in late 2018? It’s more for debate class than to help you make (and keep) money.

[text_ad]

What I think people are really asking is, “Have we entered a prolonged bear phase?” Nobody knows, of course, but I doubt it—the level of fear/panic out there is immense, and the reason is obviously well known at this point. Plus, fundamentally, the world’s best and brightest are working on medical cures/helps in a hurry; I’m not going to pretend to know the science of the virus, but I have a lot optimism that we’ll have a cure in the months ahead. As for the market, more likely is that we need some time to build a bottom after the market finds support, but we’re not at the front edge of a two-year bear phase.

All of this is a long-winded way of saying: Take it day by day and stay in gear with the market. Right now, obviously, the sellers are in control, but that will change someday, and when it does, you want to be there—no matter how anyone wants to label this market.

Picking Up the Pieces

As for what comes next, there’s obviously widespread panic and worry, but believe it or not, we’ve seen a slight improvement in the market’s internals during that time—when the market bombed on March 12, there were an amazing 4,400 stocks hitting new lows on the NYSE and Nasdaq. This Monday, when the market plunged to lower lows, there were “only” 3,900 or so. And then on Wednesday, as the market fell to lower lows, the figure was again around 3,900. That’s not a reason to party, but it’s the first sign of some resilience from the broad market since the crash phase began.

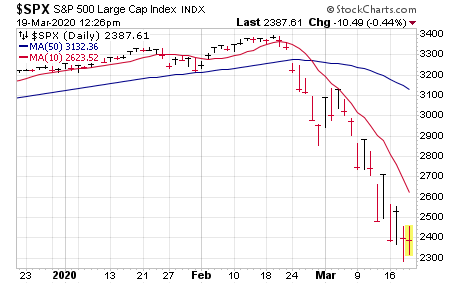

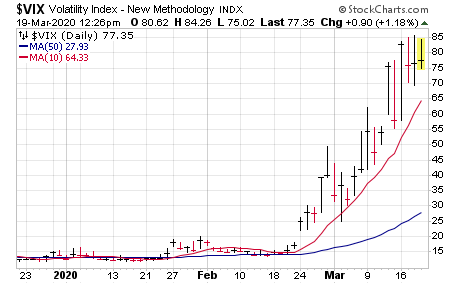

Will that finally translate into a workable low? Time will tell. Two short-term things to look for—the 10-day moving average on the major indexes (see S&P 500 chart below), which hasn’t been breached on the upside since this crash got underway on February 19. And, conversely, I’m looking to see if/when the CBOE Volatility Index (VIX) dips below its 10-day moving average.

I’m not saying moves through the 10-days would be a sign to party, but it would at least be a short-term change in character and tell us the immediate market crash may be over. Of course, even after that, the odds favor a multi-week or multi-month bottoming process even after such a change in character. I usually sit that phase out, but if you’re aggressive, you might want to play it.

2 Growth Stocks Holding Steady

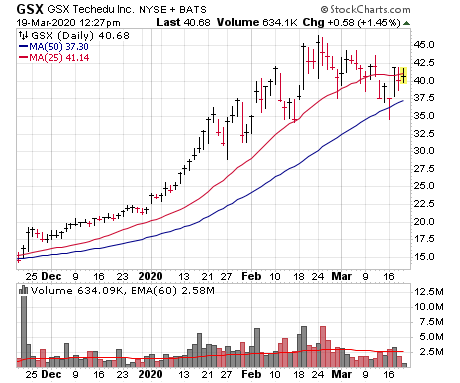

One way to do that is to go the traditional route and look for names that have actually held up near their highs. The only stock set up in a “real” base here that I see is GSX Techedu (GSX), a rapidly-growing online Chinese education firm that will likely benefit from the virus. Despite a monstrous run this year, you can see that GSX has actually held its 50-day line—a breakout above 46 with a strong market upmove could be tradable.

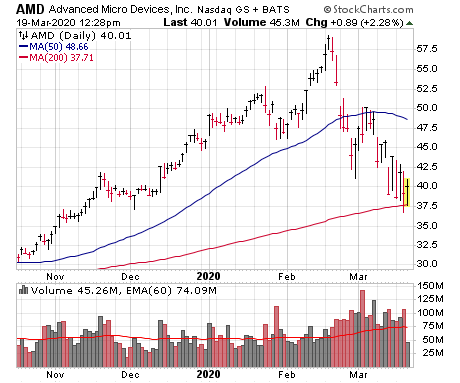

The other option is to look for stuff that’s taken a good-sized hit but has observed logical support. So far, one idea on this front is Advanced Micro Devices (AMD), which was definitely a leader in the chip stock space earlier this year, and it’s taken a hit since the top—but it’s held above its 200-day moving average line so far. Impressively, the biggest weekly volume during the month-long wipeout was when the stock was up on the week.

If you want to know what other growth stocks I’ve got my eye on, subscribe to my Cabot Growth Investor advisory, where we’re currently 71% in cash ready to put to use for the next big upturn, but do have a few winning stocks still in our portfolio.

To learn more, click here.

[author_ad]