Signs Abound that the Market is About to Break Out of its Malaise. And these 3 Growth Stocks Could Lead the Charge.

Today, I’m going to talk about the current state of the market, and three growth stocks that are setting up well for a potentially big breakout once the market breaks out of its five-plus-month funk. But first, let me start with something far more important…

So, I just returned from my annual weekend in Lake Winnipesaukee with a dozen of my closest friends, most of whom I know from high school. Of course, now that we’re all over 40, the drinking is less frequent (though still pretty frequent) and the debauchery is lessened (we’ve been doing this nearly every year for the past 25). It’s one of those rare occasions when you let loose and have fun, but also do plenty of relaxing and catching up with friends who’ve scattered across the east coast. Whether it’s amazing views or some booze cruising (and accompanying monkey hat), it’s always one of the best times of my year.

The trip was also beneficial work-wise, too. The past few months have been such a grind, with countless news-driven ups and downs, that it was good to recharge the batteries for a few days, forget about stocks and come back with a clean mind.

[text_ad use_post='129627']

And having come back to reality in recent days, running through a handful of my favorite stock screens, my biggest thought right now is this: After five-plus months of chopping around, I’m seeing a ton of solid setups out there among individual stocks and the market as a whole, so if investor perception changes for the better, I think there’s solid upside.

To be clear, setups don’t guarantee anything—they mean the market is in position to move, but it’s up to the buyers to actually show up. That’s why I’m still cautious in my Cabot Growth Investor advisory’s Model Portfolio given the chop-fest of the past few months—but I’m ready to move quickly should the bulls take control.

Where Does the Market Go from Here?

For the market as a whole, there are three factors I’m liking. The first is the chart itself—the major indexes have now had three tedious pullbacks since the start of May, all in the 5% to 8% range for the S&P 500 (larger for some other indexes). Usually the third time is the charm in the market, as investors throw in the towel during the third leg down based on frustrating action (of which there’s been plenty) and bad news.

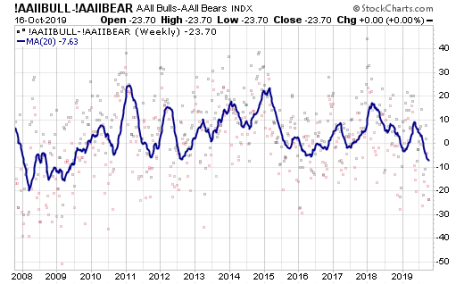

That leads us to the second encouraging factor—I’m seeing some unusual longer-term pessimistic readings from sentiment measures that frequently occur near major lows. Take a look at the 20-week moving average of the spread between the bulls and bears in the AAII survey. It’s just reached its lowest level since 2009!

And the third positive factor is the market internals—while the Nasdaq came right back down to its August low a couple of weeks ago, we saw far fewer stocks hitting new lows. A similar story played out on the NYSE, too.

All in, it certainly looks like the pieces are place for the major indexes to finally enjoy a sustained run higher.

3 Growth Stocks Poised to Break Out

To this point, very few stocks are actually reaching new highs—the Nasdaq is generally seeing just two or three dozen per day, even when it rallies strong (as it did on Tuesday). (That’s one thing that needs to change before I get aggressive on the buy side.) However, there are a bunch of growth stocks that have set up intermediate- to longer-term consolidations.

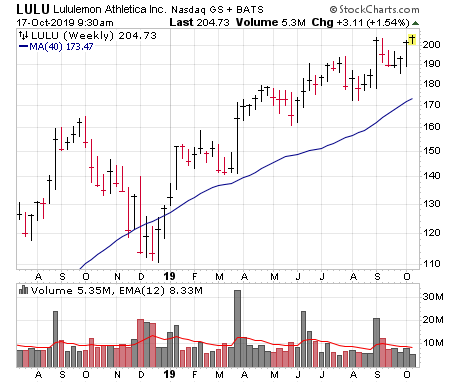

Take a look at Lululemon (LULU), for instance. It broke out powerfully on earnings back in March, but has since etched a similar pattern as the overall market, with three tedious pullbacks over many months—though now it’s challenging new highs, and business remains in high gear.

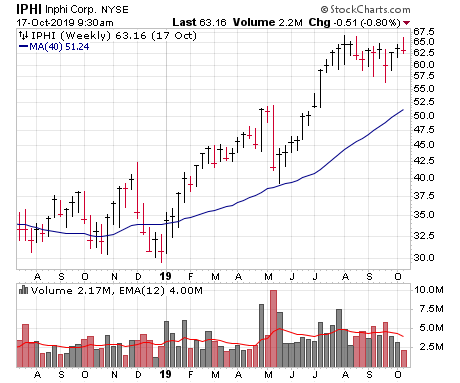

Another would be Inphi (IPHI), which is one of our top stock picks in the strong semiconductor group—it’s one of the leading players in high-speed interconnects, making it a play on faster data centers, 5G and faster telecom in general. The stock broke out in early July, part of a strong run-up, and now it’s chilled out for two months.

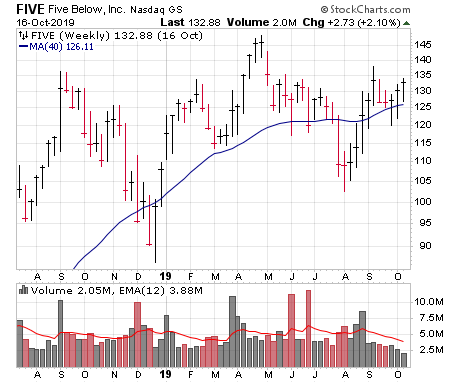

And then there are some longer-term setups. Take Five Below (FIVE), which had a great run from late 2017 until the fall of 2018 before getting caught up in the U.S.-China trade war—the stock eventually sank toward the century mark after tariffs went up for the second time this year, in August. But the action since then has been solid, with five weeks up in a row and a very low-volume, tight consolidation during the market’s October weakness.

I could go on, but you get the point—whether it’s the overall market or individual growth stocks, the upside of the past few months is that most are in position to get going. Now it’s a matter of seeing if buyers can show up and drive the indexes and leaders to new highs on solid trading volume. If so, we may finally come out of this choppy period.

[author_ad]