Everyone is talking about inflation.

My neighbor is complaining that her husband only got a 1% salary increase, which to her is effectively a salary cut given that inflation (CPI) was 6.8% in November.

I’m on the Board of Stewards at my church and we were planning to raise the pay of the church staff by 3% but are now reconsidering that decision, which was originally made in June.

Even Federal Reserve Chair Jerome Powell believes that inflation is no longer “transitory.”

[text_ad]

Powell noted that it was “probably a good time to retire that word and try to explain more clearly what we mean. …We see higher inflation persisting, and we have to be in position to address that risk should it become really a threat to — should it create a threat of more persistent, longer-term inflation.”

So how should we position our portfolios?

In 1977, Warren Buffett wrote the Forbes piece titled, How Inflation Swindles the Equity Investor.

Here is a wonderful PDF resource which includes that article as well as Buffett’s other musings on inflation.

In the postscript to the article, Buffett is asked why he still invests in equities given persistent inflation.

He replied, “Partly, it’s habit. Partly, it’s just that stocks mean business, and owning businesses is much more interesting than owning gold or farmland. Besides, stocks are probably still the best of all the poor alternatives in an era of inflation – at least they are if you buy in at appropriate prices.”

If stocks are still the best of all the poor alternatives in an era of inflation, then what stocks look most attractive today?

2 High Inflation Stocks

The most attractive stock in an inflationary environment are asset-light companies with high returns on capital and high margins. A perfect example of this is Facebook, as famous tech investor Gavin Baker says.

Facebook – excuse me, Meta Platforms (FB) – generates revenue by selling advertisements through auction. As such, they should not be negatively impacted by inflation.

Meta Platforms is growing revenue 38% yet trades at only 24x forward earnings. It sports an operating margin of 42%.

Meta also qualifies as a Peter Lynch stock for me. Lynch argues that oftentimes it makes sense to buy stock in companies whose products you use.

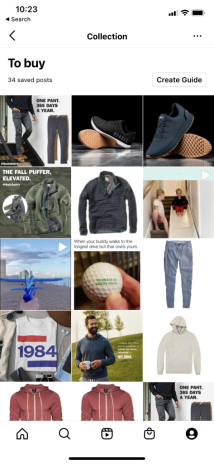

While I don’t use Facebook too much these days, I use Instagram daily and even have a folder labeled “To Buy” so that I can save products that look good.

Here’s a screenshot of my “To Buy” folder:

For my second high inflation stock pick I will get back to my roots with Dorchester Minerals (DMLP).

Dorchester – despite it being an energy company – also qualifies as a high-margin, high-return on invested capital company.

It’s a company that owns energy royalties and leasehold interests in 27 different states. It receives a check whenever its oil or gas is sold. Better yet, it doesn’t have to spend any money on CapEx and pays out all income to its unit holders.

At a P/E ratio of 12.8x and an annualized dividend rate of 10.6%, Dorchester will do very well in an inflationary environment.

Do yo have any stocks in your portfolio designed to weather high inflation? Tell us about them in the comments below.

[author_ad]