I don’t need a crystal ball to know that people will want to find out which hot technology stock I am recommending. But first, a glimpse into the future.

I’ve been writing about investing and capitalism for the past 31 years, and in that time, I’ve seen a lot of truly great companies created.

Among the companies that have changed my life—in a good way—are Apple, Best Buy, Cisco, Disney, eBay, Facebook, Google, Home Depot, Intuit, JetBlue, Keurig Green Mountain, LinkedIn, Microsoft, Netflix, OpenTable, Paypal, Qualcomm, Rackspace, Starbucks, Tesla, Uber, Visa, Whole Foods, Xerox, Yelp and Zillow.

And the capitalism that thrives in the U.S. helps everyone!

It enables millions of people in developing countries to own cell phones and televisions and join the connected world.

It’s reducing global poverty and hunger at a good pace.

And it’s boosting the standard of living in every corner of our own country.

Bottom line: Life in the U.S. keeps getting better, and life around the globe keeps getting better, too.

[text_ad]

That’s a good trend.

But then there’s the trend of interest rates.

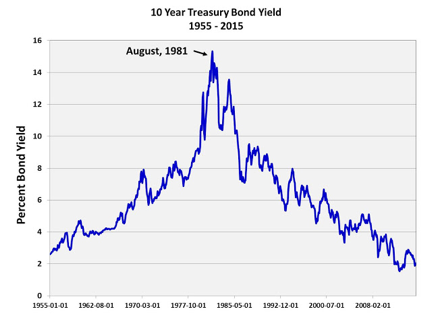

The big picture is this. From the end of World War II until 1981 (36 years), interest rates rose, as people grew increasingly confident about investing in the future.

But from 1981 until recently (again, 36 years), interest rates declined. Today, Federal Treasuries can pay next to nothing because people feel more comfortable keeping their money “safe” than lending it out at higher rates. Bottom line: they are afraid of the future.

The big question is why?

One reason is that we are going through a period of rapid technological change—not unlike the industrial revolution and the electronic revolution. The winners in this revolution include people who know how to use the new technologies to advantage; the losers include those who don’t.

Another reason people are afraid of the future is that our political institutions are decaying—both here and in Europe

Here in the U.S., the two major political parties are so focused on trying to maintain their crumbling power that they no longer even pretend to cooperate. In Europe, the United Kingdom is withdrawing from the European Union, and France just elected a man who comes from neither of the two parties that have dominated French government since World War II.

In short, the political landscape is shifting dramatically.

Meanwhile, despite all the technology that allows people to stay connected non-stop, more and more people feel that government no longer represents them.

More and more people believe that we no longer have a representative democracy in which every person’s vote matters.

Instead, they believe we have a representative democracy in which every dollar matters, and where the lobbyists paid by institutions and corporations wield the real power. As a result, Congress’s approval rating is at an all-time low.

Lastly, on the health care front, we pay more than any other developed country (17% of GDP as opposed to an average of 10%), yet we receive the lowest quality care.

And no amount of diddling by either the Democrats or Republicans (in my opinion) is truly going to move the needle in a meaningful way. In my opinion, the only party that’s truly happy with our country’s current health care system is the insurance industry, and that’s the party that should be taken out of the equation. (Obviously, lots of reasonable people have other opinions.)

The bottom line, however, is clear. Confidence in the future is low.

So what comes next?

Change, obviously. That’s the one thing you can be sure of.

Technological progress, in particular, will continue to shape our world as intelligent machines both replace humans (Hey, Alexa, write my next column) and do jobs humans could never do.

But can technological changes fix our health care problems, our political problems and our confidence problems?

The optimist in me says yes—in part because I take the long view.

On health care, I’m optimistic—in part because I believe we’re getting to a tipping point. Change will be messy, but the U.S. can certainly afford to have the best health care in the world.

On politics, I am optimistic that a new order will eventually arise out of the current dysfunction. (It’s always darkest before the dawn.) And if this new order includes the birth of a new political party, as in France, I’ll welcome it. I like change.

And on the disruption to the economy caused by new technologies, I say bring it on. Those technologies are where we find the greatest growth stocks! In fact, there’s one I want to tell you about below.

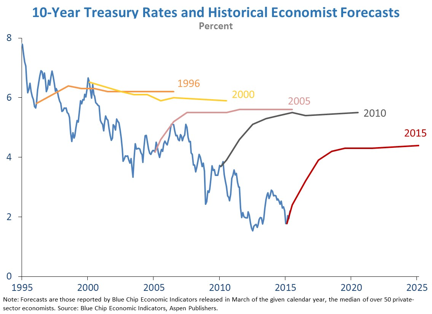

But first, I want to circle back to the question of interest rates. After 36 years of trending down, a lot of people are saying it’s time for interest rates to start trending back up to “normal” levels. Maybe. But before you jump on that bandwagon, consider this chart, which shows expert economists’ predictions of interest rates at five-year intervals over the past few decades.

As interest rates kept coming down, the experts kept predicting that they’d go up! And the experts were wrong. Very wrong—consistently. In fact, a better guide to the movements of interest rates was the simple long-term trend!

ONE HOT TECHNOLOGY STOCK

Speaking of trends (that’s my segue), here’s the chart of a hot little technology stock named China Cord Blood, which came public in 2009 and trades on the NYSE under the symbol CO.

For years, the stock meandered sideways on light volume, but it came to life last December, and in recent months, it’s been surging ahead, as more and more buyers discover the story behind the stock (which is exactly what the company’s name suggests.)

Then, just last week, the stock closed above the magic $10 level.

Trouble is, growth is still not particularly fast at the company, so buying this technology stock here still carries quite a bit of risk. If you choose to buy, you’re on your own.

What I suggest instead—particularly if you’re looking for top-performing Chinese stocks, is Paul Goodwin’s Cabot Global Stocks Explorer, which every week steers you to the greatest opportunities in Emerging Markets investing while managing risk expertly.

As I write, Paul’s portfolio is full of winning stocks, including two with profits of over 100%. And he just recommended a new technology stock that is growing by leaps and bounds as it makes inroads into the booming social media industry of China. The profit potential is limitless!

To get full details in the latest issue, simply click here now.

[author_ad]