The initial public offering (IPO) market started out slow this year, but second-quarter numbers indicate a definite uptick in new issues.

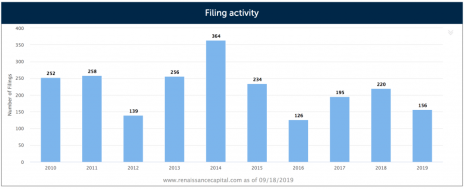

So far in 2019, 156 IPOs have been filed, down about 8% from last year. But you can see from the following graph that if the Q2 stats are predictive of the rest of the year, it should be a pretty full calendar.

In the second quarter, the market raised $25 billion from 62 IPOs, which actually was the greatest number of deals in a quarter in the last four years, according to Renaissance Capital. There are currently 60 more IPOs in the pipeline for 2019, with estimated proceeds of $11 billion.

[text_ad use_post='129620']

So, how have they done so far? Of 144 tracked by IPOScoop.com, 67 have negative returns, 12 have returned less than 10% to investors, and 12 have gains of more than 100%. The latter include:

- Elastic N.V (ESTC), up 160.72%

- NextCure (NXTC), 166.93%

- Anaplan (PLAN), 193.76%

- Guardant Health (GH), 293.32%

…and the big winner—Beyond Meat (BYND)—with a return of 541.24%!

The average return was anything but average—30%, with the best sectors being technology and biotech stocks, and the worst being energy stocks and financials.

Some of the most highly-touted IPOs were real duds, including Slack Technologies, Inc. (WORK), Uber Technologies, Inc. (UBER), and Lyft, Inc. (LYFT).

Slack, a workplace messaging service that has caught on very quickly (we use it at Cabot!), saw big revenue growth in the first quarter (up 65%), accompanied by net losses. And when the company warned that the second quarter’s losses would be larger than forecast, the stock came tumbling down.

At $8.1 billion, Uber was the largest IPO since Alibaba (BABA) debuted its stock in 2014. But, as you can see from the following graph, it turned out to be a big disappointment to its investors.

And Uber’s big competitor—Lyft (LYFT)—raised $2.3 billion in its debut, but has been tumbling since its IPO.

Bottom line, it pays to be wary of IPOs—at least until the shares have been trading awhile. Of course, unless the shares go directly to the public, as Slack did, it’s often difficult for individual investors to ‘get in’ on an IPO. That’s because brokerage firms generally reserve most of the shares for large institutions and the well-heeled clientele of the underwriting firms.

Your first point of contact is your broker, to see if his company will have any shares to distribute to their clients. Next, call the Investor Relations department of the company going public to find out if it is going to issue any shares directly to the public, and lastly, you can try contacting the underwriters of the stock and ask how they intend to distribute shares.

Here are a couple of links to upcoming IPOs:

https://www.nasdaq.com/market-activity/ipos?tab=upcoming

https://www.marketwatch.com/tools/ipo-calendar

But even if you can get into the IPO, the real question you should really be asking yourself is, “Should I buy shares right away or wait?”

Analyzing IPO Companies

Sure, you could get really, really lucky and buy shares of an IPO that skyrocket the first day, sell the shares at the end of the day, and walk away with a pocketful of money. It does happen, but not normally to regular investors like you and me. Instead, we need to rely on old-fashioned gumshoe work, viewing the IPO issue as we would any other investment, and asking ourselves, Is this stock worthy of adding to my portfolio?

That means a bit of analysis, starting with the company’s financials. Is it profitable? Does its cash flow cover its outlays? Does it have substantial assets (especially cash) and reasonable debt, in case of a downturn in the economy, its sector, or the company itself? If the financials look good, the next step is to examine the company’s products or services and determine if they meet a real, ongoing need. You can see that fairly easily by looking at its past growth and future projections, which should be included in the prospectus in the proforma financial statements.

And if the company passes your tests, and you buy the shares, you may want to wait a bit to buy in, even if you could procure shares on the first day of trading, as prices of IPOs often fall precipitously shortly after the stock debuts. And many continue to decline.

On average, IPO (according to Barron’s research) can underperform up to 2 ½ years after their initial pricing.

But as the data shows, there have certainly been plenty of winners in the IPO market. Still, investors must tread carefully. Evaluations for IPOs look a bit lofty to me these days. And there are a slew of highly-touted ones on tap, including high-end exercise equipment maker Pelaton, Airbnb, shared office space The We Company, and food delivery business Postmates.

But before you jump into them, remember that the key to successful investing is buying the right stocks at the right price, fundamentally strong companies that have the ability, strategy, and good management to continue growing over the long-term.

[author_ad]