The Bull Market Rolls On

Tesla Motors Fundamentals and Technicals

Is It Too Late to Buy Tesla (TSLA)?

---

One remarkable aspect of the current bull market is its persistent strength, more than six months after the November kickoff. To anyone who began investing in the last decade, this persistent strength is confusing; they’re waiting for a big correction.

But the market doesn’t like to give investors what they expect; it likes to fool them. And in sending a bunch of great growth stocks to one new high after another in recent months, it sure has fooled a lot of investors.

However, investors have been learning. And many, who enjoyed the great bull market of the 80s and 90s, have rekindled memories of great growth stocks like America Online, Amazon.com and Cisco, to name a few.

As a result, today I’m seeing more and more investors throw off their security blankets and embrace the potential of great growth stocks. Today, I’ll focus on one of my favorites.

---

Tesla Motors (TSLA) has been one of the hottest stocks in the market, zooming to a gain of 206% over the past 10 weeks. Year-to-date, it’s up even more. So is it too late to buy?

You can get plenty of opinions on this exact question on the Internet, and for the most part, these opinions are worth what you pay for them—nothing.

Just because people CAN post an opinion, doesn’t mean they should. And it certainly doesn’t mean you should trust them.

But hey, this is America. Free speech is one of the things that’s made us great, and I don’t want to stifle anybody.

What I do want to do today is give you some guidelines on evaluating this very unusual stock and company.

First, I’ll cover the long-term fundamentals, then the short-term fundamentals and then the technicals.

LONG-TERM FUNDAMENTALS

Long-term, Tesla’s big promise is that it will modernize the automobile business, not just in one way—by making electric cars—but in numerous ways. The word REVOLUTIONARY, therefore, applies fully, and this is very important, because in the long run, the biggest growth stock winners have been revolutionary companies that changed the world. In my lifetime, these have included Amazon.com, Apple, Cisco, eBay, Green Mountain Coffee Roasters, Home Depot, IBM, Kodak, McDonalds, Microsoft, Netflix, Starbucks, Wal-Mart and Whole Foods.

To review, here’s Tesla’s revolutionary promise:

1) Its cars run on electricity, not gasoline.

2) This electricity is currently generated by lower-cost sources of power than gasoline and will increasingly be generated by free, clean solar power, both at public charging stations and at owners’ homes.

3) Lacking an internal combustion engine—in fact, lacking any fluids at all except windshield washer fluid—Tesla’s cars will need far less service than we are accustomed to giving our vehicles. They will be far more reliable.

4) Because they are electric—and electronic—they can be reprogrammed on the fly, over the Internet, giving their owners not only the ability to adapt the vehicle to specific road conditions but also to upgrade over time.

5) These cars are produced at a highly automated non-union factory in California, which is free of the century-plus economic and cultural baggage that hampers the efforts of most car companies to adapt.

6) These cars are sold directly to customers at fixed prices, bypassing the existing car dealer infrastructure totally. With dealerships adding an average of 6% to 9% to new vehicle costs, and costing consumers hours of time in negotiation as well, is there anyone outside of that industry who thinks this is a bad idea?!!

7) Finally, to recap the basic business model, Tesla first produced a very small number of two-seat sports cars, which yielded fat profit margins and bankrolled the development of the current crop of Model S luxury sedans. These will yield slightly lower margins, but at greater volume. And these will bankroll the rollout of the Model X Crossover SUV and then the even-larger-volume rollout of the mass market all-electric $40,000 sedan that will arrive in a couple of years.

In response to questions about the possibility that Tesla might be bought by a larger company, CEO Elon Musk has answered, “What the world really needs is a great, affordable electric car. I’m not going to let anything go, no matter what people offer, until I complete that mission.” Skeptics who see Tesla as a start-up manufacturer of expensive cars are guilty of short-sightedness.

Interestingly, because everyone alive today has grown up in the internal combustion era, it’s hard for most people to truly envision the future as Elon Musk sees it. And even if they’ve imagined it, most people are unprepared for the change in behaviors—like time spent pumping gas—and the change in values that these cars will usher in. But make no mistake, the revolution has started, and forward-thinking investors will have plenty of opportunities to profit as it unfolds.

So how big can Tesla get? How profitable can it be? How high can the stock go? The first two questions, and perhaps even the third, can be tackled by bean-counters, but I’ve never found that kind of analysis useful when investing in revolutionary stocks.

Certainly, no bean-counter could justify the stock being at $100 today. No, to invest in Tesla at this point, you’ve got to embrace what Tom Phelps called “the unforeseeable and the incalculable.” There’s no way of knowing what Elon Musk will do next. There’s no way of knowing how fast Tesla’s Model S will sell in Europe. And there’s no way of knowing how far forward investors are willing to look when evaluating this stock. There’s no knowing how quickly Tesla might license some of its powertrain technology to current partners Toyota or Mercedes. There are just too many unknowns. But there’s no question that the long-term potential for the company is very, very big.

SHORT-TERM FUNDAMENTALS

There’s been a lot of positive news about Tesla in recent weeks.

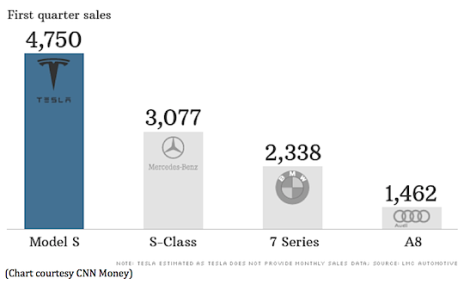

1) First-quarter earnings were spectacular—above all analyst estimates—driven by both increased deliveries and increased manufacturing efficiencies. Look at this chart comparing Tesla’s first quarter Model S sales to the most similar cars of its competitors.

2) The company completed a secondary stock offering, raising $1 billion.

3) It paid back its Department of Energy loan of $452 million, nine years ahead of schedule!

4) Better Place, the Israeli company that offered a battery-swapping program for European electric cars, is now headed for liquidation, joining Fisker and Coda in the exclusive “Recently Failed Electric Car Ventures Club.” This means that competition for Tesla is once again pretty much limited to the traditional old auto companies.

5) Today’s announcement about the tripling of Tesla’s supercharger network—where charging is free!—should alleviate some of the mileage range anxiety of skeptics.

On the downside, short-sellers point to the fact that the stock market now values Tesla at more than $12 billion, while the company’s revenues in 2013 could be around $2.4 billion. Every other public auto manufacturer is valued at less than one year’s revenues, so if the short-sellers’ dreams come true, the stock will drop more than 80% from here!

Summing up the short-term, experience tells me that eventually, some cloud will rain on Tesla’s parade; it doesn’t really matter what the news or catalyst is. It could start at this level; it could start from an even higher level. But with the stock now trading some 80% above its 50-day moving average, any bad news has the potential to kick off a serious correction. Which brings us to technical analysis.

$insert("/sitecore/content/ads/COT/2012-2-Profit-With-Less”,"wc13")

TECHNICAL ANALYSIS

We all start off as fundamental investors. It’s the first language we learn, and some of us never learn another. But some of us learn the language of technical analysis, and once we learn it, we never go back to being single-language investors. Armed with two languages, we use them both!

And why is this second language so important? Because a stock’s charts reflect EVERYTHING that all interested investors “know” about that stock. And collectively, those investors are smarter than any one of us. In fact, as Jesse Livermore wrote, “the market is never wrong; opinions are.”

So looking at the chart of TSLA, here’s what I see.

TSLA came public in mid-2010 at 17. It peaked at 30 the first day, and the next week was trading at 15. It’s been in a general uptrend since then, but the stock didn’t get hot until this year, when the company pre-announced a profitable first quarter at the start of April and six weeks later blew away all expectations with the actual report.

Investors who became more optimistic about the company’s future bought as the shares climbed higher. Skeptics who’d been short the stock bought to cover their losses. And the stock went crazy!

From late March to late May, TSLA soared from 35 to 110, for a gain of 214%!

Subscribers to my Cabot Stock of the Month advisory, who bought at 29 back in December 2011, and are looking at even larger gains!

This is rather extreme behavior. But as I mentioned at the start of this column, it is not unprecedented, particularly in such a broad and strong bull market as we’ve had this year.

So what comes next? Is TSLA too high to buy now?

If you have a long enough horizon, my answer is no. Buying Tesla now might be like buying Microsoft in 1987, after the stock had tripled in less than a year. That worked out pretty well. But significant volatility is to be expected, and unless you have a cast-iron constitution, I recommend taking it slow, giving the stock time to find its footing, and allowing time for the broad market’s excesses to dissipate a bit.

Ideally, if you’re going to invest at this point, I strongly recommend that you take a subscription to Cabot Stock of the Month, so you can get my weekly updates on TSLA, and other high-potential stocks as well.

Click here for details on Cabot Stock of the Month.

Yours in pursuit of wisdom and wealth,

Timothy Lutts

Editor of Cabot Stock of the Month

Related Articles:

4 Stock-Picking Tips You Can Use to Find Big Winners

Trouble in Cyprus and Tesla Motors

Tesla Motors is Overvalued AND Undervalued

Video: Tim and Antony Currie of Reuters Breakingviews talk about Tesla on CCTV