For the last few years, large-cap stocks—especially large-cap growth stocks—have been the place to be. Large-cap growth stocks have returned an average of 35.95% to investors over the last three years, far outpacing the runners-up—large-cap value stocks, which gained 8.86%.

So far in 2024, that has pretty much remained the status quo, with large-cap growth stocks rising 13.50% and large-cap value growing by 6.51%.

For several years—since the pandemic—economic gurus have been calling for a recession, then a soft landing. Even now, as the economy continues to look pretty good, recession odds are about 58% for this year. But hey, economists are also right about 50% of the time!

[text_ad]

The stock market and the economy are interrelated, and the economy’s been very strong so far this year, so the natural question on investors’ minds is, how long can the market rally last?

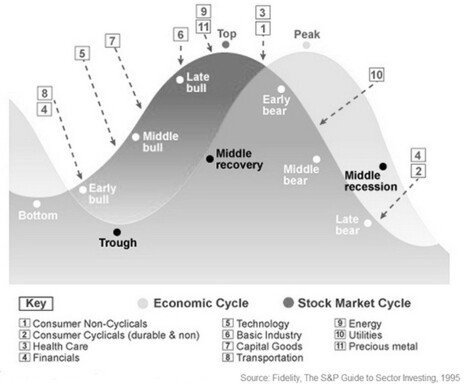

I’m no soothsayer, but we can learn a lot from history. And it’s a fact that during certain economic cycles, some sectors do better than others. Here’s a picture of how, historically, economic and market sectors have meshed.

Sectors and Market Cycles

Of course, history hardly ever exactly repeats itself, as you can see by the sector table below.

U.S. Sectors & Returns

| Name | YTD | 1 Year | 3 Years |

| Communication Services | 15.04% | 32.35% | 7.07% |

| Utilities | 13.52% | 10.40% | 9.77% |

| Financial Services | 10.05% | 26.16% | 7.84% |

| Technology | 9.46% | 26.24% | 53.36% |

| Energy | 8.25% | 13.59% | 63.89% |

| Consumer Staples | 7.33% | 5.03% | 8.47% |

| Industrial | 7.03% | 20.86% | 16.19% |

| Basic Materials | 6.37% | 15.81% | 3.73% |

| Healthcare | 6.11% | 11.04% | 18.91% |

| Consumer Discretionary | -1.63% | 12.03% | 3.67% |

| Real Estate | -5.39% | 2.96% | -14.87% |

Source: Seekingalpha.com

It’s weird, for instance, that Financials are finally breaking out of their doldrums at the same time that Energy and Utilities are doing well. And that Consumer Staples are doing better than Consumer Discretionary—but I’m fairly sure that has more to do with high inflation than an expansionary cycle. Same with Real Estate. That industry has had a wild run since COVID, but escalating home prices and rising mortgage rates have dampened demand.

I show you this sector table to demonstrate that while statistics and historical averages are great tools, you cannot automatically rely on them to provide exact market timing for getting into and out of particular sectors.

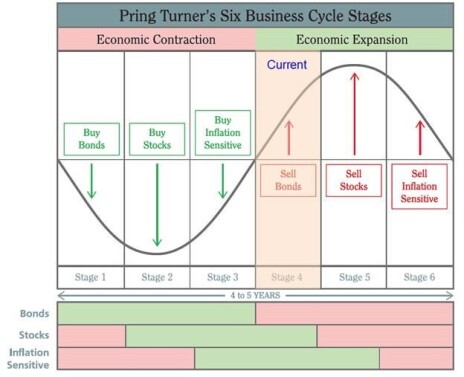

However, having said that, I would be remiss to totally ignore cycles. And the following chart depicts the cycle that many economists believe we are currently seeing—still in an expansionary mode.

Looking over these charts, I have to say that I mostly agree with them. I do believe we are still in an expansionary mode, and that large-cap stocks remain attractive. But I also think that investors need to choose their stocks wisely and not just go with the flow or assume that all large-cap stocks are great investments.

With that in mind, my research has turned up a few names that still look pretty interesting. I hope you’ll agree!

3 Large-Cap Growth Stocks for This Cycle

| Stock | Price ($) | 52-wk Range ($) | P/E | Dividend Yield (%) |

| Johnson Controls International plc (JCI) | 71.70 | 47.90 - 74.23 | 26.62 | 2.07 |

| Walmart Inc. (WMT) | 65.96 | 49.50 - 66.37 | 28.18 | 1.26 |

| NVIDIA Corporation (NVDA) | 1,146.16 | 373.56 - 1,161.23 | 66.99 | .03 |

All three of these stocks could benefit from continuing economic expansion, but if you’re interested in learning more about which stocks I’m currently buying, subscribe to Cabot Money Club today.

[author_ad]