Getting in Early on Three Great Stocks

Every investor’s fondest dream is to buy a young stock and hold on while it climbs up and up and up—yet extremely few investors are able to do that.

Why?

Because they follow the crowd; they don’t think different. And maybe because no one ever taught them to think different.

But I’ve enjoyed numerous big stock winners in my investing career (as well as hundreds of lesser winners), and today I want to review what three of them had in common, so you too can find similar stocks.

Amazon (AMZN) was my first big winner, bought in January 1998 at the beginning of the dot.com bubble. The company had reported revenues of $125 million the year before from selling books—and only books. Earnings were nowhere in sight. And experts were predicting that the established booksellers Borders and Barnes & Noble would soon adopt Amazon’s methods and put the little company out of business. But I was a regular customer—I’ve always been a big reader—and what CEO Jeff Bezos said made a lot of sense to me.

[text_ad use_post='137724']

Plus, the stock was strong! After coming public in May 1997 at 18, it zoomed to a high of 66, and we bought on a pullback to 57. Less than two years later, we had a profit of 1,465%, and we finally sold in January 2000 for a profit of 1,234%.

(Yes, if we’d held onto the stock through today, the profits would have been far greater, but sitting through the stock’s massive 95% implosion from the end of 1999 to October 2001 would have been extremely difficult.)

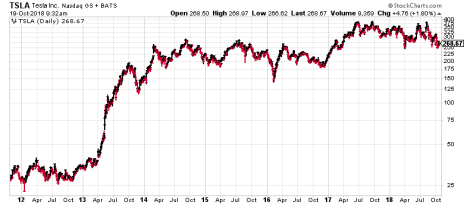

Tesla (TSLA) was another notable big winner, bought in late 2011 at 29. The company had reported revenues of $117 million in 2010, up slightly from $112 million in 2009, and was on pace to bring in $204 million in 2011. As with Amazon, earnings were nowhere in sight. But enthusiasts were raving over the performance of the company’s little Roadsters, and the pre-production models of the company’s big Model S impressed me.

Plus, the stock was strong! Not as strong as AMZN back in the dot.com boom, but definitely demonstrating positive momentum, even in the face of criticism that the little California automaker only made cars for a niche market—and that General Motors (GM) and Ford (F) would eat its lunch.

TSLA’s big breakout year was 2013, as the Model S garnered rave reviews, and the stock eventually hit 390 in September 2017, giving us a profit of 1,245%. Since then, the stock has been consolidating those gains, as the reality of the fundamentals draws closer to the expectations of the price. We’ve taken numerous partial profits, and our gain on the rest of our shares is currently 825%, and we’re holding tight.

Canopy Growth (CGC) is my most recent big winner, bought in August 2017 at 7. The company had reported revenues of $13 million in 2016 and was on track to hit $40 million in 2017. Once again, earnings were nowhere in sight. But I detected growing interest among investors about the cannabis industry and the huge potential profits that would accrue to early investors, so I started a whole new advisory based on marijuana stocks (Cabot Marijuana Investor) and Canopy has been in the portfolio since the start.

As to the stock, it had been strong in the later half of 2016, and then consolidated normally into the middle of 2017, meeting up with both its 25-day and 50-day moving averages, and that was our low-risk entry point for the little-known stock.

Since then, the sector has done extremely well, with many stocks hitting highs last week as the adult-use market in Canada became legal. As I write, our profit in CGC is 640% and I’m confident that it’s only a matter of time before it tops 1,000%.

Five Rules for Finding Big Stock Winners

Those three big stock winners have similarities and differences, but overall, these are the lessons I’ve learned from stocks like them—and my guide to helping you find similar big winners.

- Be an optimist about fundamental progress. Last week I noticed a lot of stories about Sears (SHLD), in which people looked backward fondly. If you want to find big stock winners, you’ve got to look ahead! Embrace the great progress happening in the world and dig into the ideas that interest you.

- Don’t buy at the IPO. Buy only after the public has demonstrated that it likes the stock! In the three cases above, our buys were six months to a year after the IPO.

- Look for strong charts. There’s no better guide to other investors’ enthusiasm than a strong chart.

- Don’t wait for earnings. Bean-counters who wait for earnings arrive late.

- Subscribe to one or more Cabot advisories to stay on top of today’s growth stocks. Cabot Growth Investor is our flagship, with a focused portfolio of 10 stocks (maximum), and if you want even more ideas, try Cabot Top Ten Trader, which presents 10 strong stocks every Monday. It’s the best source of new stock ideas.

[author_ad]