Every good investor has a set of rules, tools and indicators that guides him or her through the market’s various environments, though they can vary depending on the person and the system. Some look at dozens of inputs, and others rely on what is often the complex and arcane. Me personally, having gone down the rabbit hole of research 20 years ago, I always lean toward the KISS principle (keep it simple, stupid), relying on a few rubber-meets-the-road sort of measures that keep me in gear with the market.

However, my point here isn’t to dive into my system—but simply to say that, no matter what market timing (and often stock selection) stuff you look at, the goal is really about identifying changes in character—spotting the time when a stock goes from downtrend or sideways to uptrend, or when growth stocks go from underperforming to outperforming, and so on.

[text_ad]

And as we sit here in early June, I’m starting to see more and more changes in character in the market—almost all of them bullish. No, it’s not 1999 out there, but the following five things all seem to be flipping, which itself is a sign that big investors are changing their tune.

5 Signs of an Improving Market Environment

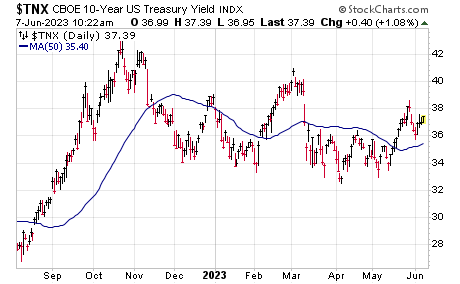

1. Interest Rates

OK, I sort of cheated on this one, as the change occurred a few months ago, but the fact is that after a huge rise, market-based interest rates actually peaked last October, hit a lower high in February and, at best, are stuck in a sideways range. We’ll see how it goes, but the rate of change in interest rates has turned neutral-to-lower—a good thing for stocks.

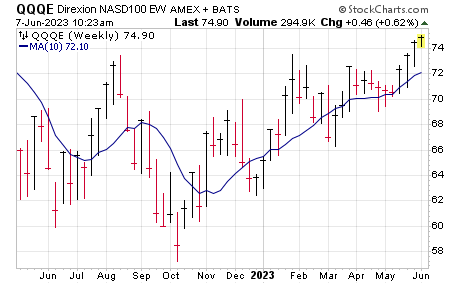

2. Equal-Weight Indexes Are Rallying …

There’s no doubt the past few weeks were dominated by a handful of stocks—in fact, as the S&P 500 was testing new multi-month highs a couple of weeks back, the equal-weight S&P (symbol RSP) nosed to two-month lows! But now we’re starting to see that change, especially when it comes to the Nasdaq: Shown here is the equal-weight Nasdaq 100 (QQQE), which found resistance in the 73 range in February, late March, mid-April and again in late May … but now it’s finally breaking out on the upside.

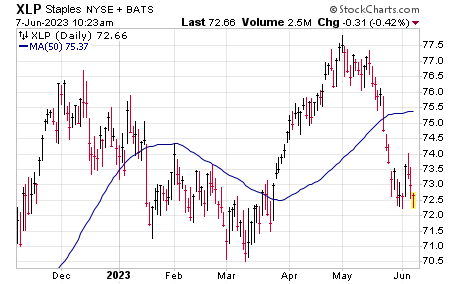

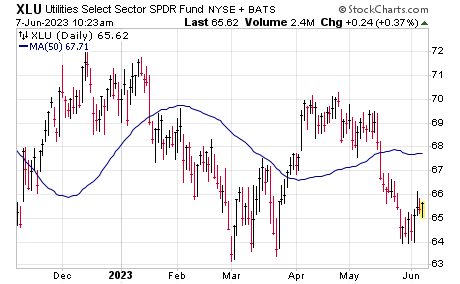

3. … While Defensive Stocks Retreat

In concert with improved action from growth stocks and the broad market, I’m seeing defensive areas roll over, or at least come under selling pressure. It’s most obvious in the consumer staples (XLP) area, which kited higher into early May but has keeled over the past two weeks. Utilities (XLU) and defensive healthcare (XLV) are also worse for wear.

What’s even more telling, given the past two points, is one of our Aggression Indexes—simply looking at the ratio of the QQQE above and XLP. After a big decline last year and a higher low in March, you can see the Index has raced to its highest level in more than a year and is well above its intermediate- and longer-term moving averages—clearly bullish.

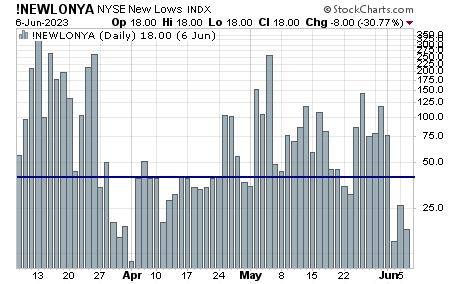

4. New Lows Starting to Dry Up

Every situation is different, and 2023 might be one of those cases. But in most instances, one of your first clues the market environment is changing character is a drop in selling pressures—and my favorite way to measure that is the number of stocks hitting 52-week lows on each exchange. I mostly follow the NYSE figures but keep an eye on the Nasdaq new lows as well, and while it’s early, we’re starting to see some real improvement. If this goes on for another few days, it will represent an all-clear for the broad market and a clear character change from the prior couple of months.

5. Leaders Breaking Out AND Holding/Extending Their Gains

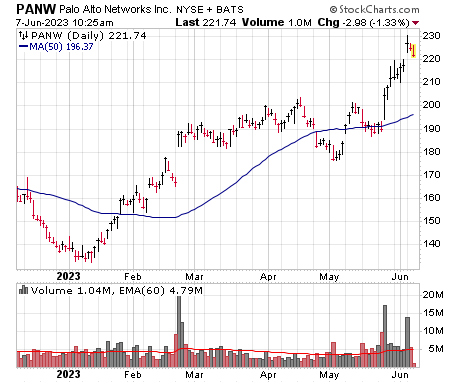

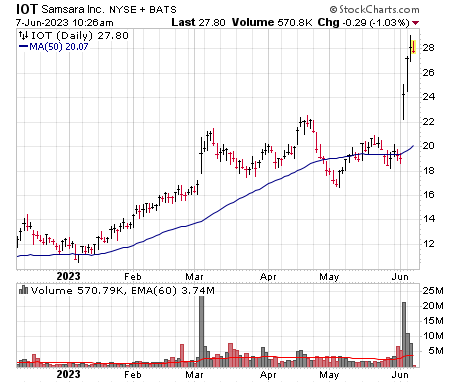

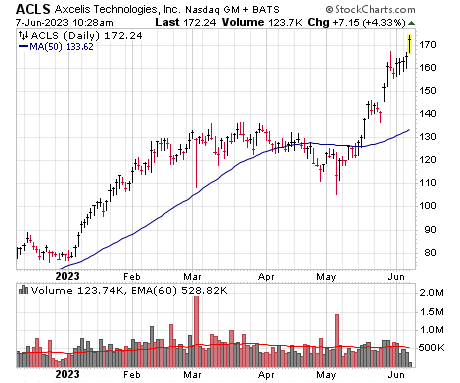

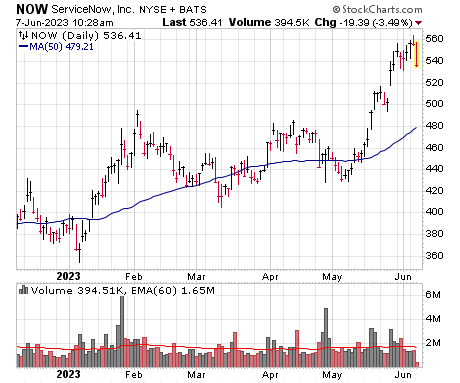

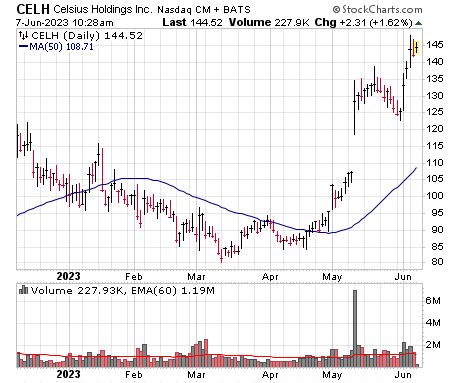

The four points above are all solid pieces of top-down evidence for the market—a strong hint that the perception of big investors is changing for the better. But #5 is by far the most important to me, in part because of what I repeatedly said was the top characteristic seen during the bear market: For months at a time, any time quality potential leading growth stocks would approach key, multi-month resistance, they would either (a) be rejected quickly, or (b) move to new highs for a few days before quickly rolling over.

That type of action was all over the tape last year, but even earlier this year more than a few breakout attempts fell flat in February, March and April—and it was especially frustrating as many times there were tons of stocks set up to go, but the market environment wouldn’t allow them to run.

But now, just within the past three weeks or so, the action has done a 180. You know about the AI stocks, of course, but check out the collection of names below from different groups that have all popped higher—and held or extended those gains.

Of course, there’s never any surety in the market, and not all of the evidence is positive—we’ve all seen enough twists and turns during the past 18 months to know this nascent upmove could hit a speedbump at any time (maybe if the Fed decides to hike rates next week?).

But at long last, I’m finally seeing some real character changes in the market environment itself—and more importantly, in a growing batch of leading stocks that are finally doing something they haven’t in a long time … rally in a sustained way.

[author_ad]