As the market continues to recover, new market leaders are emerging. But recovery may be a long way off for certain roughed-up blue chips.

Before I reveal a couple new leading growth stocks (and one blue chip that’s fallen on hard times), I have three quick points I wanted to relay today based on a number of questions I’m getting from a variety of subscribers.

The first comes from a book called Ten Years of Wall Street by Barnie Winkelman who was quoted in Barton Biggs’ book Hedgehogging (highly, highly recommended book), and it applies to those who are overly obsessed with the current economic malaise:

“Those who seek to relate stock movements to the current statistics of business, or who ignore the strongly imaginative taint of stock operations, or who overlook the technical basis for advances and declines, must meet with disaster, because their judgment is based on the humdrum dimensions of facts and figures in a game which is actually played in a third dimension of the emotions and a fourth dimension of dreams.”

[text_ad]

In other words, for the many saying the market “can’t go up” because of the damage of the virus and the shut-in, they’re dealing too much with facts and figures and not listening enough to the market itself.

It goes the other way, too—just because the Fed is buying any asset that isn’t nailed to the ground, for instance, doesn’t guarantee the market is headed higher. While the real world runs on exact numbers, the market moves on expectations and perceptions, both up and down. That’s why it’s better to rely on the action of the market itself (major indexes, leading stocks), which helps you stay in gear with what’s actually happening, instead of coming up with a biased judgment based on the news.

New Leading Growth Stocks Emerge

The second point here comes to that exact point—interpreting the action. These are the kind of environments where it really pays to at least take a glance at some stock charts to get some perspective among all the noise and volatility out there.

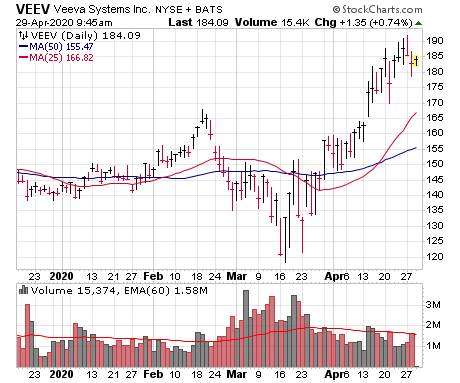

For instance, let’s take a look at a daily chart of Veeva Systems (VEEV), an emerging blue chip in the cloud software sector that was out of favor for eight months but has acted extremely well since the market’s late March bottom.

But look at the very recent action: On April 21, VEEV fell as many as 14 points intraday (nearly 8%!). And then early this week, the stock fell from a high of nearly 192 on Monday to a low of 179 on Tuesday (about 6.8%). If you were a shareholder, none of that was fun—but as you can see on the chart, neither dip was really out of the ordinary. In fact, relative to the action of the past couple of months, it looked downright normal, with neither dip even approaching the 25-day line.

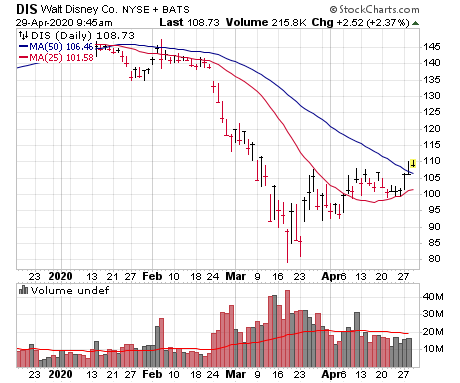

On the flip side, look at Disney (DIS), the blue-chip stock that’s fallen on hard times as parks have closed and movie production has halted. Since the absolute low, the stock’s had some sharp bounces—in early April, DIS rallied from 93 to 108 over four days, and this week, it popped 10 points in just two days. But, while it could be just fine longer-term, you can see the recent moves aren’t decisive by any means; DIS remains miles below long-term resistance and hasn’t recovered much of its February/March crash.

That doesn’t mean Disney stock is doomed for years to come, but the point is dramatic headlines and big one- or two-day moves can often get the heart pumping—but don’t often tell you if the stock is really making a meaningful move.

Thus, you want to focus most of your attention on the market and leading growth stocks, but you also want to add some perspective. And last, don’t forget to look for the market’s top merchandise—something that’s shown meaningfully bullish action on the chart, but also has a growth profile that is rapid, reliable and has a long runway ahead of it.

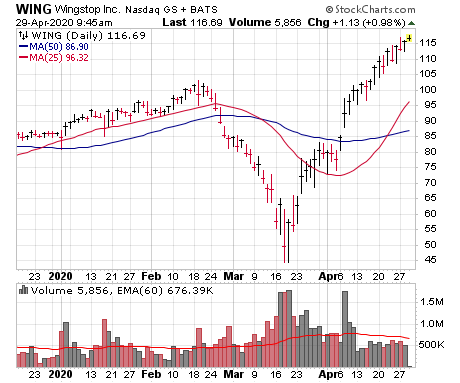

One idea on that front: Wingstop (WING), which has a great long-term cookie-cutter story. Here’s what I wrote about the firm in a mid-April edition of my Cabot Top Ten Trader advisory:

“The company has long had one of the simplest, but most powerful, cookie-cutter story—the firm offers wings with all sorts of flavors, as well as the usual pub-ish fare like fries, dips and soda though its 1,413 generally small format restaurants (1,700 square feet), the vast majority of which are franchised. The firm’s track record has been hard to beat, both from new store openings (boosted its store count by 10% last year) and excellent growth from existing locations (same-store sales up a whopping 12.2% last year; plus, each year’s new openings outperform the prior year’s level), and the big idea here revolves around management’s ambitions—it sees Wingstop as eventually being one of the top 10 global restaurant brands (6,000 potential locations worldwide, including more than 3,000 in the U.S. alone), and at its Investor Day in January, it says it’s seeing zero signs of saturation in any of its markets. The top brass’ digital efforts are also a plus—39% of orders are now digital or delivery, and that rose to 47% in Q1. Most important of all, Wingstop just gave an update on business, and any slowdown as been minor; even in March, domestic same-store sales rose 8.6%, and for Q1 as a whole, the firm opened 28 new restaurants. It looks like even a pandemic isn’t slowing down this steady cookie-cutter story.”

The stock’s comeback from its crash lows has been jaw-dropping—a pullback/shakeout (possibly on earnings, which are due May 6) would be tempting.

[author_ad]