Two months ago in this space, options trading expert Jacob Mintz contemplated whether Nvidia stock was about to crash on the heels of a 250% gain in 2016. Jacob was responding to frequent reader questions asking, “When do we short Nvidia (NVDA)?”

While Jacob didn’t recommend short selling Nvidia stock just yet, he did suggest ways to gain bearish exposure to the fast-rising chipmaker in case of a big crash. And while Nvidia stock has yet to truly crash, it may be inching closer to doing so. In fact, a NVDA crash may be in the works.

[text_ad]

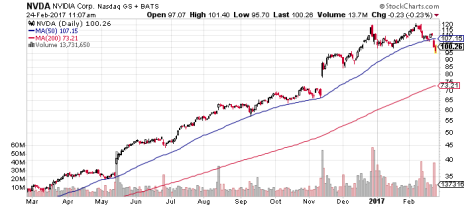

The stock had a rough Thursday last week, gapping down from 110 to 100 in one trading session after a couple of bearish ratings from high-profile Wall Street analysts came out. Instinet’s Romit Shah downgraded Nvidia stock from “buy” to “reduce,” while BMO Capital’s Ambrish Srivastava dropped his rating to “underperform” after rating NVDA as “market perform” for two and a half years.

The result was the biggest one-day dropoff for Nvidia stock since it came public in 1999—on trading volume that was more than twice normal levels.

The stock stabilized somewhat on Friday, finding support right around 100. But it did break below its 50-day moving average for the first time in more than a year, and that’s definitely a red flag.

Reasons behind the sudden drop in NVDA stock vary: increasing competition in the semiconductor space, margin pressure, etc. But the main reason is valuation.

After more than tripling last year, the stock now trades at 38 times earnings, down from a P/E of 61 when it peaked in late December but still higher than its P/E of 29 this time a year ago. Also, sales and earnings growth are expected to slow considerably in the coming quarters—analysts estimate a mere 16% sales growth and 10% EPS growth this year, down from 38% and 172%, respectively, last year.

That’s still pretty good growth! But the company set the bar for itself quite high with its banner 2016. Anything short of that growth—and, in this case, well short—is enough of a reason for institutional investors to get out of the stock with their 200% return still intact.

You could join the sellers and short Nvidia stock yourself. Or, if you’re options savvy, you could take Jacob’s early January advice and buy put options in NVDA to gain bearish exposure.

Long term, NVDA could still be a very good stock given its continued top- and bottom-line growth. But it appears some short-term pain is in store after an incredible run.

[author_ad]