Today, I want to talk about QuantumScape stock, a small yet promising company with a revolutionary technology that will help power the booming electric vehicle industry. It reminds a lot of another company we wrote about nearly three decades ago…

The Evolution of Automotive Power Sources

Way back in 1993, a company named Ballard Power came public, trading under the symbol BLDP. Ballard’s business, as some readers know, was (and still is) fuel cells, which generate electricity from hydrogen through chemical reactions and can be used to power vehicles. BLDP’s lowest price that month, adjusted for subsequent splits, was slightly over a dollar a share. Seven years later, during the 2000 market top, the stock hit 150!

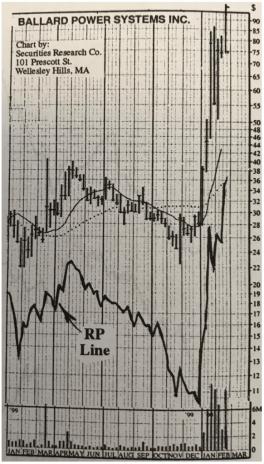

Here’s a chart Cabot published just before that peak (a shade reminiscent of the recent peak in GameStop (GME)).

But as we all know, 2000 was a major market top, and BLDP investors were hit especially hard; the stock was trading below a dollar by 2012. Since then, it’s been working its way higher, and it’s done especially well in recent years, as investors have jumped into all kinds of new energy stocks. Trading at 25 today, however, BLDP is still some 83% off that old 2000 high, and the simple reason is that the dreams that investors had back in the 1990s—dreams that fueled the massive advance—simply haven’t materialized. Reality did not conform to expectations.

[text_ad]

Yes, Ballard Power has a real business today, which brought in $29.6 million in the latest quarter. But Ballard still doesn’t have earnings. And the simple reason is that management chose to follow the “wrong” path.

Back in the ‘90s, when BLDP was strong and Cabot was recommending the stock, the road to success appeared obvious. Fuel cells would one day power most of the world’s vehicles, generating abundant electricity from non-polluting and renewable energy sources.

The Common Wisdom was Wrong

The logic behind this conclusion was simple. The only other remotely possible energy source was batteries, and batteries, as everyone knew back then, were simply too heavy. It was a fact—and easy to believe for anyone who had carried a standard 12-volt automotive battery around.

But the common wisdom was wrong, as became clear in 2008 when Tesla began producing its battery-powered Roadster.

Ballard’s website today will tell you that Ballard products and technology have powered vehicles (mainly buses and trucks) that have driven more than 75 million kilometers (mainly in China). That sounds like a big number. But those miles haven’t brought big revenues to Ballard. And today, those 75 million kilometers (47 million miles) are dwarfed by the miles that Tesla vehicles have driven (estimated at 23 billion a year ago).

But this column isn’t about Tesla (TSLA). TSLA was a great stock to own in 2020 when it grew sevenfold, but now it’s in a well-deserved cooling-off period. The darn stock is just too popular.

The Promise of QuantumScape Stock

What I want to spotlight today is QuantumScape (QS), a company that is working on some breakthrough electric vehicle battery technology.

Current lithium-ion batteries, for all the progress made over the past 20 years, are still heavy, expensive to produce, don’t last all that long and take considerable time to recharge. QuantumScape believes they will soon be rendered obsolete by solid-state batteries, which have dramatically greater energy density than today’s lithium-ion batteries.

QuantumScape’s solid-state batteries promise not only greater energy density (more power per pound), which means greater range, but also superior reliability and a longer life than their lithium-ion cousins. In addition, they’re also capable of charging to 80% in as little as 15 minutes, half the time needed by the fastest Tesla Supercharger.

QuantumScape at this point has seen no revenues; the company has nothing to sell yet. But it does have a serious investor. In 2020, Volkswagen invested $300 million in QuantumScape, securing 20% equity ownership of the company. Furthermore, on the board of directors are John Doerr and JB Straubel, two men with great track records of launching winners.

As for QuantumScape stock, it is definitely not unknown today.

QS had a great run in late 2020 when the retail investing crowd (fueled by Robinhood and Reddit) piled into electric vehicle stocks. QS stock ran from 11 to 132 in just two months!

But whenever I see a chart with a parabolic advance like that, I know that there’s a big decline somewhere ahead, and with QS we’ve had it. Since bottoming at 40 in early February, the stock has twice more bottomed at 40 (the third time was after announcing an offering of 10 million shares), and the longer this bottom lasts, the greater the odds that the next big move will be up.

Now, I don’t think there’s any urgency about investing in QS. Bottoms take time, and if the broad market weakens, it’s possible that QuantumScape stock will fall below 40. But if it does hold up here, and if the stock strengthens, the odds are very good that this stock will be the automotive energy success story that Ballard Power wasn’t.

[author_ad]